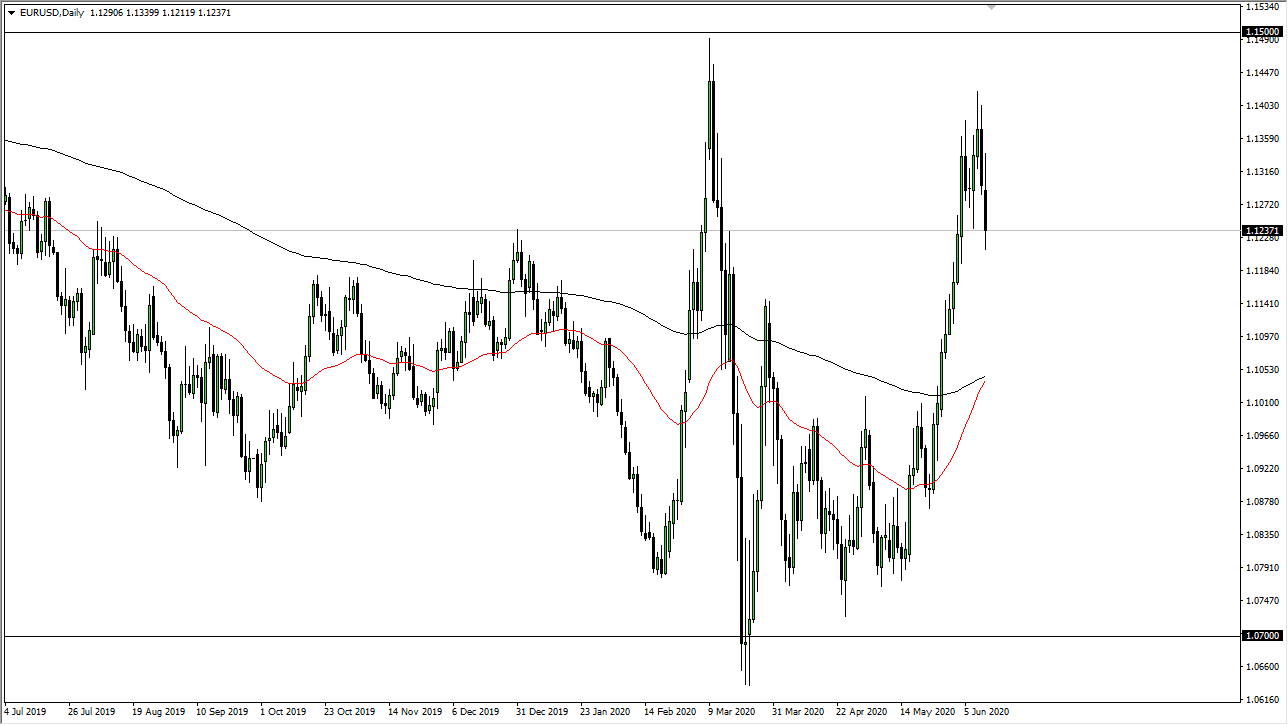

The Euro initially tried to rally during the day on Friday but gave back quite a bit of the gains a turnaround and show signs of exhaustion. The weekly candlestick looks a bit like a shooting star as well, so it looks likely that we are going to try to break back down and reach towards the bottom of the longer-term range. This is a market that has seen a lot of resistance near the 1.15 handle, and most recently the 1.14 handle. By breaking lower, it looks as if the market is probably going to go looking towards 1.10 level, which is basically where the 200 day EMA is, and of course the round figure of course will attract a lot of attention.

At this point, believe that the market is going to continue to see a lot of back-and-forth trading, and the EUR/USD pair is simply acting the way of the risk appetite has flown around the world, as we are looking at extreme amounts of volatility. I do not think that this market is ready to break out to the upside, at least not yet. The 1.15 level being broken above on a daily close could send this market much higher, but I do not think we are ready to see that, especially considering how the Friday session closed. At this point, I think it is only a matter of time before gravity comes back into play and we reach to lower levels.

The 1.12 level is an area that has offered a little bit of support, but I do think more importantly what I will be looking to do is fading rallies that happen within the area extending all the way to the 1.14 handle. All I need to see is a shorter-term candlestick with the long wick to the upside to jump on. I do believe that we are going to see this parabolic move broken back down, and for what it is worth, I am starting to see other pairs show signs of weakness against the greenback as well. It looks as if the market is going to continue to favor of the greenback longer-term, despite the fact that the Federal Reserve is out there trying to kill off the greenback. All things being equal, this is a market that I think continues to see volatility, but we are at the top of the range so falling makes quite a bit of sense.