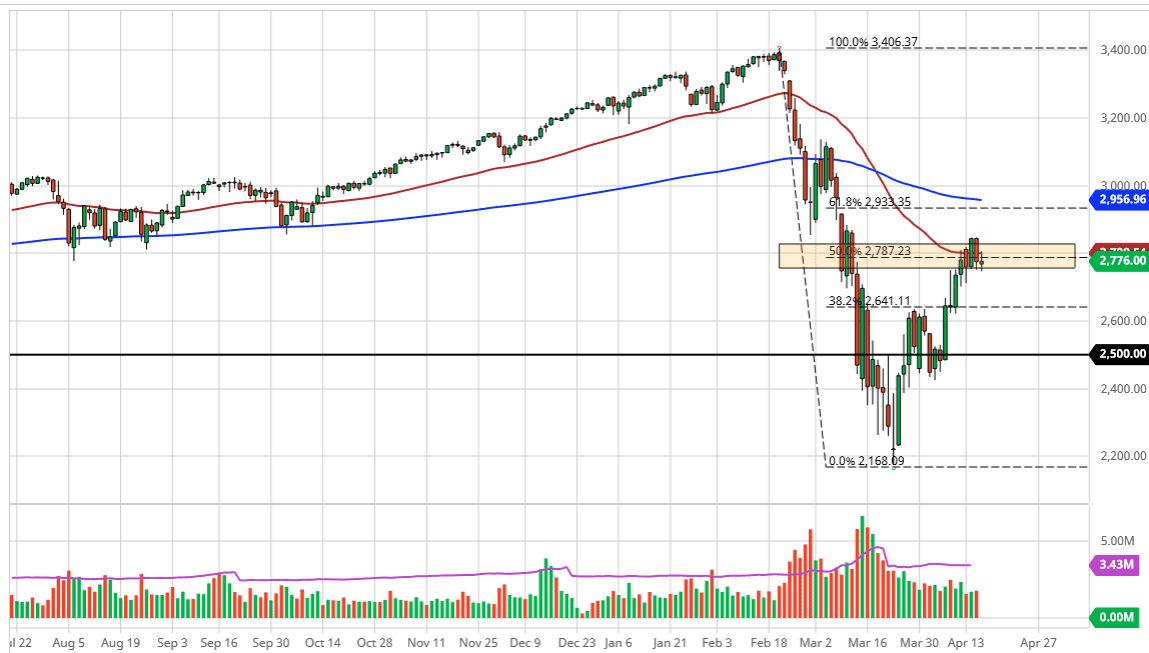

The S&P 500 has gone back and forth during the trading session on Thursday, as we have chopped around just below the 50 day EMA. Looking at this chart, we have slowed down during the week and I think at this point we are at a major inflection point due to the fact that we had seen a lot of consolidation in this area previously, and there are a slew of technical factors in this region.

To begin with, we have the 2800 level. These large round numbers attract a lot of attention anyway, as they make good headlines. Furthermore, we have the 50 day EMA in this region, and of course the 50% Fibonacci retracement level. In other words, this is exactly where we should see a bit of trouble. I think at this point it’s a simple matter of whether or not we break down below the lows from earlier in the week, or if we break above the highs in the middle of the week as to where we go next. If we do break out to the upside, I see a nice gap above at the 61.8% Fibonacci retracement level that will attract a certain amount of attention, as well as the 200 day EMA which of course is crucial.

To the downside, if we were to break down below the lows of the week, I think that we go to the 2640 handle which was the previous resistance barrier based upon “market memory.” If we break down below there, then the 2500 level comes into play. I think that the S&P 500 could struggle little bit going into the weekend as a lot of traders will be concerned about carrying a lot of risk, but it should be noted that early in the morning Asia time Donald Trump is going to be giving a speech about the plan to open up the US economy. This of course could throw monkey wrench into the entire situation, but at this point it’s all conjecture as to whether or not it is something that the market will light, let alone something that can actually happen. It’s obvious that Trump wants the economy to open as soon as possible, so it will be interesting to see how this plays out. I suspect that Friday is probably going to be a day that you can leave alone but we do have some obvious levels to pay attention to.