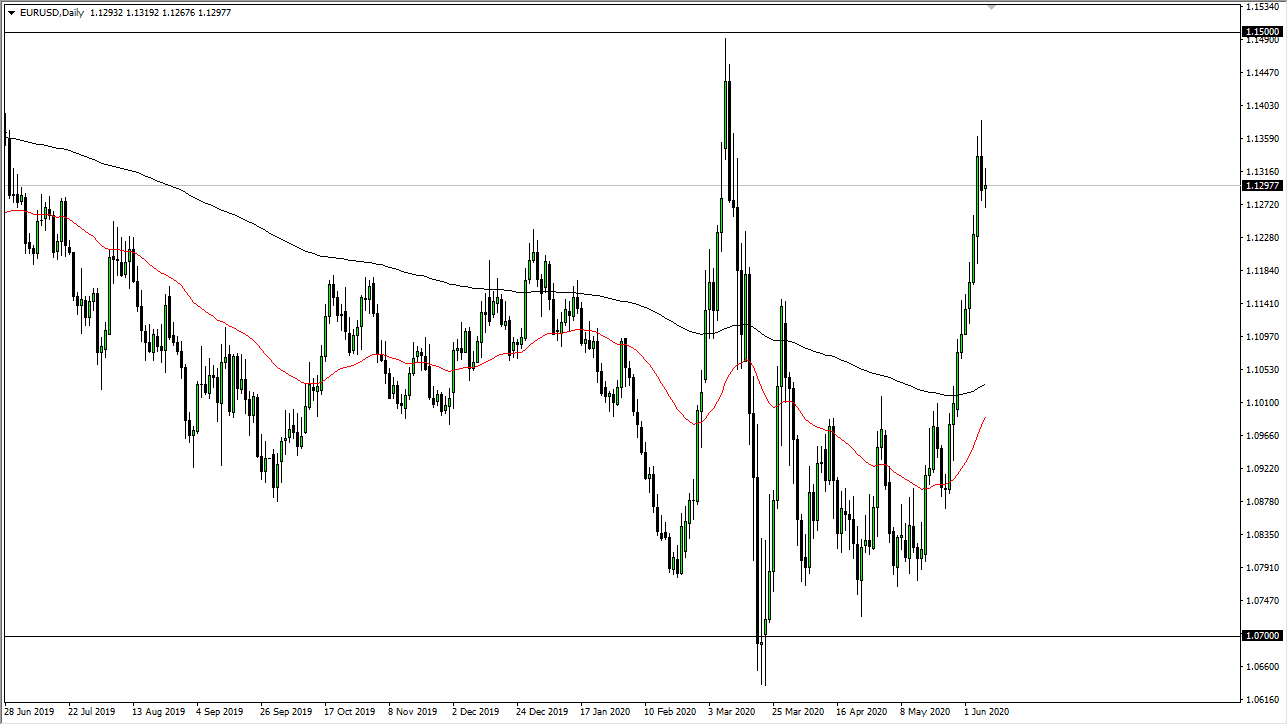

The Euro has gone back and forth during the trading session on Monday, as traders continue to test the 1.13 level in both directions. This is a market that looks likely to need to at least digest gains, if not pull back drastically after the parabolic move. Going straight up in the air from here is not something that you can plan for, because quite frankly we have gone so parabolic that it would be dangerous to put money to work at this point and simply assuming that we are going to go crashing into the 1.15 handle. Even if we did, the 1.15 level should be massive resistance.

The 1.15 level above is an area that should attract a lot of attention due to the fact that it is a psychologically important large round figure, but it is also an area that has previously been resistive. Furthermore, before that it was supportive. At this point, it makes quite a bit of sense that the 1.15 level should continue to be a bit of a target for both buyers and sellers, depending on what side of the line we are on. Though, it is only a matter of time before the sellers would get involved in that area, if we do clear the 1.15 handle, as it is likely that the Euro will continue a longer-term move, perhaps something that lasts for quite some time.

The candlestick for the Monday session shows that we are more likely to grind sideways in the short term, perhaps digesting the gains more than anything else. The Euro course is getting supported by the idea that the Federal Reserve is going to try to do everything you can to bring down the value of the US dollar again this week, as they have a meeting. The Federal Reserve has made it clear that it is trying to kill the greenback, as we have seen over the years. More of the quantitative easing type of policies are still coming down the road, and therefore eventually traders start to sell the US dollar as the purchasing power drops. At this point in time, if we were to break down below the 1.1250 level, then I would throw another short position against the Euro, but the Monday session shows that people are not exactly afraid of owning the Euro at these levels.