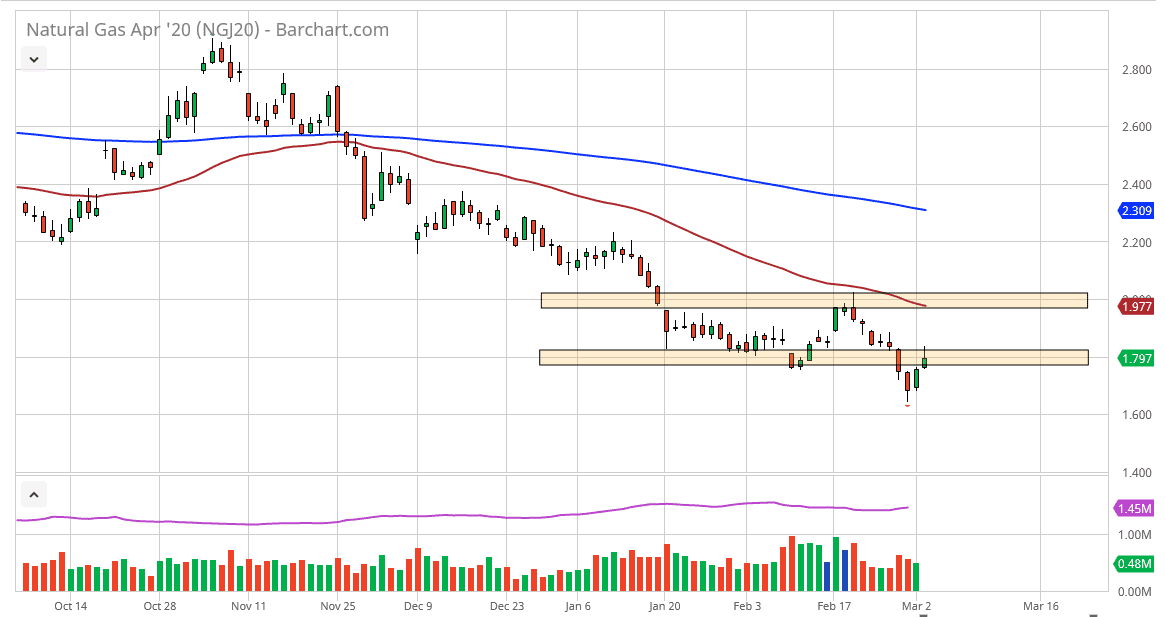

The natural gas markets as rallied during the trading session on Tuesday, reaching as high as $1.85 before pulling back. At this point, the market is likely to see more selling coming, because the natural gas markets are oversupplied, and that is going to continue to be a major driver of what happens in this market. Even if we were to break above the top of the candlestick for the trading session on Tuesday, then I think it’s simply a matter of waiting for higher levels to show signs of exhaustion so that we can sell from those higher levels. There is no scenario in which I am willing to buy natural gas, as although we have bounced a bit, we are still very depressed as far as price is concerned.

To the upside, the 50 day EMA above will offer resistance as well and is currently sitting at the $1.97 level. The $2.00 level above is also psychologically resistive, so at this point I think it’s only a matter of time before the sellers would be pressing this market to the downside. Ultimately, the Federal Reserve cutting interest rates by a surprise 50 basis points during the day has had a major influence on the US dollar, and then of course has had an influence on the commodity markets. Ultimately, this is a market that I think will find plenty of sellers eventually, because regardless of the noise that we have seen coming out of the Federal Reserve, it doesn’t matter what type of stimulus they do, it is very difficult to imagine a scenario in which the demand for natural gas suddenly picks up to the point where we can get through the oversupply.

The overall resistance is very stringent, and it is almost impossible to imagine a scenario in which the market suddenly takes out to the upside for a longer-term move. If the market does break above the $2.00 level, then it’s likely that we will see plenty of reason for a major reversal. Having said that though, the two point to zero dollars level also is very resistive. Ultimately, I’m looking for some type of exhaustive candle in order to take advantage of what has been an extraordinarily negative market. At this point, the market is still in a downtrend so at this point it’s very difficult to imagine a scenario where we can be buyers.