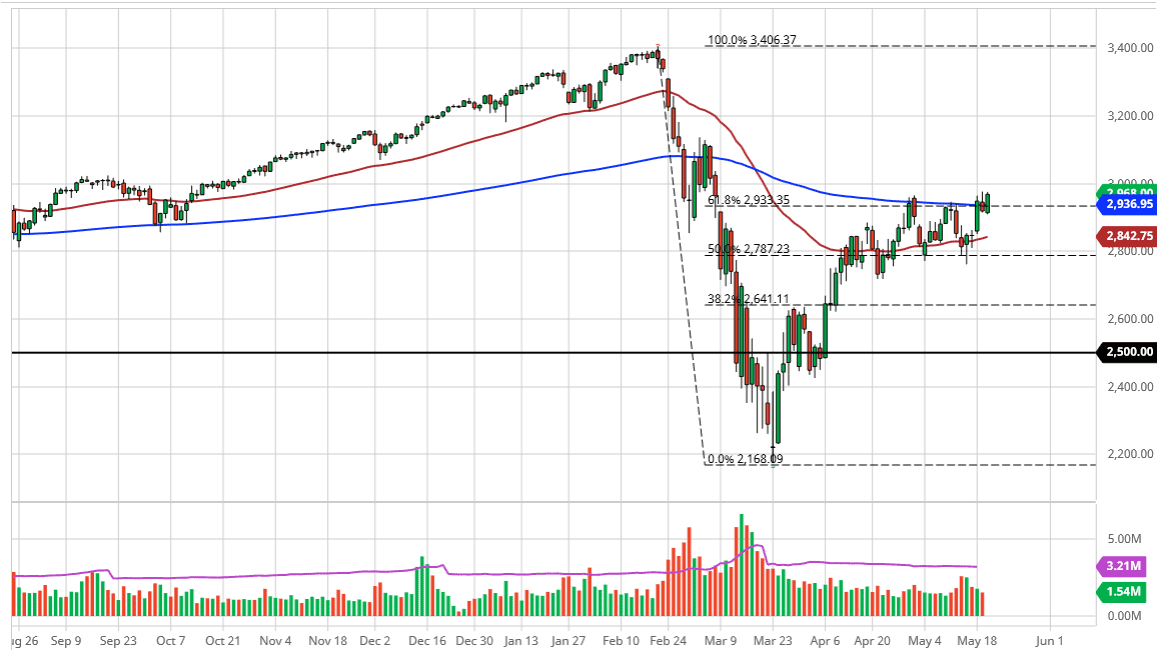

The S&P 500 has rallied significantly during the trading session on Wednesday again, testing the 2970 level yet again. This is a market that simply will not give up, and the fact that we almost broke above the top of the shooting star is an extraordinarily strong sign. Furthermore, we closed at the top of the range for the day, so that of course could be very bullish.

If we turn around a break down below the bottom of the range for the trading session on Wednesday, then that would be extraordinarily negative. At that point, it is likely that we will go towards the 2800 level. At this point, the market looks as if it is ready to make a decision, and quite frankly despite the fact that the economy is not going to take off, it looks like Wall Street is going to pump this thing up in the air. However, I cannot buy this market until we get above the 3000 handle. Between here and there, it has nothing but trouble just waiting to happen.

If we break down below the bottom of the candlestick for the Wednesday session, then it gives you an opportunity to play the range yet again. It has been rather reliable, and we have not quite broken out yet. It should also be noted that the NASDAQ 100 looks very bullish as of late, and as a result it could drag this market right along with it. I do not understand exactly what it is traders are seeing other than liquidity from the Federal Reserve, but then again that has been the only thing that has mattered for about 12 years when you look at the whole of the situation. As long as the Federal Reserve is willing to bail out Wall Street without exception, one has to think that traders have to buy risk assets eventually. The next 24 hours will more than likely be rather important, so pay attention to the candlestick as it tells us where we go longer term. A breakout above the 3000 level more than likely has the market reaching towards the 3100 level. However, a return to the 2800 level is much easier to stomach given what is going on as far as earnings season is concerned and of course the economic concerns out there. At this point, we are sitting on the precipice of yet another big move.