After a massive recovery across the cryptocurrency sector, off of the March lows, short-term fundamental pressure on Litecoin is rising. Two essential developments point toward significantly bearish progress. The number of active wallet addresses is contracting in a sign of a decrease in interest. It is mirrored by the absence of large volume transactions, a typical indicator for institutional activity. According to a recently published analysis, an estimated 60% of Litecoin investors incur losses. The array of adverse events positions the LTC/USD to extend the recent breakdown into its short-term support zone.

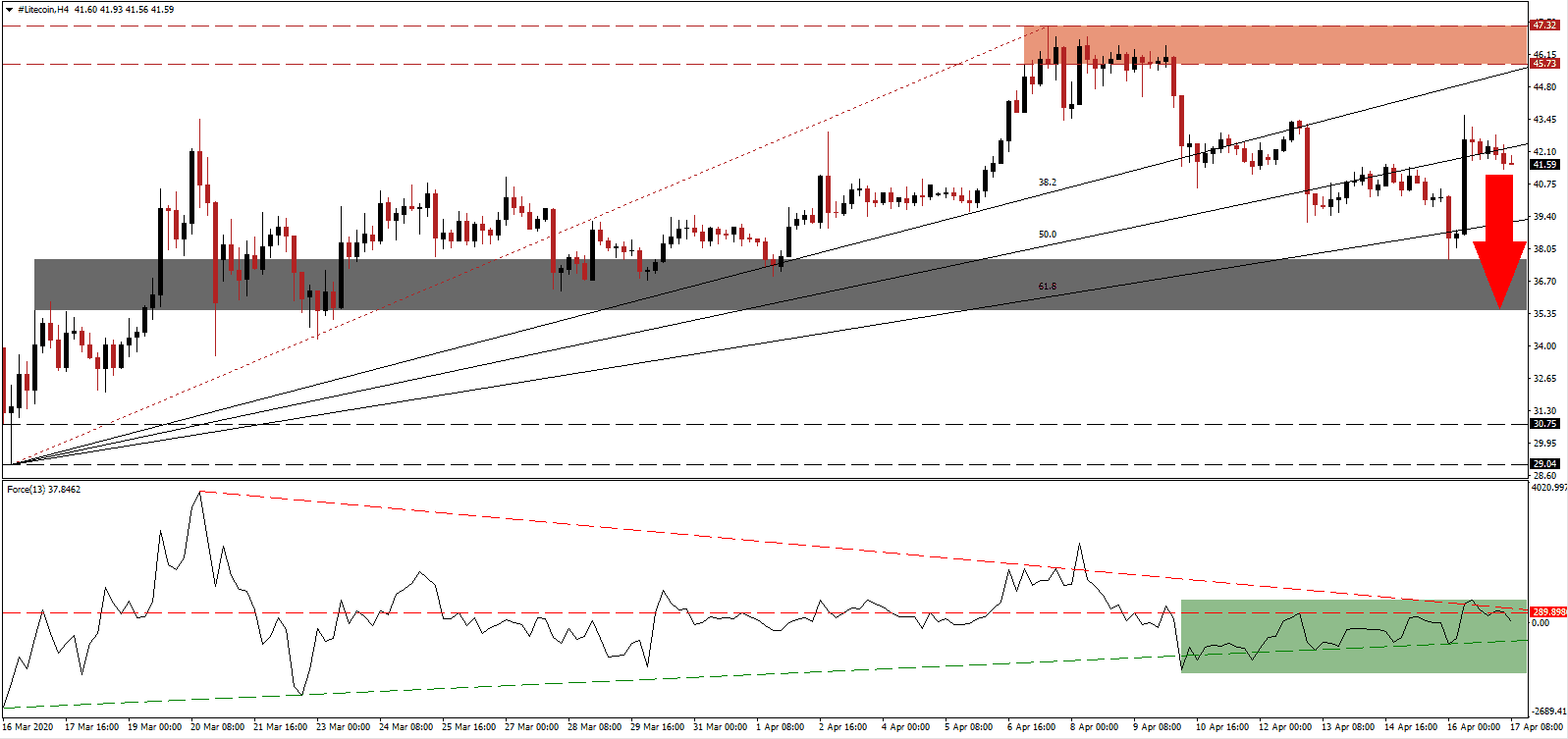

The Force Index, a next-generation technical indicator, failed to sustain its advance and retreated below its horizontal resistance level. With the descending resistance level adding bearish momentum, as marked by the green rectangle, the Force Index is expected to collapse below its ascending support level. Once this technical indicator moves into negative territory, bears will regain control of the LTC/USD, driving this cryptocurrency farther to the downside.

Following the breakdown in price action below its resistance zone located between 45.73 and 47.32, as marked by the red rectangle, the bullish recovery ended. A temporary move below its ascending 61.8 Fibonacci Retracement Fan Support Level was quickly reversed off of the top range of its short-term support zone but failed to remain dominant. The conversion of its 50.0 Fibonacci Retracement Fan Support Level into resistance added to fundamental bearish developments in the LTC/USD. Bitcoin’s inability to keep its recovery alive is adding auxiliary selling pressure across the entire sector.

With the global Covid-19 pandemic highlighting the interconnectivity of the cryptocurrency market to the rest of the financial ecosystem, a divergence across leading projects is likely. Litecoin is in the process of converting into a privacy coin, with many enthusiasts awaiting the release of Mimblewimble, an upgrade to the privacy protocol. It will make Litecoin more relevant, adding a long-term bullish catalyst to other positive developments. Regulatory issues and the potential delisting off of several exchanges need to be overcome. Presently, the LTC/USD is favored to correct into its short-term support zone located between 35.46 and 37.60, as identified by the grey rectangle.

LTC/USD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 41.60

Take Profit @ 35.50

Stop Loss @ 43.60

Downside Potential: 610 pips

Upside Risk: 200 pips

Risk/Reward Ratio: 3.05

In case the Force Index moves above its descending resistance level, the LTC/USD is anticipated to accelerate to the upside. Volatility is likely to remain elevated, and this cryptocurrency pair remains confined to its current trading range. The upside potential is, therefore, limited to its resistance zone. Unless a significant bullish catalyst emerges, an extended advance appears unsustainable.

LTC/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 44.75

Take Profit @ 47.25

Stop Loss @ 43.60

Upside Potential: 250 pips

Downside Risk: 115 pips

Risk/Reward Ratio: 2.17