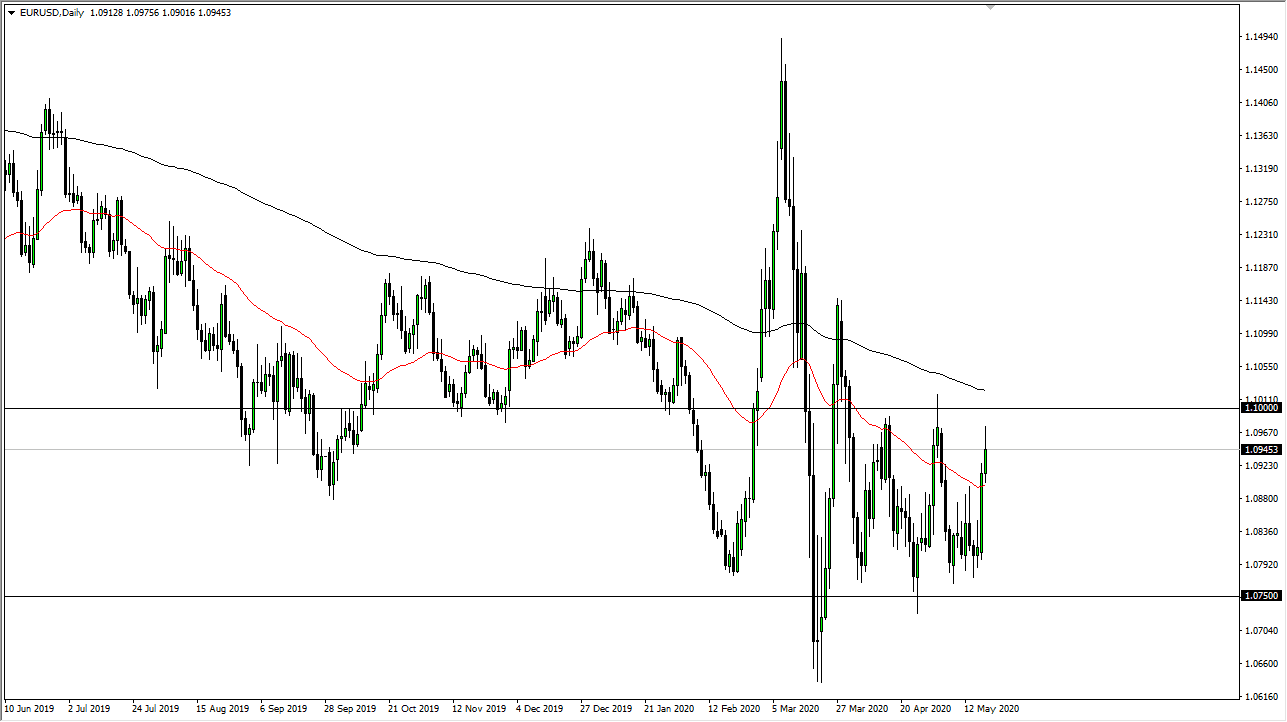

The Euro has rallied a bit during the trading session on Tuesday to reach towards the 1.0950 level, and even poked above there at one point early in the session. At this point, the market looks very erratic and has no idea what to do with itself, but we are at the top part of the range, so I think it is only a matter of time before we fail again. The range has been rather tough, so it does make quite a bit of sense that the trading community will look to short the Euro in this area. Ultimately, the 1.10 level is a major ceiling in the market while the 1.0750 level is massive support. Ultimately, this is a scenario that continues to show to central banks that have no idea what to do other than to loosen monetary policy and by junk bonds.

Because of this, it really comes down to who blinks first and at this point nobody can kill their own currency like the Federal Reserve. Jerome Powell has reiterated that he is going to do so, so that could be the excuse for the Euro to rally, despite the fact that Germany is now talking about taking on debts of other countries in the economy, which for short-term bursts might work, but at the end of the day signifies that the European Union is in serious trouble of becoming nonexistent as it is ripping the very fabric of what was supposed to be.

In other words, both of these currencies are under a significant amount of pressure in the short term, but longer-term it is obvious that the market is simply chopping around and flailing like a dead fish. The Euro is notoriously choppy anyway, so this should not be a surprise and therefore all you can do is play the range. The 200 day EMA is coming into play just above the 1.10 level, so it is likely that it will offer a bit of resistance. In other words, if you wait long enough you will probably get whatever move you are looking for, but I have absolutely no conviction in anything other than the fact that we are in a range. The EUR/USD pair is quite possibly the worst Forex pair out there, and the action over the last couple of weeks certainly sees more of the same yet again.