The NASDAQ 100 gapped higher to kick off the trading session on Friday, after President Donald Trump suggested that the US economy could get back to work much quicker than people anticipated. Gilead has suggested that one of their drugs is working against the coronavirus, and therefore the whole world celebrated by purchasing anything risk related. However, the NASDAQ 100 is a completely different scenario than most other indices, because over 1/3 of the value is derived from for specific companies. Those are all the companies that everybody else is always buying: Microsoft, Apple, Amazon, and of course Google. Because of this, it’s very difficult to think of this anything as anything other than ETF.

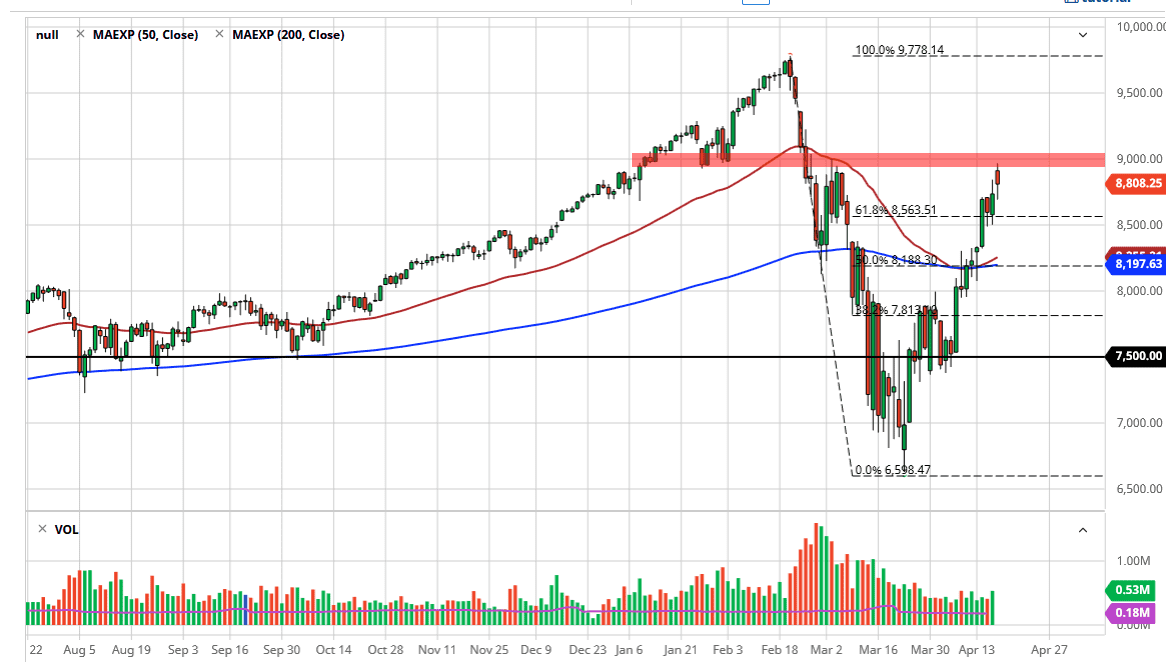

The 9000 level above is a major barrier. If we can break above there, then the market is more than likely going to go to all-time highs given enough time. However, if we turn around a break down through the gap and then maybe more specifically the 8500 level, this market will break down rather significantly. One of the biggest issues facing this market is that we are going into the weekend, and it’s possible that a headline comes out the cause all kinds of issues.

Regardless of what happens, it appears to me that the NASDAQ 100 will continue to lead the way for the S&P 500 and continue to outperform it one way or the other. I think that the market is right on the precipice of a breakout, and all it needs is more of this “fear of missing out” trade finally throw it over the crucial 9000 handle. At this point, for the buyers the 9000 level is everything. If we pull back and bounce from the 8500 level, that’s almost as good as the same thing. If we close on a daily close below that 8500 level, I think the selloff could be rather brutal, sending the NASDAQ 100 much lower. While I am bearish longer-term, the reality is that the momentum is to the upside, so we need to be cognizant of this, trying to make money instead of trying to be “right.” Remember, there is the old expression that “markets can be irrational much longer than you can be solvent.” This is a perfect example of that, because quite frankly the economy is not going back to normal anytime soon. With that in mind, we need to pay attention to the momentum, but there will be that moment where everybody freaks out again.