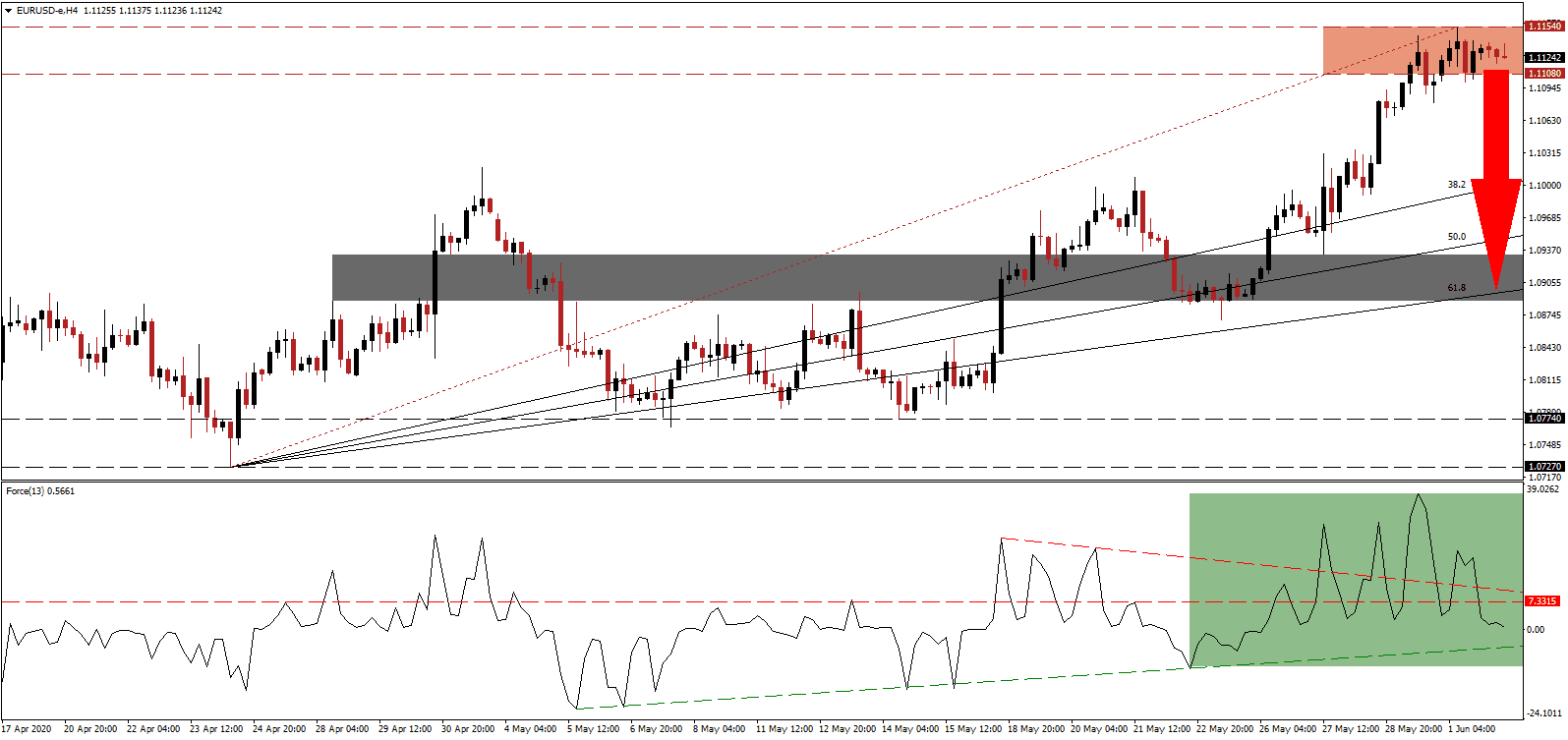

Despite the European Central Bank’s acknowledgment that the Eurozone will face a more precipitous than previously considered recession, the Euro experienced extensive capital inflow’s against the US Dollar. The fallout from the Covid-19 pandemic is set to dwarf the aftermath of the 2008 global financial crisis, and the Euro faces an increase in existential threats. Protest across Italy erupted, demanding the government to abandon the single currency and revert to a national one. It adds to breakdown pressures in the EUR/USD, presently inside of its resistance zone, with fading bullish momentum.

The Force Index, a next-generation technical indicator, initially spiked to a new multi-week high before crumbling. A recovery resulted in a significantly lower high. It led to an acceleration below its descending resistance level, followed by a conversion of its horizontal support level into resistance, as marked by the green rectangle. Bears wait for this technical indicator to move below its ascending support level and into negative territory before resuming complete control of the EUR/USD.

Increasing bearish progress for the European Union as a whole is the pending resignation of EU Trade Commissioner Phil Hogan. After only seven months at the job, he is rumored to consider running for Director-General of the World Trade Organization. The present head of the WTO, Roberto Azevêdo, announced plans to step down one year ahead of schedule. It delivers a tremendous blow to European Commission President Ursula von der Leyen, who will have to appoint a new candidate from a different country. The EUR/USD is favored to collapse below its resistance zone located between 1.1108 and 1.1154, as identified by the red rectangle and enter a profit-taking sell-off.

Developments out of the US, on a monetary, foreign policy, and trade front are expected to limit the downside potential in this currency pair. Annualized interest payments on US debt exceed $1 trillion and are poised to increase, and more debt-funded stimulus is being discussed, while more tariffs in trading partners are considered. The EUR/USD is anticipated to correct into its ascending 61.8 Fibonacci Retracement Fan Support Level, currently passing through its short-term support zone. This zone is located between 1.0888 and 1.0933, as marked by the grey rectangle, and a sell-off into it will maintain the long-term bullish chart pattern.

EUR/USD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.1125

Take Profit @ 1.0900

Stop Loss @ 1.1180

Downside Potential: 225 pips

Upside Risk: 55 pips

Risk/Reward Ratio: 4.09

Should the Force Index reverse above its descending resistance level, the EUR/USD may attempt to add to its advance without a correction. It will make this currency pair vulnerable to a more violent sell-off in the future. While the Eurozone is faced with mounting issues, they are trumped by US developments. The next resistance zone awaits price action between 1.1279 and 1.1331.

EUR/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.1225

Take Profit @ 1.1335

Stop Loss @ 1.1180

Upside Potential: 100 pips

Downside Risk: 45 pips

Risk/Reward Ratio: 2.22