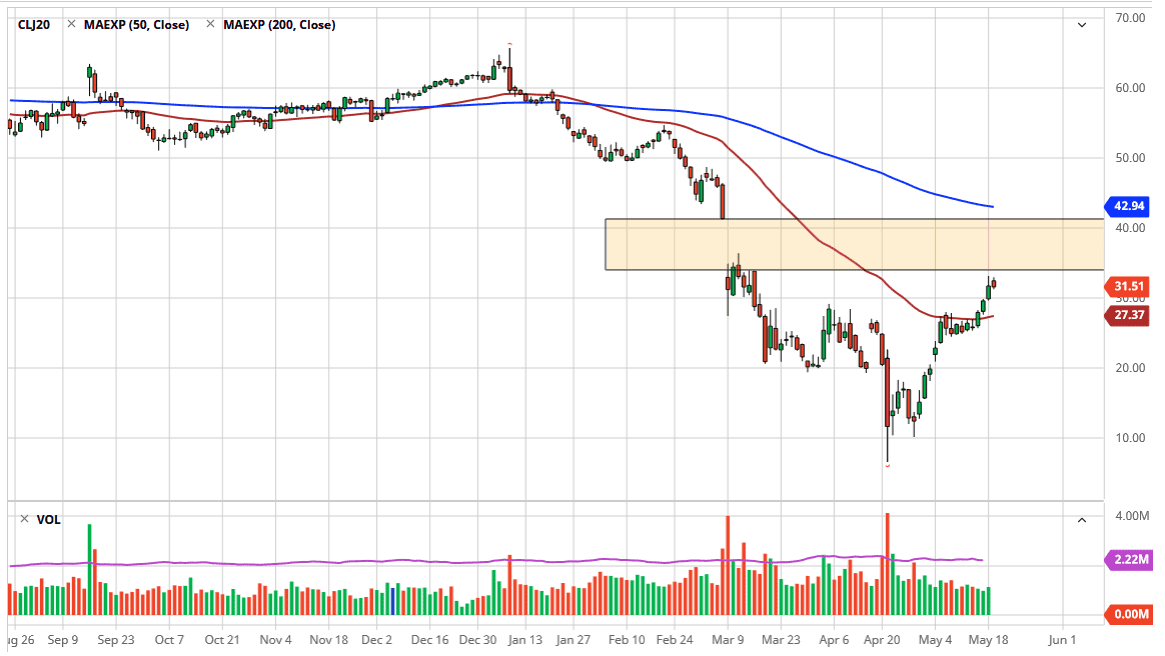

The West Texas Intermediate Crude Oil market has tried to break higher during the trading session on Tuesday but gave back quite a bit of the gains. That being said, the market is likely to see a lot of noise, due to the fact that not only are we running out of momentum, but we also have a major gap above that is going to offer a significant amount of resistance. Because of this, it makes quite a bit of sense that we could see a lot of trouble between here in the $41 level, so I think given enough time we will form an exhaustive candle that we can take advantage of. We did not quite get that during the trading session on Tuesday though, as the negative candlestick was not exactly convincing. It is because of this that I would not be surprised at all to see a bit more resiliency.

What is interesting about WTI Crude Oil is the fact that the market is likely to continue to see you have a lot of “hope”, as the world is likely to continue to try to open up. If that is going to be the case, then obviously there is going to be an increase in demand for crude oil. However, do not forget that the demand for crude oil was already falling before the coronavirus pandemic it. Because of this, there is still some negativity out there just waiting to happen.

The resistance barrier extends all the way to the $41 level, so somewhere between here and there we will more than likely to see sellers jump in and again. If we did turn around and fall from here to break down below the 50 day EMA, then that would be convincing enough to consider that the market would go much lower. I think we probably have put the bottom and though, due to the fact that the selloff was so extreme. At one point, we had gotten down to eight dollars a barrel. Keep in mind though, futures contracts are more than likely going to cause a lot of noise as people will try not to take as much in the way and delivery over the next couple of days, but this is still a very bullish move, and therefore it is going to take a lot of exhaustion to turn this thing around.