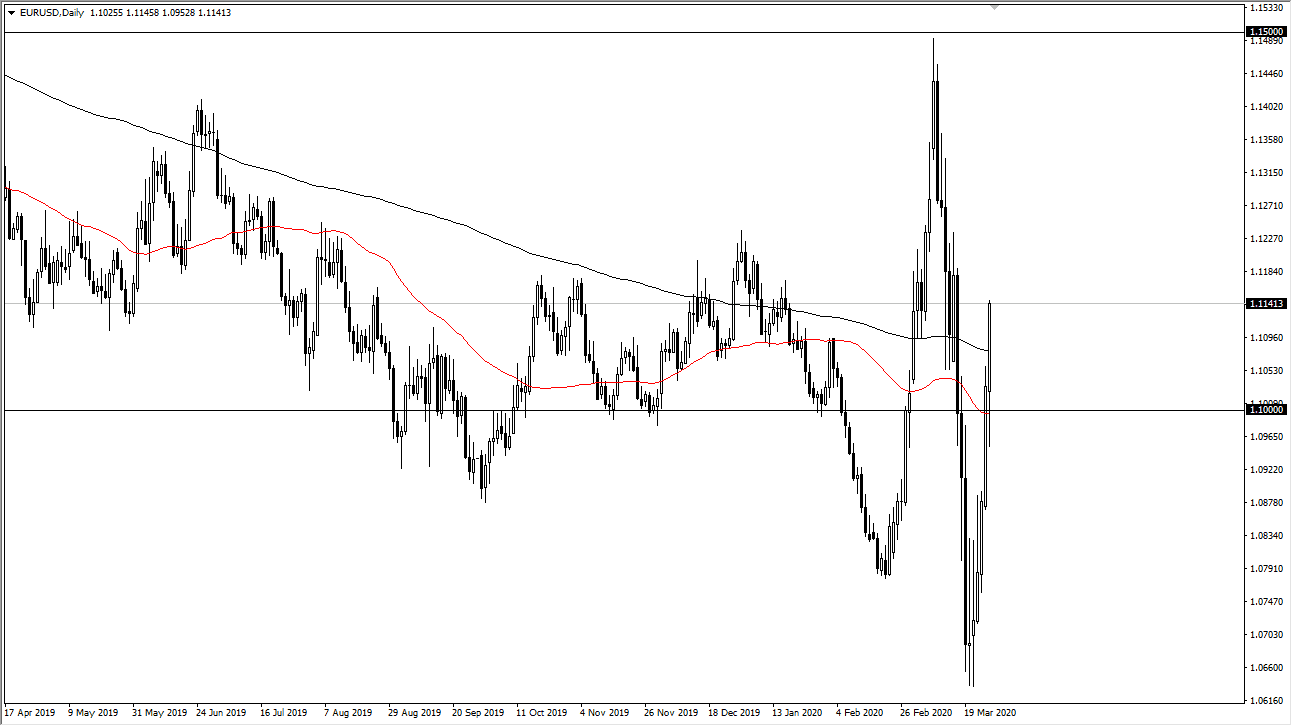

The Euro has initially pulled back during the trading session on Friday and looked quite soft until the Europeans and the British went home. After that, we started to see the move higher accelerate, in what would have been very thin trading. This is a market that looks like it’s going to continue to slam back and forth in wild swings as people are trading on panic and emotion more than anything else. These are extraordinary times, and they offer extraordinary opportunities. Importantly, the opportunities are both for-profit and massive loss. It is because of this that you simply must trade smaller positions.

US stock markets got absolutely crushed later on in the trading session, with Dow Jones Industrial Average losing over 900 points. This is another machine driven bloodbath, and as a result US dollars were being sold off. At this point, there’s only so much you can read into the rally due to the fact that a lot of it was had late in the day. Nonetheless, it looks as if the EUR/USD pair is in fact trying to get towards the 1.15 level above, this is a market that is going to continue to be a mess, with the European Central Bank flooding the market with bond buying, and the Federal Reserve trying to drown us all in Federal Reserve notes.

The 1.10 level has been crucial more than once, and ironically, I made my money shorting the Euro earlier in the day. That’s a bit hard to believe looking at the daily candlestick, but these things can happen depending on what time of the day you are trading. It literally is an hour by hour mess out there. I believe that we will have a gap when the week starts out, perhaps negatively, reaching down towards the 1.10 level underneath. The 50 day EMA is sitting in that area, and the fact that we have broken above the 200 day EMA really isn’t much to look at, because you can see we are simply slicing through it repeatedly. The market won’t be happy until there is some type of direction, and we just don’t have it now. For the Euro to be in a 1000 point range is absolutely ridiculous, but yet here we are. This is the world we find ourselves in, and the only way you can trade it is to do so with a small position.