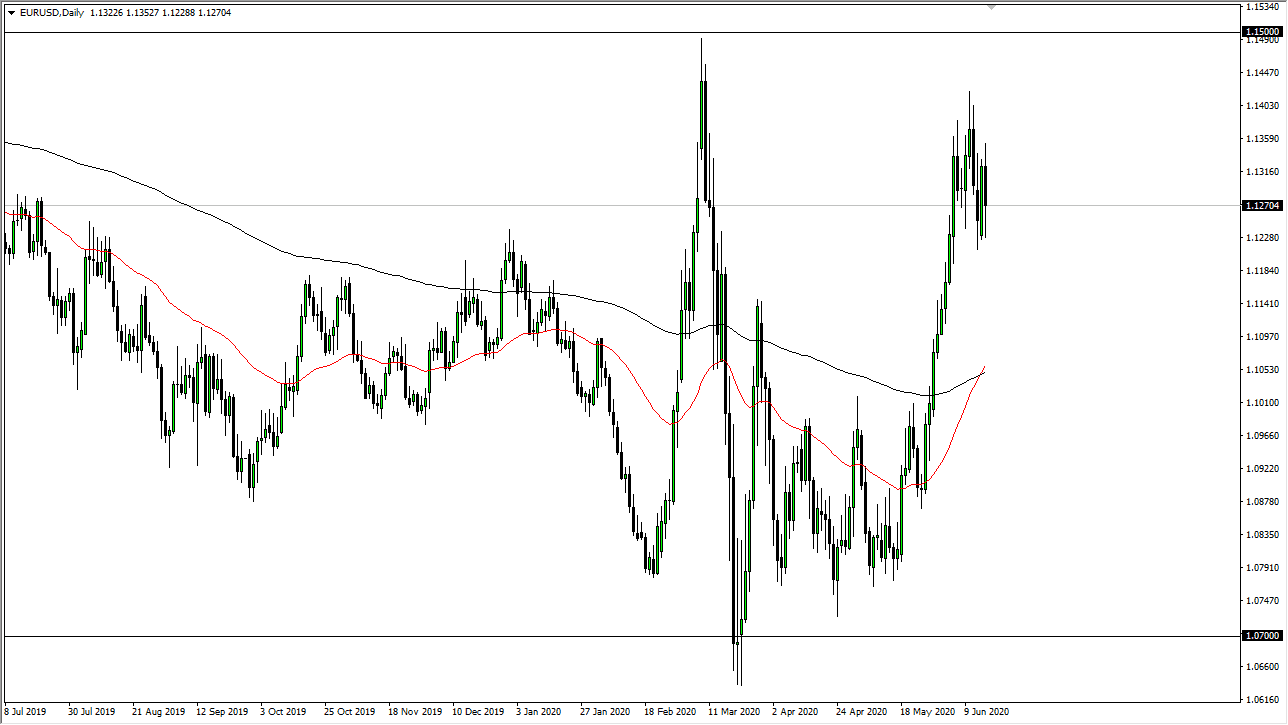

The Euro fell during the trading session on Tuesday as Jerome Powell spooked the market. He had a bit of congressional testimony that had people worried about whether or not the Federal Reserve was going to continually feed the financial markets the liquidity that they so desperately need, which had people selling off anything risk related, including the Euro. Nonetheless, this was a trade that was setting up to begin with due to the fact that the market has found consistent resistance near the 1.14 level, and we had gotten close to that level early in the day.

The question now is whether or not we can break down below the 1.12 handle, which would open up a move down to the 1.1050 level. Ultimately, I think that the market will continue to be noisy, but it is getting a bit heavy up here. If the market continues the action that we have seen, we will probably rally towards the 1.14 level before sellers come back in and start selling again. There is a massive amount of resistance between that level and the 1.15 handle, so I think it is only a matter of time before the massive resistance let us itself known.

At this point, it is probably what the Federal Reserve does more than anything else that determines where this pair goes. The Federal Reserve has been flooding the market with US dollars, so in theory it should drive the value down. However, the Euro is an absolute disaster so remember the currency pairs that your trading is relative value between a couple of currencies, not just a one-way trade. Because of this, the fact that the Euro is still weak is one of the things that has been keeping this market down longer term. However, the Federal Reserve has its way we will see this market break above the 1.15 handle, perhaps on its way to the 1.1750 level. Right now, I do not see that happening in the short term, but clearly that is the longer-term plan for the Federal Reserve. The spike that we had seen all the way appear needs to be consolidated, if not pulled back in order to find more momentum. We could see a return to the lows just as we did a couple of months ago, as this area has been so heavy for so long.