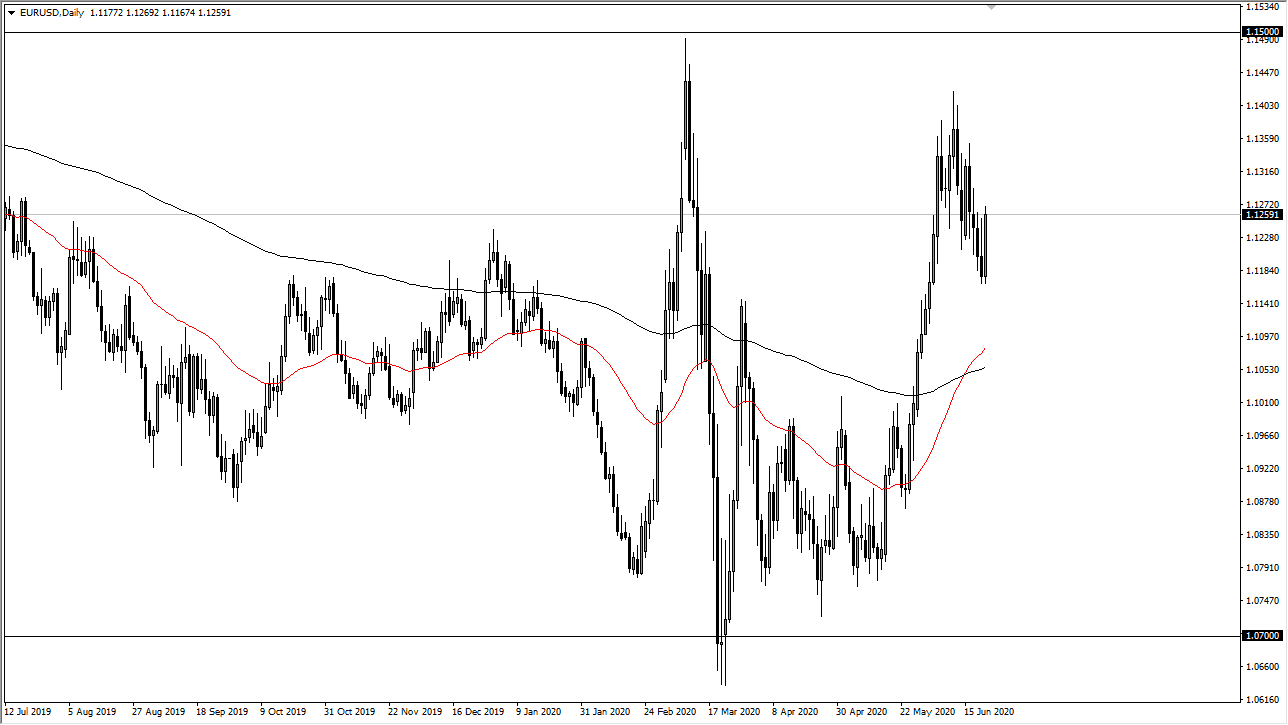

The Euro initially surged during the trading session on Monday, reaching all the way towards the 1.1275 level before running into a bit of trouble. The candlestick is very impressive, but it does not tell the entire story, as the afternoon was relatively quiet and then started to see a little bit of the selloff as New York went home. At this point in time, the Euro does look a bit heavy and I do think that it is likely to pull back from here. Even if it does not pull back right away, it has proven more than once that the 1.14 level offers a significant amount of pressure to the downside and I think that we are likely to continue to see that pressure play out and push the market lower.

Even if we do rally from here, I will simply look for signs of exhaustion that I can take advantage of. If I get that, then it is likely that we will see market participants jump in and start shorting, which I of course will plan on doing. To the downside, I see that the market could go down to the 1.1050 level which is the 200 day EMA, possibly even the 1.10 level after that. After all, the pair has been in a huge trading range for some time, and we are closer to the top than we are at the bottom.

Beyond all of that, there are plenty of reasons to believe that the treasury markets will continue to attract a fair amount of trading capital, and that of course works in favor the US dollar because it is not only “risk off”, but it is also denominated in US dollars. This means that traders who are looking to buy those assets outside of the United States need to buy that currency. Having said all of that, I do not necessarily expect that this is going to go straight down I think it will end up being very choppy which is the typical MO for the Euro which is probably one of the choppier currencies out there. Beyond all of that, we also have a lot of concerns when it comes to the European Union from a longer-term standpoint, so I think it is only a matter of time before we see the Euro give up all of the gains that it has recently enjoyed.