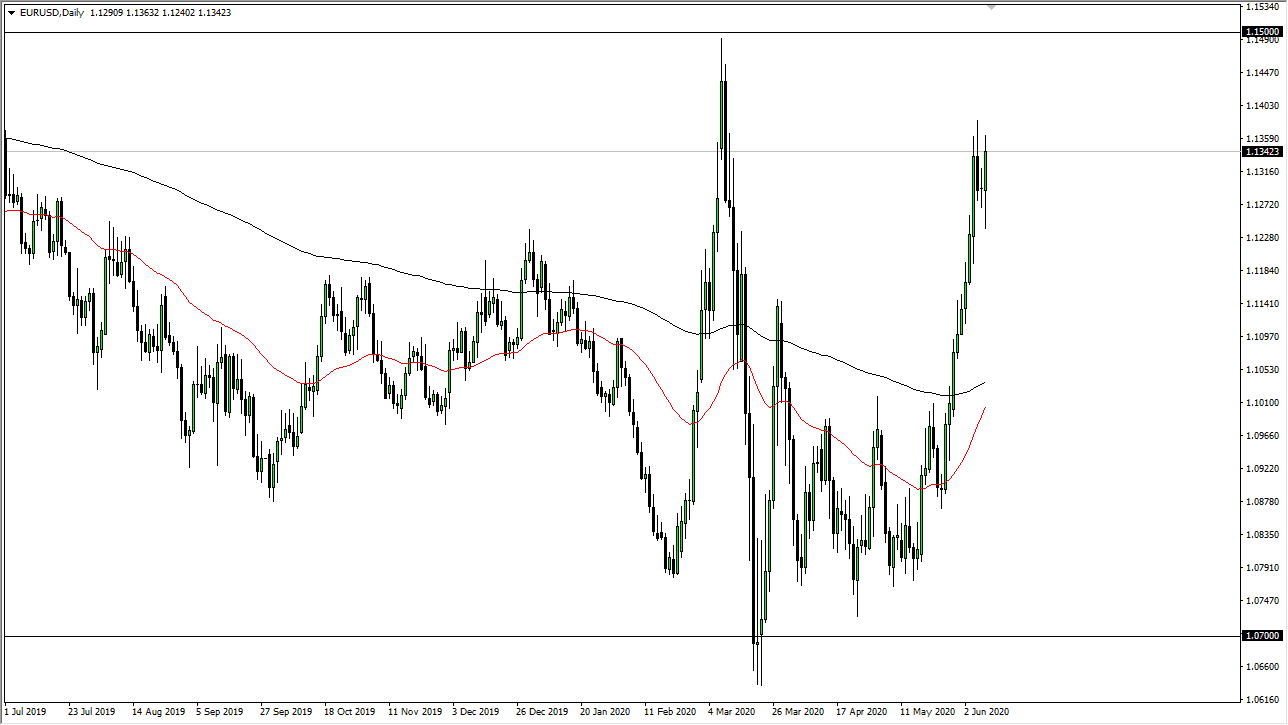

The Euro initially dipped during the trading session on Tuesday but found buyers near the 1.1240 level to turn around a break back above the 1.13 handle. I suspect that the market is simply waiting for Jerome Powell to get done with his speech during the trading session on Wednesday, which could give us an idea as to whether or not the Federal Reserve is going to continue to loosen monetary policy or at stimulus. Ultimately, this is the market that is going to continue to be very noisy, but clearly it is highly likely that traders are waiting for this statement and assume that it will of course be very dovish. It is highly likely that the Federal Reserve does anything to “upset the apple cart”, and I believe traders are trying to front run the Fed.

To the downside, I believe that if we do break down massively, the 1.1050 level will be an area that will be interesting, as the 200 day EMA is right in the same neighborhood. Because of this, I think that there would be a lot of value hunters in that area, but it will be interesting to see if we get down there and why we would get down there. Quite frankly, I think that the Federal Reserve suggesting that it was suddenly going to be less accommodative would be the main reason, and that could of course in the Euro much lower. I would anticipate the odds of that happening almost to be 0%, so I look at pullbacks as potential buying opportunities. The real question is whether or not we can break above the 1.15 level which would of course be a major turnaround in this pair from the longer-term. We have seen a massive move higher over the last couple of weeks, but when you look back a couple of months ago, you can see that this has happened previously, and clearly that got turned around, so nothing is set in stone obviously.

The statement comes out at 2 PM Eastern Standard Time in the United States, so keep in mind that there is probably going to be a lot of volatility around it, as algorithms are reading headlines and placing positions. Nonetheless, the market is likely to see an overall push to the upside as the Federal Reserve has shown that it is more than willing to support Wall Street.