Yesterday's trading session was harsh for USD/JPY, as investors strongly abandoned the US dollar, although fears of the beginning of a second wave of the Corona epidemic are still present. Growing numbers threaten the future of reopening global economies. The Japanese Yen had a better opportunity to push the pair towards the lowest 106.07, the support level for almost two months, before settling around the 106.60 level at the time of writing. The US currency fell despite President Trump's assertion that a trade agreement with China was still in place.

As President Donald Trump tweeted that an initial trade agreement with China was still in effect after comments by a senior White House advisor indicated that it had expired, Trump said: “The Chinese trade deal is completely sound. We hope they continue to adhere to the terms of the agreement! The Trump administration has sharply criticized China’s efforts to contain the new coronavirus early on, and the president has repeatedly blamed China for the epidemic in his remarks, which have raised questions about future cooperation in areas such as trade.

On the economic level. New US home sales increased by a staggering 16.6% in May as major parts of the country were reopened, which could increase activity in the housing market. The Ministry of Commerce has reported that new home sales per family increased to an average annual seasonal rate of 676,000 homes last month. This was a much better performance than expected. Many economists had expected sales to fall in May.

New home sales figures come just one day after the United States announced a 9.7% drop in May sales of existing homes at an annual rate of 3.91 million, the slowest pace in almost a decade. There are hopes that the housing slump that occurred with the closure of the Covid 19 virus is coming to an end, although millions of jobs lost due to the epidemic could hamper any recovery.

Nancy Vanden Houten, the US economist at Oxford Economics, said she expects a modest recovery in sales in the coming months after the big declines in the first quarter, but still expects a general decline this year. She stated, "The slow recovery in the labor market will limit the upside of any recovery in the housing market."

The average price of the new US home increased 4.9% to $317,900 in May after falling 8.7% in April, a decrease due to a major discount by construction companies at the conclusion of the virus closings.

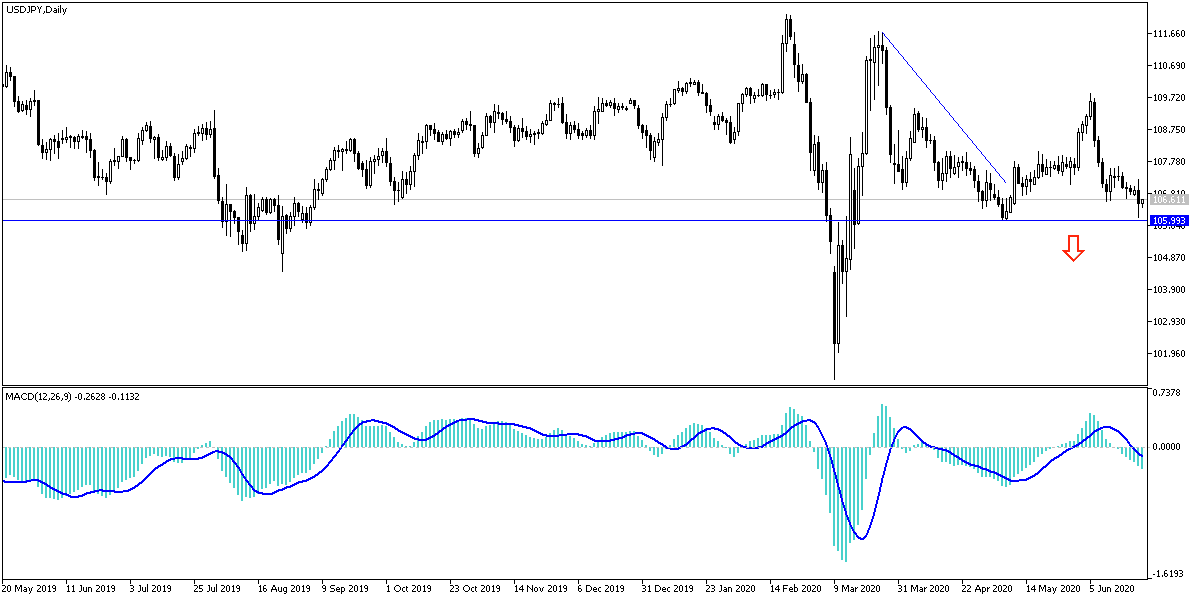

According to the technical analysis of the pair: The technical indicators on the USD/JPY chart moved towards strong oversold areas. We expect an upward correction anytime. The closest support levels for the pair are currently 106.10, 105.65 and 104.90 respectively. Despite the recent performance, I still prefer buying from a lower level. Divergent economic performance, monetary policy and currency strength are still in favor of the US dollar. Resistance at 108.60 remains the key for the bullish correction force to take place.

The pair does not expect any important economic data today from either the United States or Japan. Risk appetite will have the strongest effect.