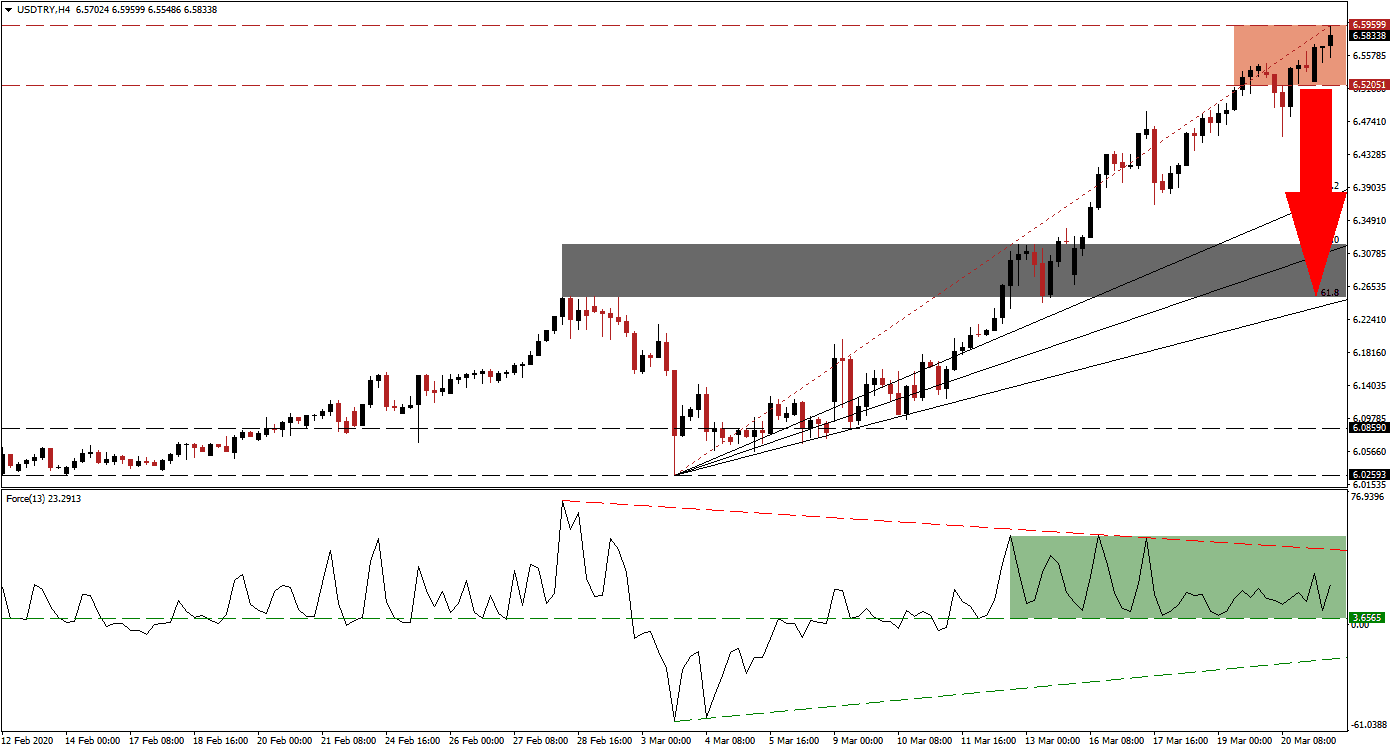

A rush to liquidity boosted the US Dollar, with the US Federal Reserve pumping trillions into the financial system. It does not reflect fundamental conditions, but Covid-19 resulted in panic reactions by global central banks. Turkey’s finance ministry announced that the first-quarter GDP is expected to exceed estimates, with a minor slowdown in March due to the coronavirus. The government announced a 100 billion Turkish Lira economic relive package, but the high unemployment rate and the requirement for foreign capital pose headwinds. After the USD/TRY pushed into its current resistance zone, bullish momentum is faltering, making this currency pair vulnerable to a short-term sell-off.

The Force Index, a next-generation technical indicator, points towards the existence of a massive negative divergence. While price action was propelled higher as a result of the liquidity rush, the Force Index created a series of lower highs. It remains above its horizontal support level, as marked by the green rectangle, but is faced with downside pressures provided by its descending resistance level. This technical indicator is favored to collapse below its approaching ascending support level, into negative territory, and cede control of the USD/TRY to bears. You can learn more about the Force Index here.

Besides the 100 billion Turkish Lira stimulus, the central bank will contribute between 50 billion and 60 billion in liquidity to financial markets over three months. The finance ministry noted Turkey entered this period with solid financial infrastructure in place, ruling out International Monetary Fund assistance. It is adding to breakdown pressures in the USD/TRY after pushing into its resistance zone located between 6.52051 and 6.59599, as identified by the red rectangle.

Volatility is expected to remain elevated, and price spikes due to liquidity concerns cannot be excluded, but the magnitude is likely to diminish. Borrowing rates in the US are already on the rise due to market concerns over the cost of further financial bailouts. The US is rumored to announce a $2 trillion stimulus this week, double of the initial estimates, in a sign that the economic situation is direr than currently priced. A profit-taking sell-off is anticipated to take the USD/TRY into its short-term support zone located between 6.25143 and 6.31811, as marked by the grey rectangle, enhanced by its ascending 61.8 Fibonacci Retracement Fan Support Level.

USD/TRY Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 6.58250

Take Profit @ 6.27750

Stop Loss @ 6.65500

Downside Potential: 3,050 pips

Upside Risk: 725 pips

Risk/Reward Ratio: 4.21

In the event of a sustained breakout in the Force Index above its descending resistance level, the USD/TRY could spike higher. The upside potential is limited to its resistance zone located between 6.95089 and 7.12440, dating back to August 2018 at the height of fears over funding concerns and inflation in Turkey. Forex traders are advised to consider an acceleration into this zone as an outstanding opportunity to place new sell orders.

USD/TRY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 6.73750

Take Profit @ 7.00000

Stop Loss @ 6.61750

Upside Potential: 2,625 pips

Downside Risk: 1,200 pips

Risk/Reward Ratio: 2.19