The West Texas Intermediate Crude Oil market has drifted a little bit lower during the trading session on Tuesday after initially trying to rally. That being said though, the $25 level underneath looks to be a little bit supportive. If we break down below there, then the $24 level will probably get targeted. The market is going to be relatively quiet in the short term though I believe because the OPEC meeting on Thursday is what everybody is waiting on. In the sense, the crude oil market is simply killing time as we are waiting to see whether or not OPEC and it’s compatriots decide to start cutting output.

There seems to be a bit of uncertainty as to whether or not the United States and Canada are going to get involved, so if that’s the case we very well could see a lack of efficacy to these cuts. Granted, Saudi Arabia itself and to a lesser extent Russia, are going to be enough to get rid of the oversupply of crude oil that we have right now. After all, the oversupply in crude oil has been going on for some time and it’s likely that it will continue going forward. Granted, the entire idea of starting to price war was to drive US shale producers out of business, and now Donald Trump is floating the idea of possibly having some type of import tariff on foreign oil.

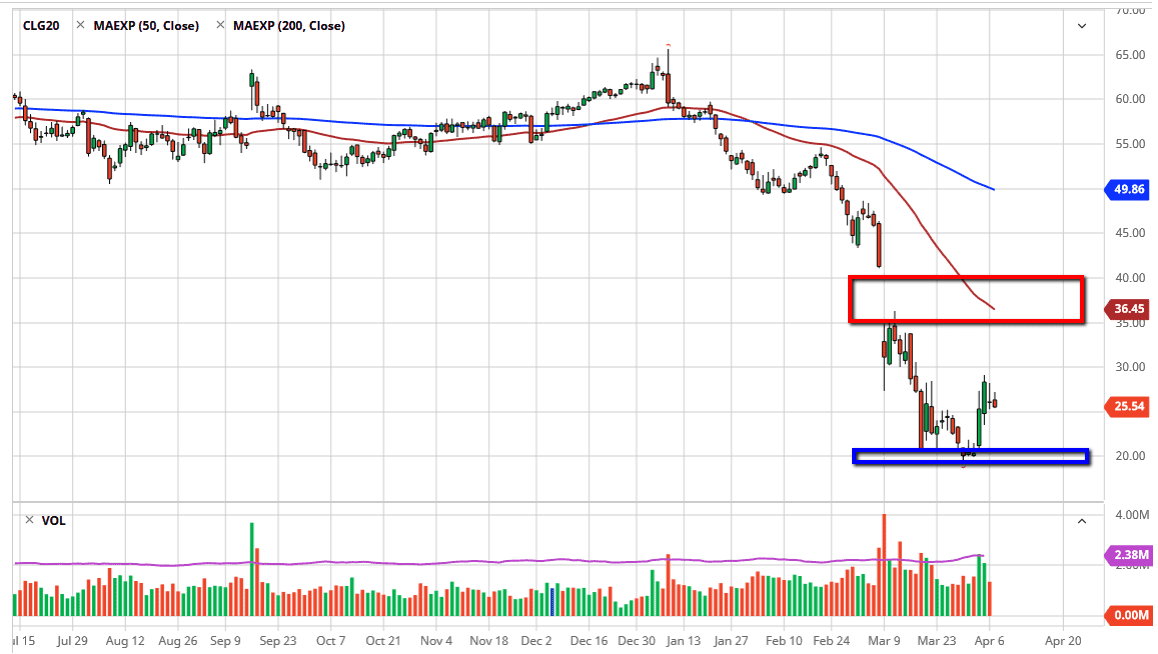

That being said, the biggest problem that crude oil finds itself and right now isn’t necessarily the oversupply of crude oil due to drilling, but the fact that there is plenty of oversupply due to the fact that there isn’t enough in the way of demand. If that’s going to be the case, there isn’t a whole lot that these countries can do about the situation. With this, I suspect that crude oil will probably test the bottom again unless of course OPEC comes out with some type of massive announcement on Thursday. Quite frankly, it would have to be pretty historic to change the overall attitude of the market. At this point, fading short-term rallies should continue to work but if the announcement pushes this market above the $30 level, it could have the market moving towards the $34 level, and then the 50 day EMA above which is currently at the $36.44 level. I don’t know that we break down below the $20 level, unless of course OPEC failed to come up with any type of cut.