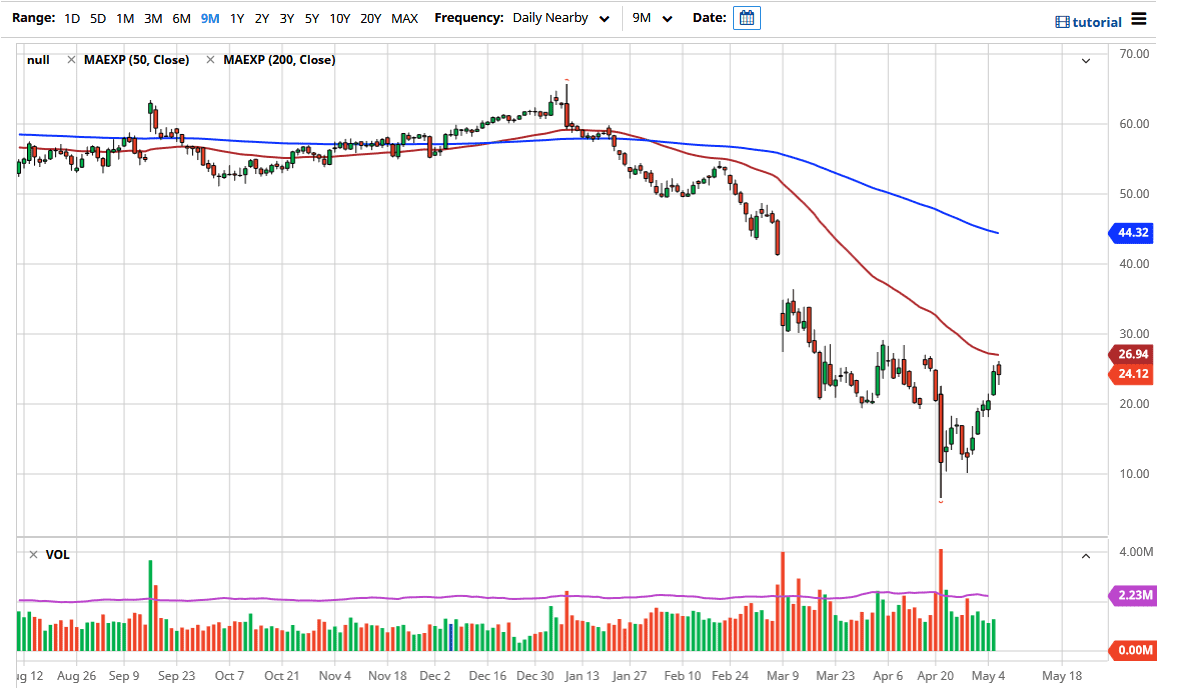

The West Texas Intermediate Crude Oil market pulled back just a bit during the trading session on Wednesday as we approached the 50 day EMA. The market has gone straight up in the air and even though there are some signs up more demand coming down the road, it is still absolutely anemic compared to what the market is used to. All things being equal, this should also be noted that the supply continues to be a major issue. The US producers are looking to cut some production and that is part of what has propelled this market higher, and then quite frankly the fact that it had gotten so oversold. Having said that, we are at a crossroads now, and will need to make a serious decision.

The 50 day EMA of course attracts a lot of attention in and of itself, but we also have the $30 level above which had previously been significant resistance. At this point, I do not see the market simply slicing through there, but I am the first to admit that I did not see it simply slicing through the $20 level either. It is very likely that the market is going to continue to see volatility regardless of what we have coming next, and of course we have to keep in mind that the jobs number comes out on Friday, and that will have its own effect on markets in general, especially as the US dollar will strengthen or weaken based upon that as well.

If we do break above the $30 level, then it is highly likely that we will go looking towards the top of the gap, which means we could go as high as $42. That being said, it is a bit of a stretch to see it happening, but it is one of the possibilities. If we can break down below the bottom of the candlestick for the trading session on Wednesday it would turn that candlestick into a “hanging man”, which is a very bearish pattern. To the downside, you would be looking at the $20 level, and then possibly the $15 level. The closer we get to delivery in June, the more likely we are to see more bearish pressure as storage is still a major issue. Whether or not we go negative like we did in May is a completely different question, but it is still something that is worth paying attention to.