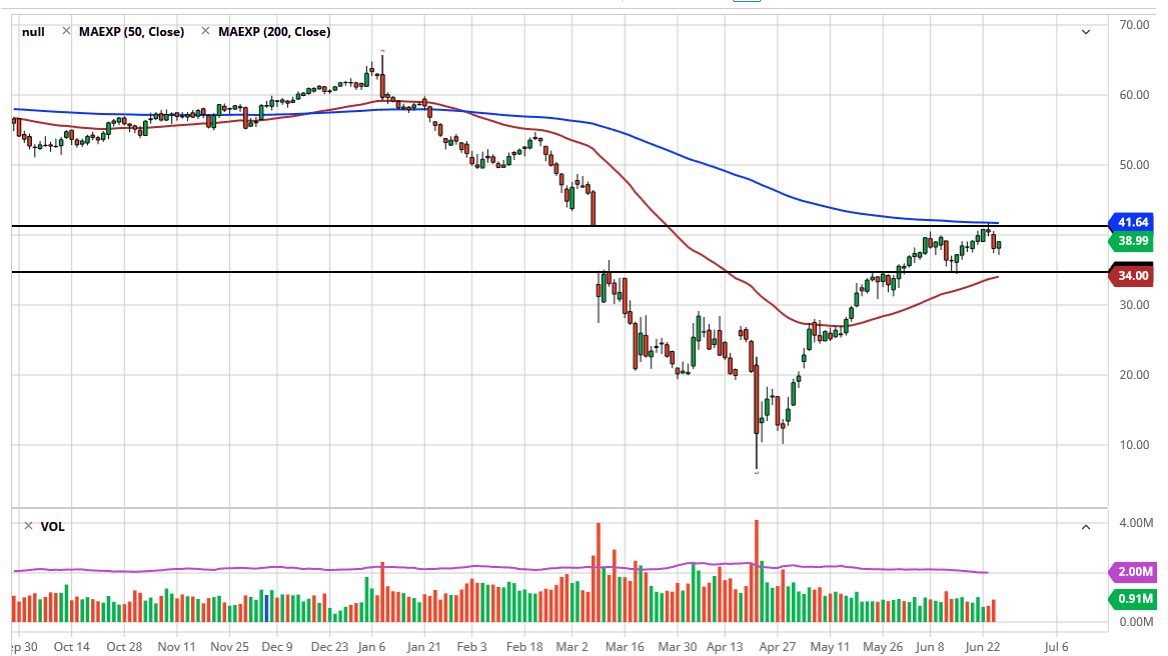

The West Texas Intermediate Crude Oil market initially fell during the trading session on Thursday, but then turned around to show signs of life again. This is a market that looks likely to try to go back towards where the gap was at the $41 level. Now that we have filled the gap, it is likely that we are going to try to find some type of range from which to trade. The crude oil market is quite often stuck in a $10 range, and that makes quite a bit of sense that we would find this eventually. The $40 level should be a region of resistance, and now we need to find the bottom. In the short term, it looks to me like the $35 level should be as the 50 day EMA is in that general vicinity.

Looking at this chart, it is obvious that we have had a nice run over the longer term but when you look at the momentum it certainly is starting to drop a bit. The market will continue to pay attention to the supply and demand equation, something that is starting to favor lower pricing in the short term. Having said that, OPEC is certainly going to do something to try to elevate Price as more talk of cuts continue.

One of the biggest problems that crude oil has is that the global economy is not taking off the way oil producers needed to do so in order to drive prices higher. I think at this point the market is trying to settle into a range, so I anticipate a move back towards the $40 level where we will see a bit of a pullback. To the downside, the $30 level could offer quite a bit of support, as it was previous resistance. At this point in time, that is my guesstimate but one thing I do know is that the 200 day EMA is an indicator that a lot of longer-term traders pay attention to. If we were to break above that, then the market is likely to go much higher, with $49 being the initial target at the very least. All things being equal though, I believe that we are probably going to see more chop than anything else over the next several sessions as this market has been overextended for a while and at the very least, we need to consolidate.