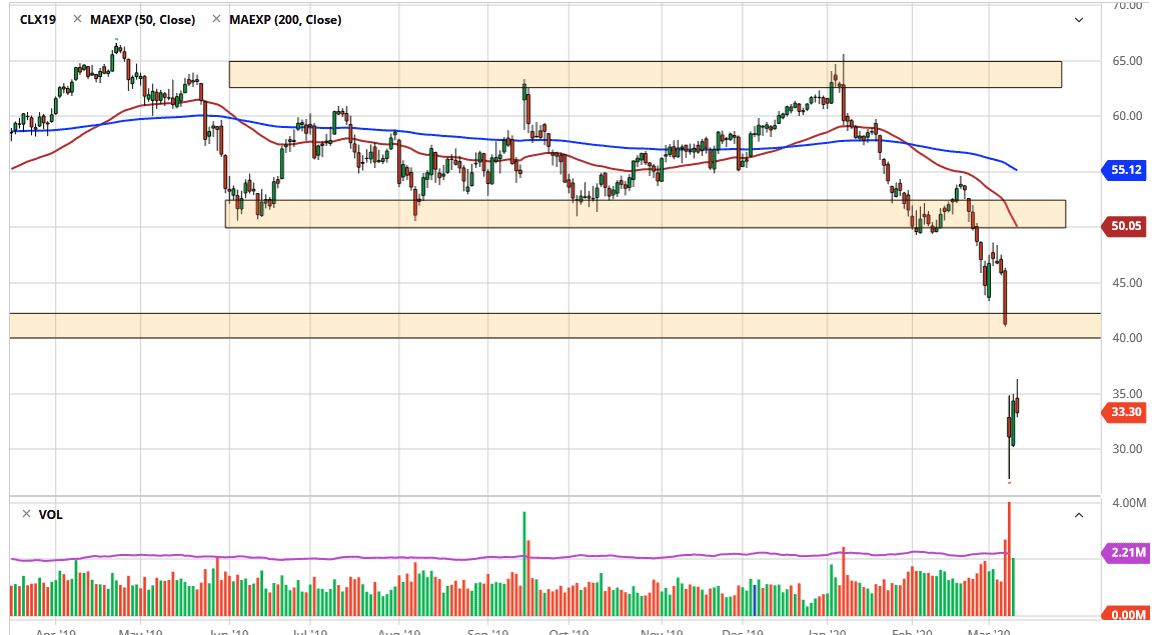

The West Texas Intermediate Crude Oil market initially tried to rally during the trading session on Wednesday but gave back gains just above the $35 level. That of course is a very negative sign and it suggests that we are going to drop even further from here. That of course makes sense considering that a price war is going to continue to be one of the bigger overhangs of the market. As the Saudi government announced that it was going to flood the market, this would be a difficult situation to see rallies last for any significant amount of time.

The massive gap above will continue to offer a lot of technical resistance, and it extends all the way to the $42 level. Any rally towards that area will simply invite more sellers as the longer-term trend certainly has shifted quite a bit. Until the price war is over with, it’s likely that we could get a bit of a turnaround, but we are probably months away from that. Furthermore, the Wednesday session also saw an inventory number that was absolutely negative. By seeing a build of 7 million barrels, it shows just how weak demand is going forward. It was only expected to be a build of 2 million barrels, so that is 3 ½ times what the market was counting on.

Underneath, the $30 level should show a certain amount of support, but I think it’s only a matter of time before we try to break down below that level as well. Russia has reiterated its comfort with the present situation, and therefore it’s likely that the situation will grind forward. Adding more negativity to the market, the coronavirus should continue to drive down demand and at this point some people from the World Health Organization are speculating that the entire world will be infected within 9 to 14 days. If that’s the case, it’s very likely that the demand for oil is going to simply dry up. This of course is in the backdrop of a market that is far too oversupplied and shows no signs of changing. At this point, we should continue to see a lot of choppiness but certainly rallies will be sold into as the market has a long way to go before fears are combed. At this point, I think the market is about ready to try to break down into the 20s, perhaps after a short bounce.