West Texas Intermediate Crude Oil market initially tried to rally during the trading session on Thursday, when it was reported that Saudi Arabia and Russia were discussing cuts that could be as deep as 20 million barrels per day. However, other reports are suggesting that it’s more likely that it will be 10 million barrels a day. Because of this, the market didn’t know what to do on Thursday and with Friday being closed due to the Good Friday holiday, oil traders sold into the weekend assuming the worst, that there would be no agreement.

At this point, it should be noted that Mexico is standing in the way of an agreement, but one must believe that eventually they will acquiesce as even Donald Trump has suggested that he would help them with a cut quota. That being said, there is nothing that can be done about the lack of demand due to the coronavirus, so with storage capacity at almost completely full, there isn’t very much that OPEC can do in the end.

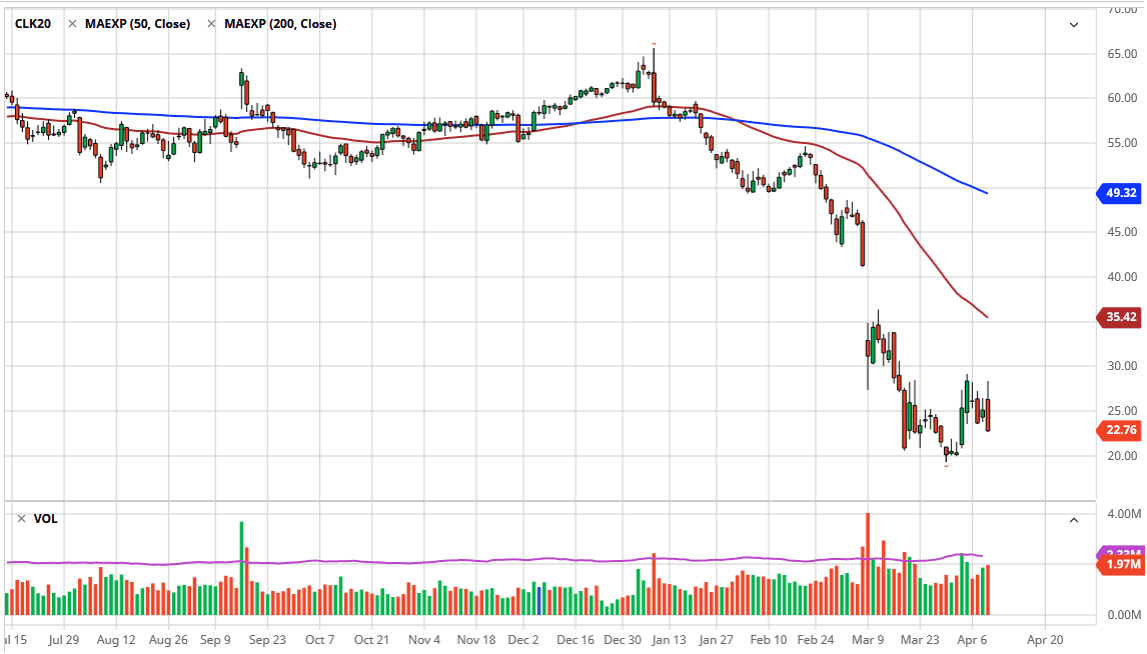

While we could rally rather significantly in the short term, I don’t think that a sustainable rally is in the near future. Yes, we could get a sharp pop to the upside and perhaps even towards $35, but it would take a significant 20 million barrels a day cut, something that doesn’t look very likely at this point. In fact, OPEC has been discussing more of a tiered approach, something that won’t be as effective.

The $20 level underneath is obvious support and I think it will hold under most conditions. However, if we do get a break down below the $20 level it could send this market much lower, probably down to $15, maybe even lower than that if the demand doesn’t pick up. At one point or another, economies will have to come back to work, and if they do then it’s likely that oil will start to find a bit of its footing. To the upside, if we were to break above the $30 level it does send this market higher. That being said, it’s simply going to come down to the latest headline coming out of this meeting, followed by the coronavirus figures. As things stand right now things don’t look very good for crude oil other than a short-term pop that will more than likely be sold into. Keep in mind that there is a gap above, but it extends all the way to the $42 level, something that seems very unlikely to be filled in the short term.