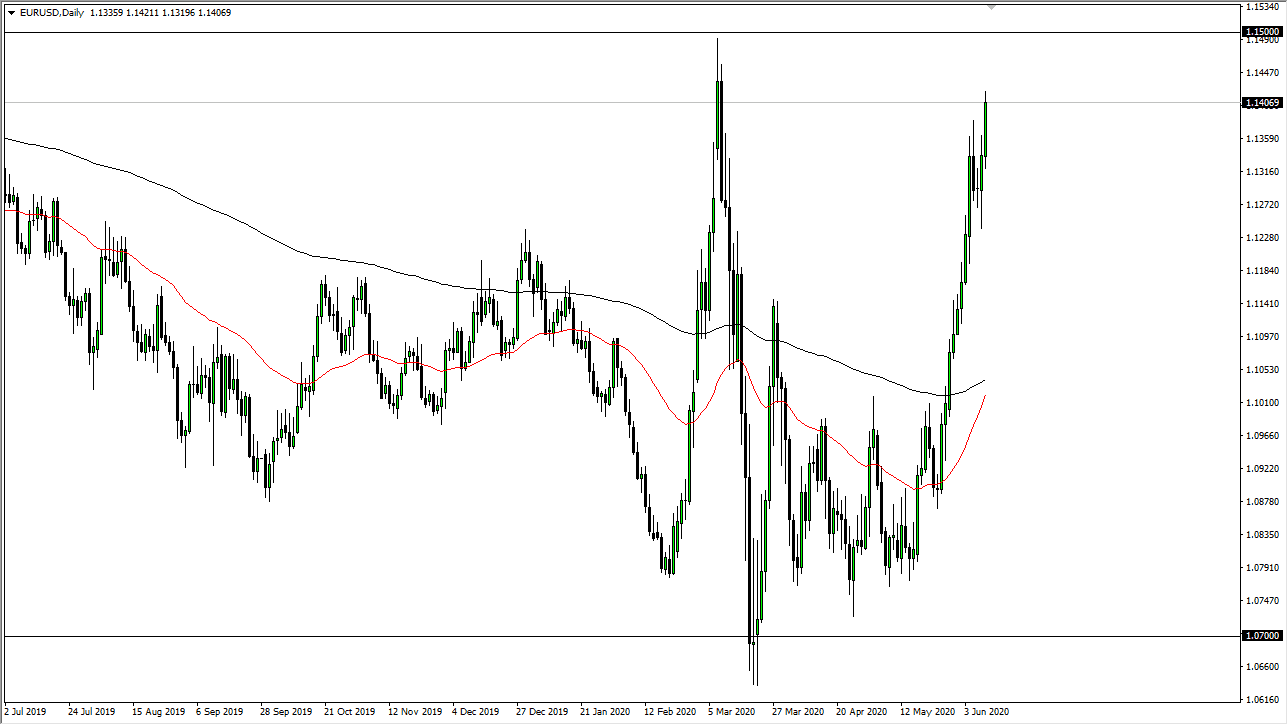

The Euro rallied significantly during the trading session on Wednesday, breaking above the 1.14 level at one point. However, we are starting to give back some of the gains late in the session, so I wonder whether or not we have the staying power to continue higher. To the upside, I believe that the 1.15 level is a major resistance barrier. If we were to break above there, then it is likely that the market goes much higher, but in the meantime, I believe that we are more than likely going to see a certain amount of exhaustion come into the marketplace.

I do not necessarily think that you can short this market, but it certainly looks as if it is going to struggle to continue the parabolic run that we have seen. The last couple of days have been a little bit in the way of consolidation, so I think that there is support running down towards the 1.13 level. Ultimately, this is a market that I think continues to see a lot of noise, mainly because there are so many questions out there when it comes to where the economy is going. I do not like buying all the way up here anyway, so having said that it is likely that the pullback in the short term will find a certain amount of value hunters, but if we give way below the 1.13 handle, it is likely that we could drop even further, perhaps reaching towards the 200 day EMA. We have seen these parabolic moves before, and they typically at the very least need some type of pullback.

The candlestick is somewhat positive for the day, but the fact that we gave back so much in the end tells me that we are quite ready to break out above the 1.15 handle. That would lead to even bigger gains, and I think we are simply looking at more violent moves in the short term than anything else. Because of this, I would not put too much into the market in either direction, because quite frankly there is so much in the way of risk out there and both directions. Remember, the US dollar will be thought of as a safety currency if we see problems out there, and of course the Euro will be looked at as an opportunity for adding a little bit of risk to your portfolio. At this point, I suspect that the risk is skewed to the downside, but not quite trade-able actions yet.