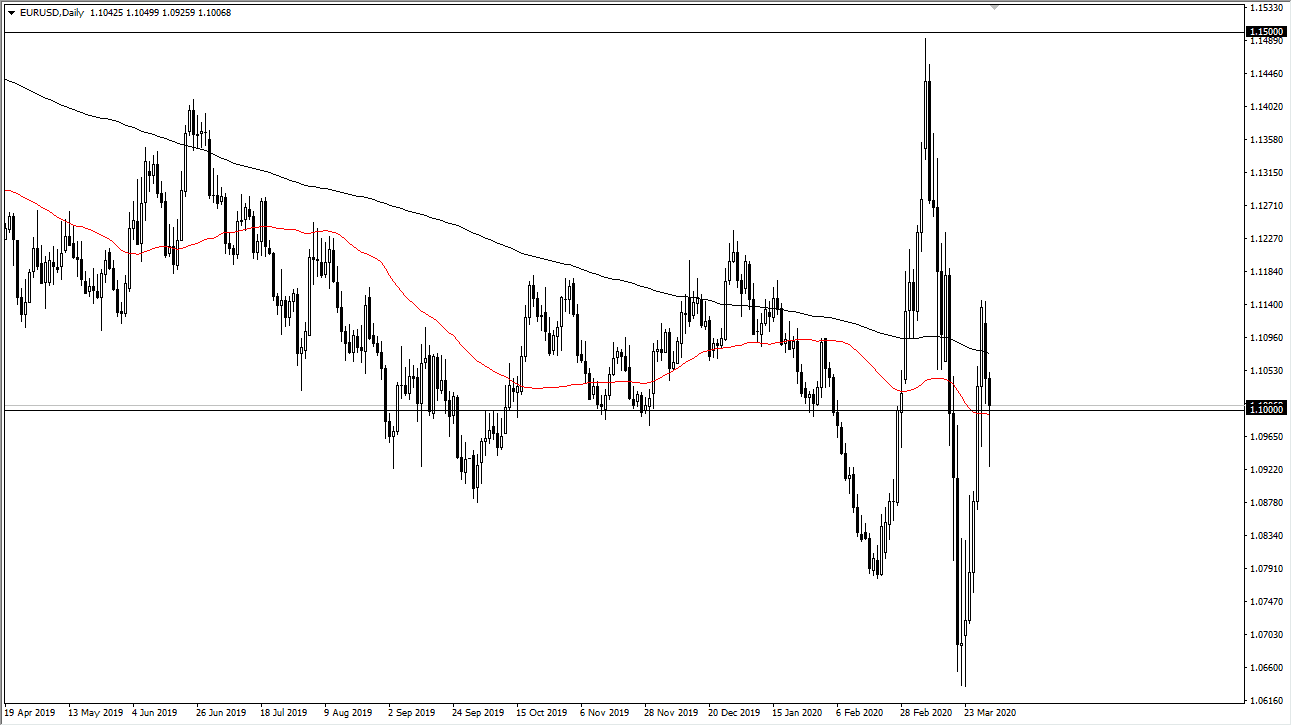

The Euro initially fell during trading on Tuesday but then turned around to show signs of support. By forming the bullish looking hammer that it has at the 1.10 level, it appears that there is plenty of support underneath. Having said that, the European Union will continue to struggle in general, as the coronavirus still rages through Italy. This is going to be a scenario where traders continue to see a lot of volatility, simply because the central banks are both working against their own currencies.

The Federal Reserve has opened up a repo market for central banks to access dollar liquidity, and that could in theory at least help the idea of less treasury selling in the United States. Having said that, the market is likely to be all over the place due to the fact that both areas will struggle when it comes to directionality. That being said, the only thing we can do is look at the various levels and the way the market reacts to them in order to get some type of directionality.

Looking at the hammer, if we were to break down below the bottom of that candlestick, it would be very bearish and deed for the Euro, perhaps sending it down towards the 1.05 level where there is significant support on the longer-term chart. That doesn’t mean that we would go there right away, but it certainly would be the overall direction. I believe the first target would probably be 1.08 if we do break down.

On the other side, if the market was to break above the top of the hammer, we could very well see the 1.1150 level targeted over the next several sessions. The 200 day EMA above offers a certain amount of psychological resistance, so keep that in mind. All things being equal though, it does look like we are trying to see a recovery, so I expect a lot of volatility over the next couple of days. Keep your position size small, and most certainly you should be looking at quick gains and losses more than anything else. Hanging on for a bigger trade is going to be extraordinarily difficult to do. The volatility is probably only going to get worse as headlines continue to cross about the coronavirus, global shutdown, and a whole host of other things that could come into play when it comes to the economic outlook.