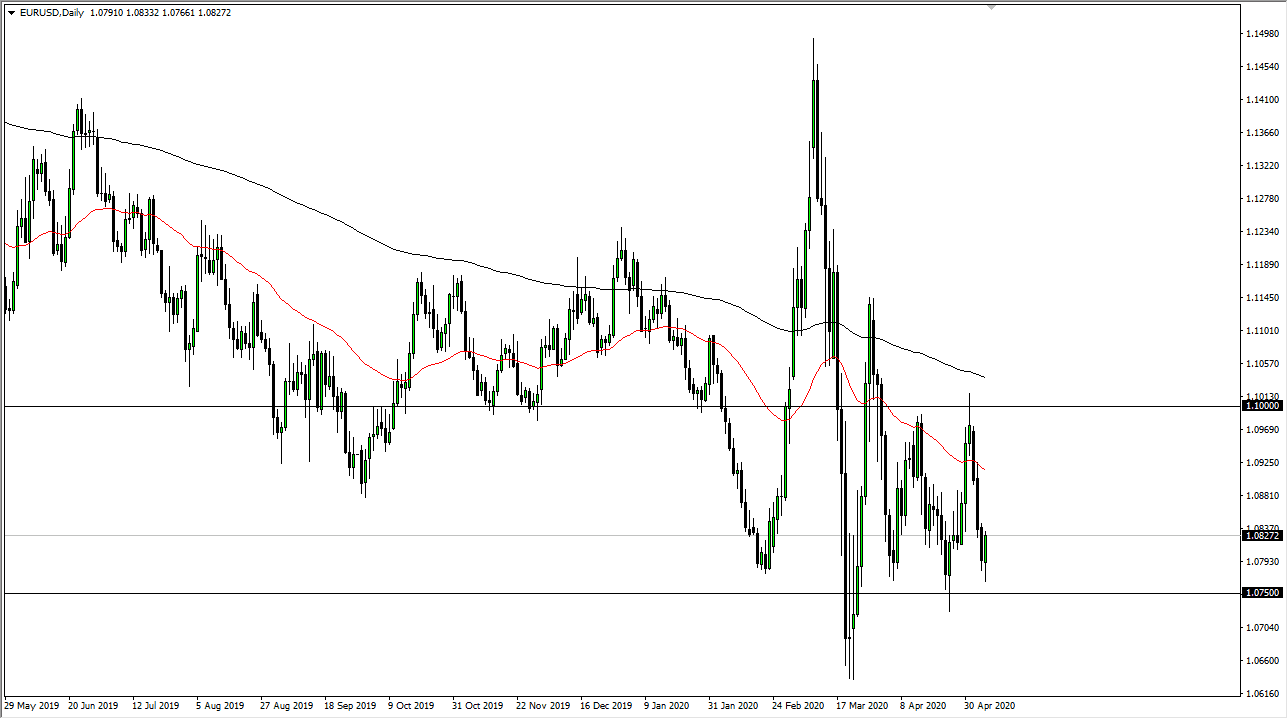

The Euro pulled back a bit during the trading session on Thursday, reaching towards the 1.0750 level. However, we bounced quite hard from there due to the fact that the Fed Funds Rate went negative for December 2020. This is extraordinarily negative for currencies, so it makes quite a bit of sense that the Euro would gain against the US dollar as it sold off against everything. Having said that, the Euro was at the bottom of the range so it makes sense that we would have bounced anyway.

On Friday, we will have the jobs number coming out the United States, and that of course will have its influence on this pair as well. We already know that the jobs number in the United States is going to be horrible, so do not be surprised if Wall Street has a quick reaction, and then goes back to normal almost immediately. That being said, if we can break above the top of the candlestick for the trading session on Thursday, I believe that the Euro will go looking to at least the 50 day EMA above. After that, we will probably go looking towards the 1.10 level which is the top of the overall range.

Having said that, the market is trying to simply go back and forth as we have for quite some time so even if you do not pay attention to the fundamentals, it makes sense that this move happened. That being said, I do not expect the market to suddenly go much higher, rather I think we simply find sellers again at the other side of the consolidation area. Keep in mind that the European Union has even bigger problems than the United States, so this was more or less going to be the excuse traders used to stay within the range that we are in. The candlestick is rather impressive, but again it is simply a continuation of what we have seen. If we did turn around a break down below the bottom of the candlestick though, and clear the 1.0750 level, that would be an extremely negative sign. At that point I think that we are more than likely going to go looking towards 1.0650 level after that. Below there, then the next move is going to be the 1.05 handle, which is crucial from a multi-decade standpoint when looking at a basket of European currencies against the greenback.