The Euro has had a choppy session on Friday, as it tries to figure out where it is going next. The fact that the United States is locking down a few states again, although not completely, is helpful to the Euro. People are wondering whether or not the US will come out of the coronavirus pandemic relatively unscathed or not. The reality is that the reaction so far has been relatively muted, so I think that any rally at this point will probably see more of the same action that has been the case for a while.

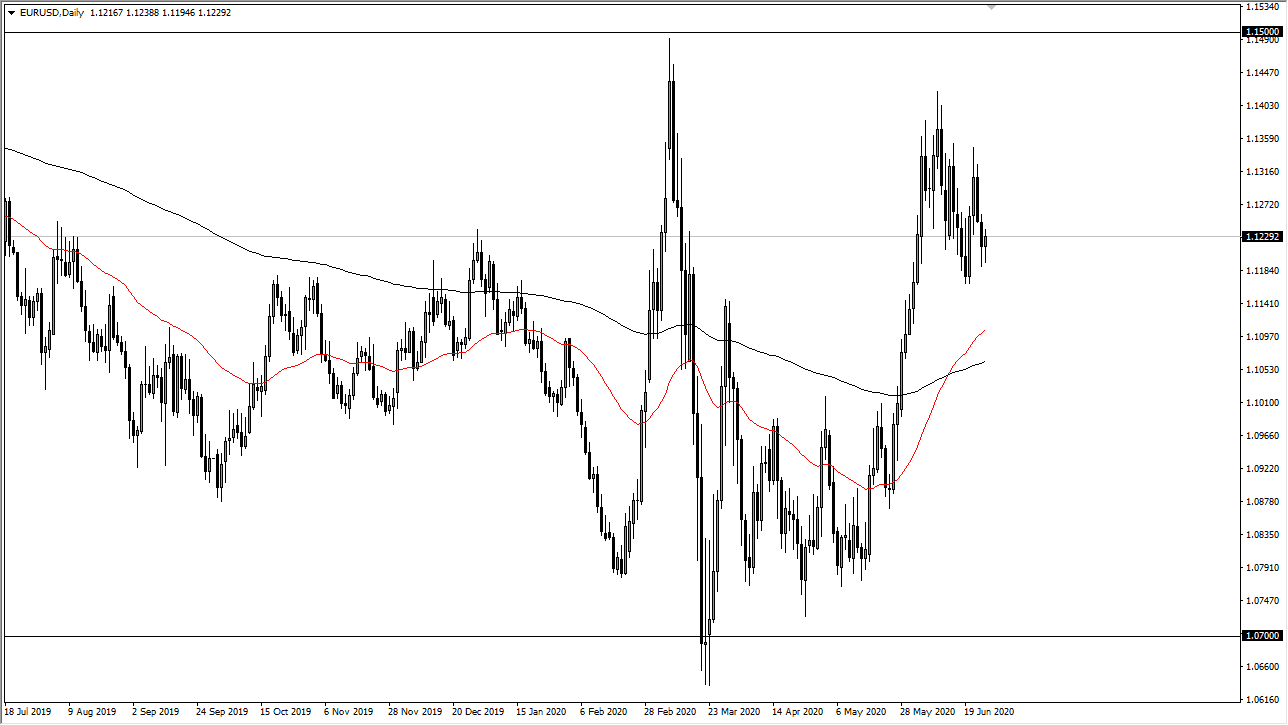

When you look at the weekly charts, after seeing a couple of shooting stars, we are more than likely to continue seeing sellers. If we can break out above those wicks of candles from the weekly timeframe, it will open up a move to the 1.15 handle. That is an area that I think is crucial for the longer-term outlook for this currency pair, so if we were to break above there, I would be looking for some type of bigger long-term “buy-and-hold” scenario. I do not see that happening though, at least not in the short term. After all, there are plenty of reasons to think that we could have something spook the market, and spooking the market of course means that people will be looking to buy US Treasuries. This of course required pullback so I think that could be reason enough for the market to start following again.

In the short term, I think that we probably have a scenario where the market rallies towards the 1.13 level or so and then starts selling off again. I do not have any interest in trying to buy it, at least not until we get past all of this noise, and it should be noted that the most recent high was lower than the one before it so it is likely that we are starting to change attitude yet again. I like the idea of fading rallies as they occur. Having said all that, I think it is only a matter of time before the markets have to return towards the 1.10 level based upon historical precedents and the fact that the 200 day EMA is sitting in that general vicinity. I remain bearish, but open to the idea of a trend change on a break higher.