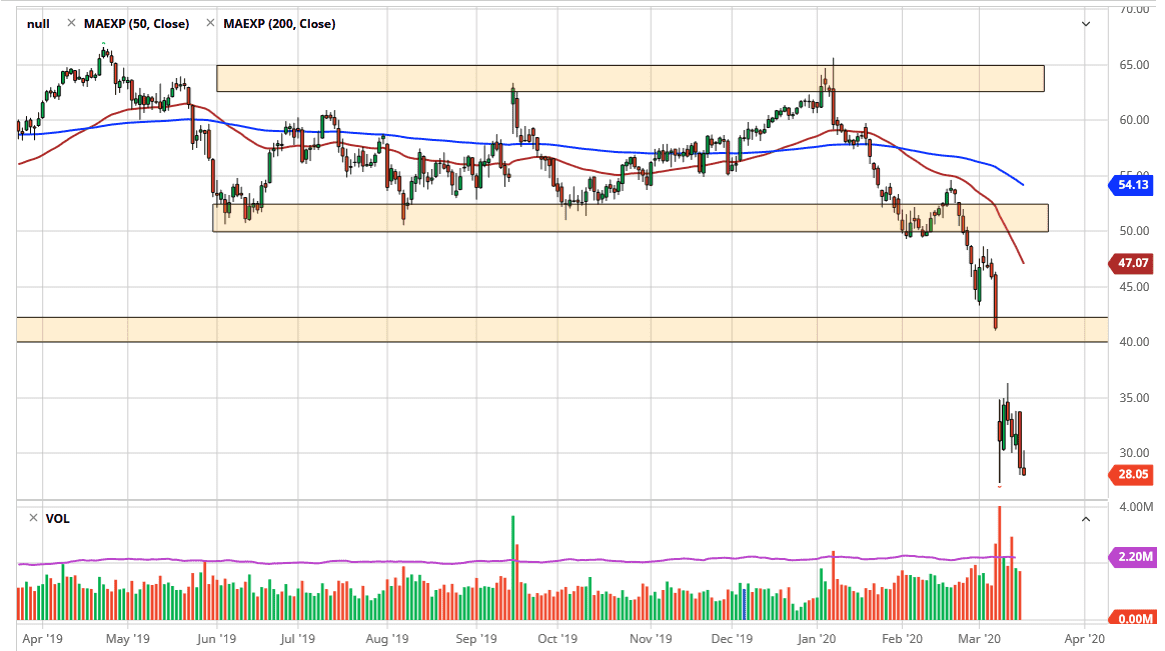

The WTI Crude Oil market initially rallied during the trading session to reach towards the $30 level, but then broke down to show signs of extreme weakness as the market closed near the $28 handle. This is a very bad look, and it’s obvious that crude oil may have further to go at this point. I think this is a market that will continue to see a serious lack of demand due to the economy slowing down in the United States, as well as other places.

The shape of the candlestick is an inverted candle, and that of course is a very negative sign. Even if we break above the top of this candlestick, I think it’s only a matter of time before the sellers get involved, especially near the $34 level, perhaps closer to the $35 level. Looking at this chart, it’s obvious that sellers will come back in and short this market at the first signs of exhaustion. The gap above of course is very negative, extending all the way to the $42 level. I think at this point it’s very unlikely that the market is going to break through there, as it was such a shock to the system when Saudi Arabia decided to flood the market with supply. At this point, I think that signs of exhaustion will be jumped upon and rightfully so as the demand around the world is going to continue to fall off of a cliff.

If we can break down below the hammer from the low on that gap lower, it’s likely that the market goes down to the $25 level, possibly even the $20 level. This is a market that will continue to struggle due to the fact that the market is being flooded with supply and of course there is very little demand at the same time, which is basically a “one-two punch” when it comes to price. I am not interested in trying to buy this market, but I am interested in selling at rallies as it gives the market more real estate to travel and therefore a better risk to reward ratio for short selling. It’s very difficult to imagine a scenario where oil suddenly becomes highly favored and that buyers take off to the upside. That being said, eventually this market will offer a great long-term investing opportunity, but we are quite a while from seeing that.