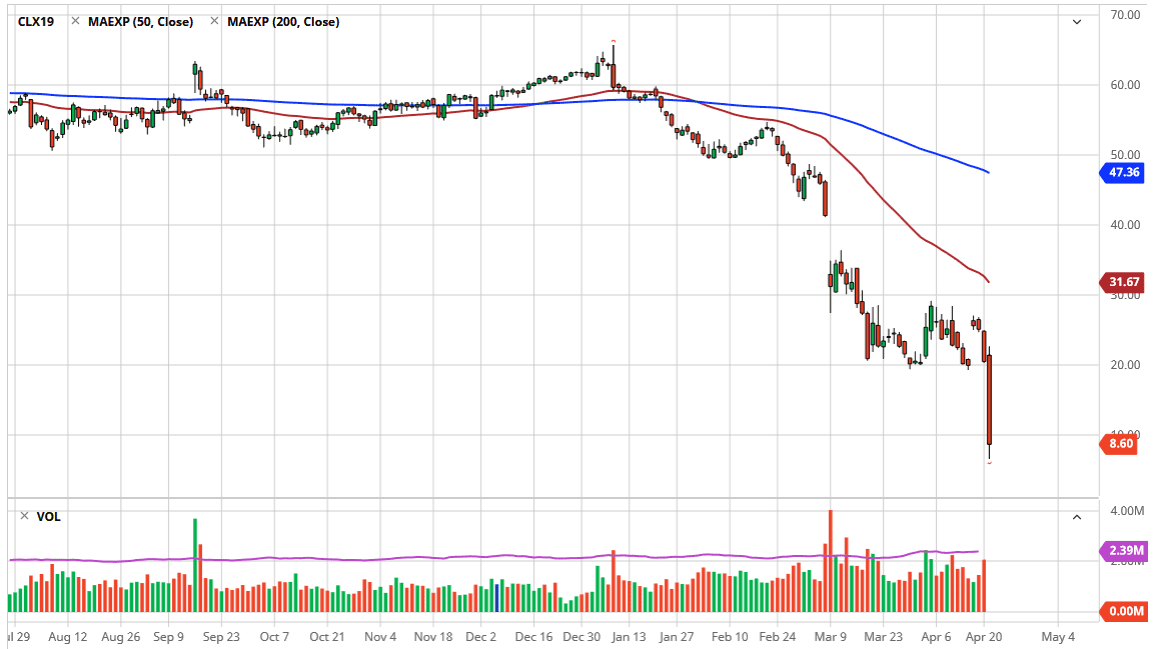

The West Texas Intermediate Crude Oil market has fallen apart during the trading session on Tuesday after a historic day on Monday with the May contract printing a negative level. At this point, the June contract looks like it may be heading in the same direction, due to the fact that there is simply nowhere to store oil anymore. It does not really matter whether or not crude has any fundamental value, the reality is there is nowhere to put it. This is something that has been building up for months, and now we are starting to see it come to a loggerhead.

At this point, you can see that the market had broken below the $10.00 level rather handily during the trading session on Tuesday, and I think you should be looking at short-term rallies as potential selling opportunities. There is not much to keep this market from going negative at this point, although I do not expect to see that in the next day or two. I think that the $20 level is now your “ceiling” in the market, so therefore any move towards that direction will attract a significant amount of short selling. The volatility in crude oil is above a reading of 200, which unless you follow crude oil volatility numbers, it may not mean much to you. To put it in blunt layman’s terms: its off the charts.

The candlestick for the trading session is extraordinarily long and ugly, and certainly will lead to more selling. Crude oil markets are an absolute disaster this point and unless you have the ability to actually take physical delivery of crude, you have no business trying to buy this contract. If you have the ability to take delivery of a full contract of oil, all you will have to do is sit on the sidelines for a couple of months and collect massive profits. Think of those funds who have the ability to store negative priced crude oil. Even if they give it away for free that it still made a profit. Somebody out there is making a fortune, but it is not going to be you is the retail trader. At this point the best thing you can do is simply fade rallies as they occur, looking at the $20 level as a massive resistance barrier that should be extraordinarily difficult to overcome, and as long as there is a relatively negative economy out there, it should hold.