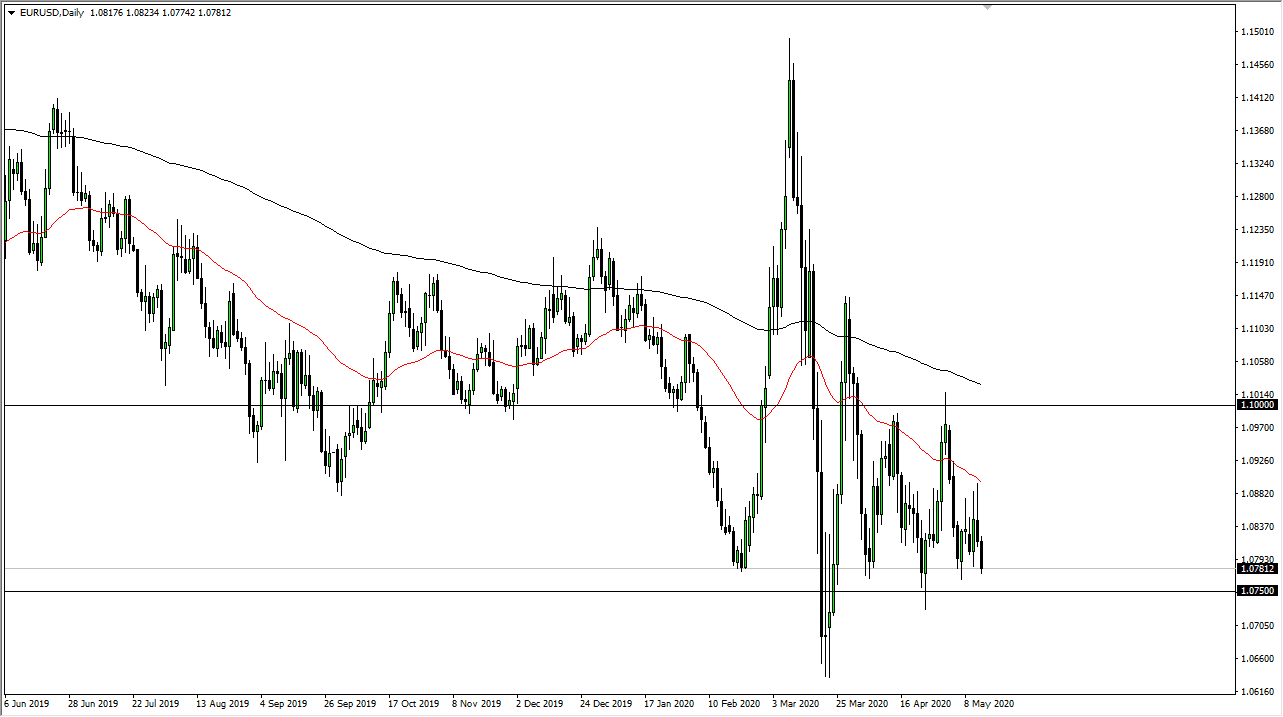

The Euro fell during the trading session on Thursday, reaching towards the 1.0750 level, an area that I think is rather supportive. When you look at the longer-term chart, you can see that we have been bouncing around between the 1.0750 level on the bottom, and the 1.10 level on the top. Ultimately, this is a market that I think continues to see a lot of choppy trading, and therefore I think it is only a matter of time before we bounced again, more than likely only to find sellers above.

The 50 day EMA is painted in red above and has offered significant resistance over the last several sessions. It is sloping lower, so therefore it is likely that the market will continue to see a lot of pressure from above, and ultimately I think it is likely that the market will continue to press lower and try to break down through that significant 1.0750 level, which could offer a significant amount of support. All things being equal I suspect that the markets will continue the same action that we have seen as of late, as the European Union is financially on the ropes.

The US Treasury markets continue to show signs of strength, and as a result the US dollar will continue to be attractive for traders in general. At this point, the market looks to be one that is going to be in a small range going forward, so therefore I think short-term day trading is probably as good as this gets. Fading rallies will be the way going forward, but you are going to need to be patient enough to wait for the Euro to become a little bit overvalued before getting involved. Ultimately, this is a market that I believe will eventually find its way through the bottom, and perhaps down to the 1.0650 level. If we can break down below there, then it is likely that the market will go looking towards the 1.05 handle. That is a major support level from ultra-longer-term charts, based upon a basket of European currencies with the Deutschmark being the leader. When looked at from that prism, a break down below the 1.05 level could go all the way down to the 0.80 level. At this point in time, the market is likely to see the casual attempts to go higher, but those should be looked at as an opportunity.