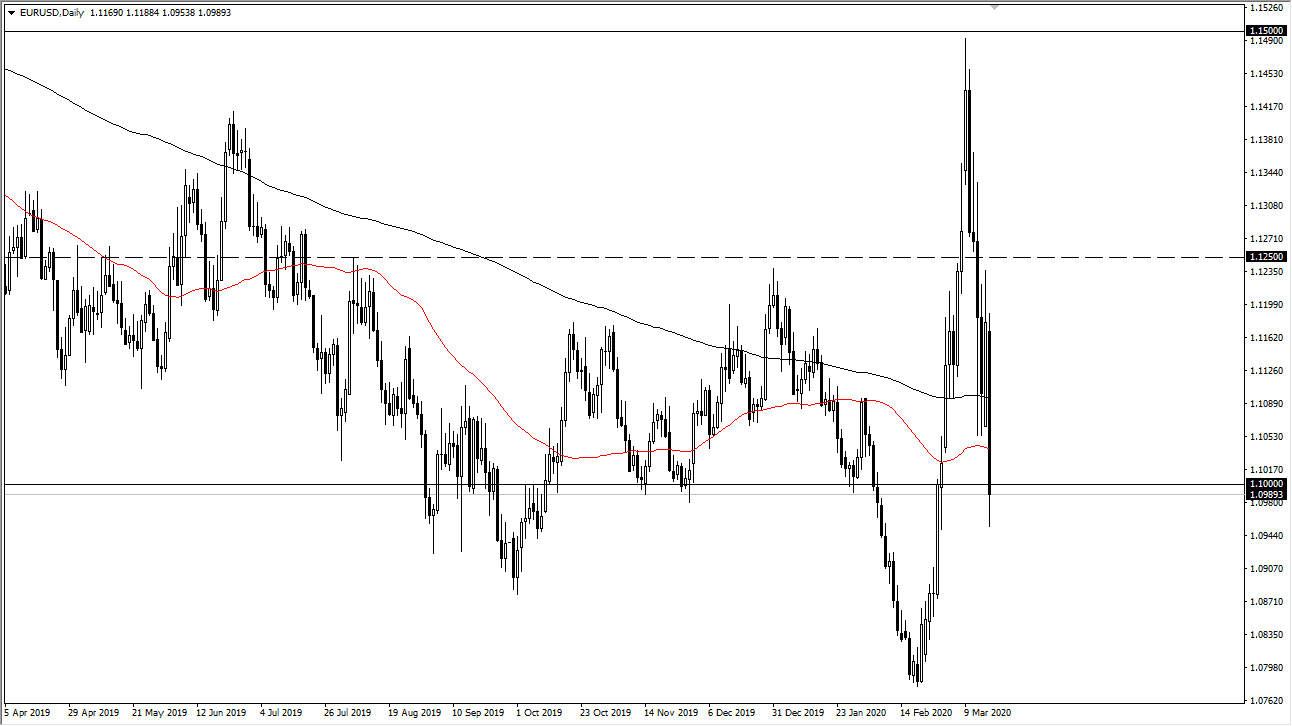

The Euro fell initially during the trading session on Tuesday, slicing through the 1.10 level rather handily. Having said that, the market did bounce back above it, showing signs of resiliency. The 1.10 level of course attracts a lot of attention, as it is a large, round, psychologically significant figure. Ultimately though, I think what we are trying to do is figuring out the range that we are going to be trading in. At this point, the market probably has a lot of resistance near the 1.1250 level, so I don’t think we get above there anytime soon. With this in mind, I believe that we are going to continue to keep this range, but obviously the next headline could change everything as the machines have taken over and panic trading has become the norm.

If we were to break down below the bottom of the trading range for the Tuesday session, it’s likely that the Euro will drop down to the 1.08 level. At this point, I believe that the market is going to be very choppy and difficult, so keep in a small position is probably best in this pair. Normally, this pair puts me to sleep but I have to admit that it has been one of the more interesting ones over the last couple of weeks. All one has to do is look at the last several days to see just how different things are from the past couple of years. The speed has been completely breathtaking, as traders try to figure out what to do next. All things being equal, I think we are going to see a lot of noise and it’s going to be very difficult to hang on to trade for any significant amount of time.

With that in mind I would be very quick to move the stop loss orders to breakeven, and I am not looking for longer-term traits right now, because things change so rapidly. That being said, the market is currently trying to decide what the next trend is, and that is almost always a very disruptive turn of events and normally means that there is a lot of trouble just waiting to happen. I think at this point it makes sense that traders exercise serious caution but if we break down below the bottom of the candlestick for the trading session on Tuesday, that of course would be a very negative sign that probably brings then a little bit more certainty than any other move.