The continued weakness of the US dollar contributed to the cautious gains of the EUR/USD pair, as it tested the 1.0990 resistance, where it is stable at the time of writing the analysis. What contributed to the gains, was an additional improvement in risk appetite among investors about the numbers of Coronavirus infection and deaths, which contributed to paralyzing the global economy. Accordingly, investors sold the dollar, which reaped many record gains during the height of the Corona pandemic crisis. This year's gains for the US dollar index, DXY, shrank from 6.5% to only 2.7%, as markets are responding to signs that the epidemic curve remains firm in both the United States of America and many European countries. Globally, new Coronavirus infections recorded the fourth consecutive decline. The epidemic curve is flat in the United States, Italy, Spain, France, the United Kingdom, Switzerland, the Netherlands, Canada, and others.

The leveling of the epidemic curves gives investors hope to restart the world's major economies as soon as possible, and perhaps in May. Indeed, some countries such as Austria and the Netherlands have already taken steps towards this end. This is negative for the stronger safe haven dollar, which was abandoned after the massive stimulus plans launched by the US Federal Reserve.

Last Thursday, the US Federal Reserve announced that it would provide up to $2.3 trillion in loans to companies and families, an amount equal to more than 10% of the United States’ gross domestic product, to “enhance” the effectiveness of the myriad of other facilities that were announced this year. This comes after Washington approved a $2.2 trillion support package that included helicopter money for families as well as cheap, yet unconditional loans for companies to keep jobs.

Thursday's announcement came after the US Department of Labor announced that another 6 million US jobs were lost due to the closure policy to contain the spread of Coronavirus. The total has reached more than 17 million jobs in the past three weeks. Fed policy makers are concerned first and foremost this time with keeping as many jobs as possible, instead of the short-and medium-term inflation results as they usually are.

The bank has a dual mandate that requires it to boost price stability as well as the maximum sustainable employment, and Chairman Jerome Powell said last week that consumer price growth was not the main concern at present.

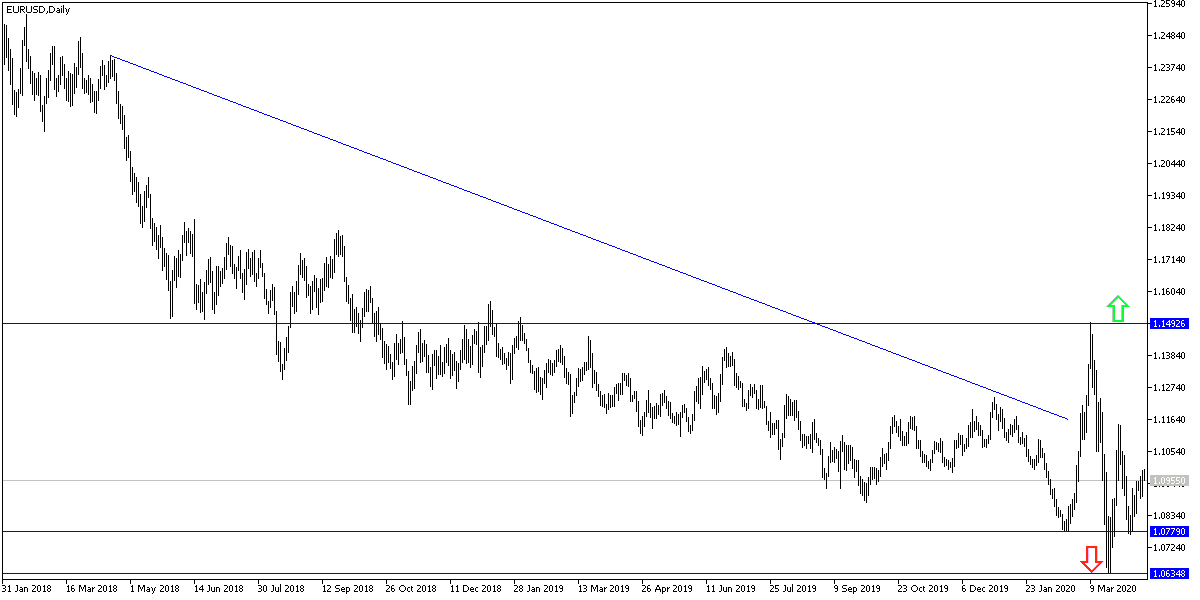

According to the technical analysis of the pair: the EUR/USD success in overcoming the 1.1000 psychological resistance, as the case now, will increase the momentum to correct for higher gains, and the closest of them are currently 1.1045, 1.1120 and 1.1200 respectively, which are levels confirming the strength of the trend reversal. Despite this optimism, the trend is still down on the long run.

As for the economic calendar data today: The focus will be on the US session data, which includes the announcement of US retail sales figures, the industrial production rate and oil stock numbers.