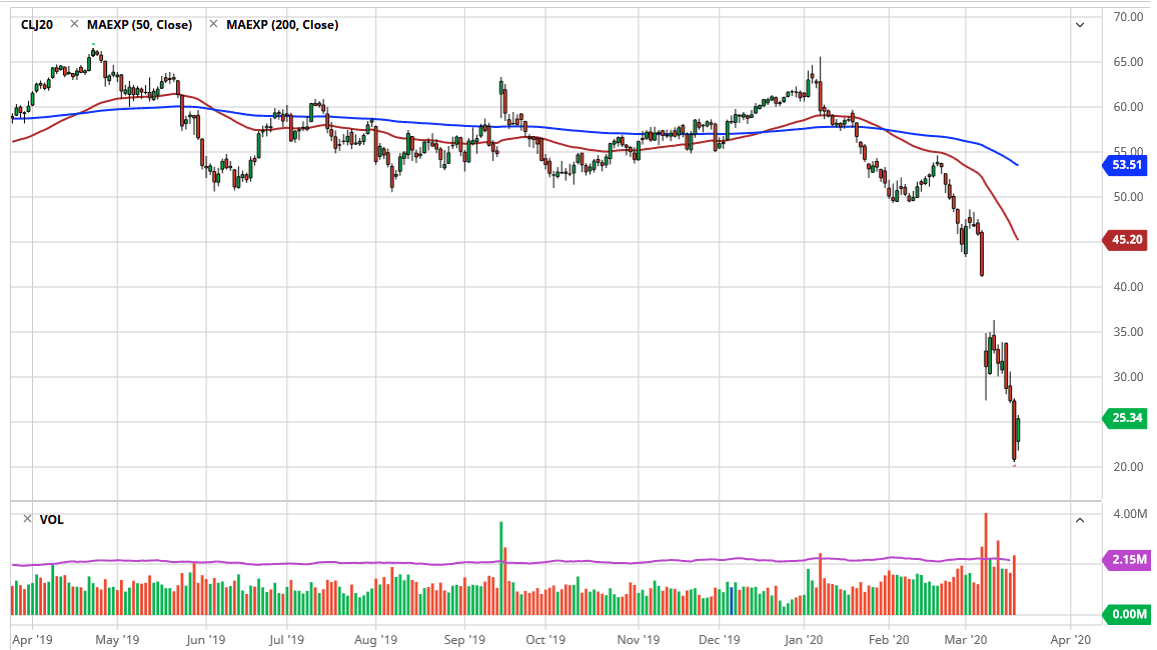

The West Texas Intermediate Crude Oil market has gapped higher to kick off the Thursday session before breaking above the $25 level. This is a very bullish sign, and in fact the market has even gained over 25% during its peak. That being said, this is a market that is extraordinarily oversold. This oversold condition of course causes a major bounce just waiting to happen, and I think that’s what we are seeing. After all, this is a market that is oversold by just about any measure, and this of course means that eventually some short covering happens. I think that’s what we are getting ready to see so short-term traders may be willing to take advantage of this move. That being said, the selling is not over, and I do think it’s only a matter of time before you can start shorting this market again.

The gap above will obviously be an interesting spot for traders, and it could be the target on some type of major relief rally. What’s interesting is that the daily candlestick’s form a bullish harami, something that will attract a lot of attention. The $30 level above will be significant resistance, followed by the $34 level, and then eventually the $42 level. A bounce from here should see plenty of exhaustion above that people can take advantage of for a bigger move to the downside. After all, there are major issues out there that will continue to influence the marketplace, not the least of which demand is a part of. After all, demand started to drop before the virus started to reach the West.

If the market breaks down below the $20 level however, it would be a very negative sign and could send WTI down to the $17.50 level, and then eventually the $15 level after that. A lot of a well-respected analyst on Wall Street are calling for oil to break below the $20 level, but to think that we could do it without some type of hassle would be very difficult to believe. In this scenario, you have a couple of opportunities: you can either try to play the bounce or wait for exhaustion after that bounce to start selling. It comes down to your time horizon, but I do think that we will see lower prices before the selling is over for the longer-term trend.