The West Texas Intermediate Crude Oil market has broken down significantly during the trading session on Thursday, as we have seen a lot of selling pressure across the risk spectrum. I do not even know that this had anything to do with crude oil at all, because the markets sold off anything that was remotely not the US dollar. At this point, the crude oil market has pulled back a bit to show signs of exhaustion, which makes sense considering how we have gone far too high in such a short amount of time.

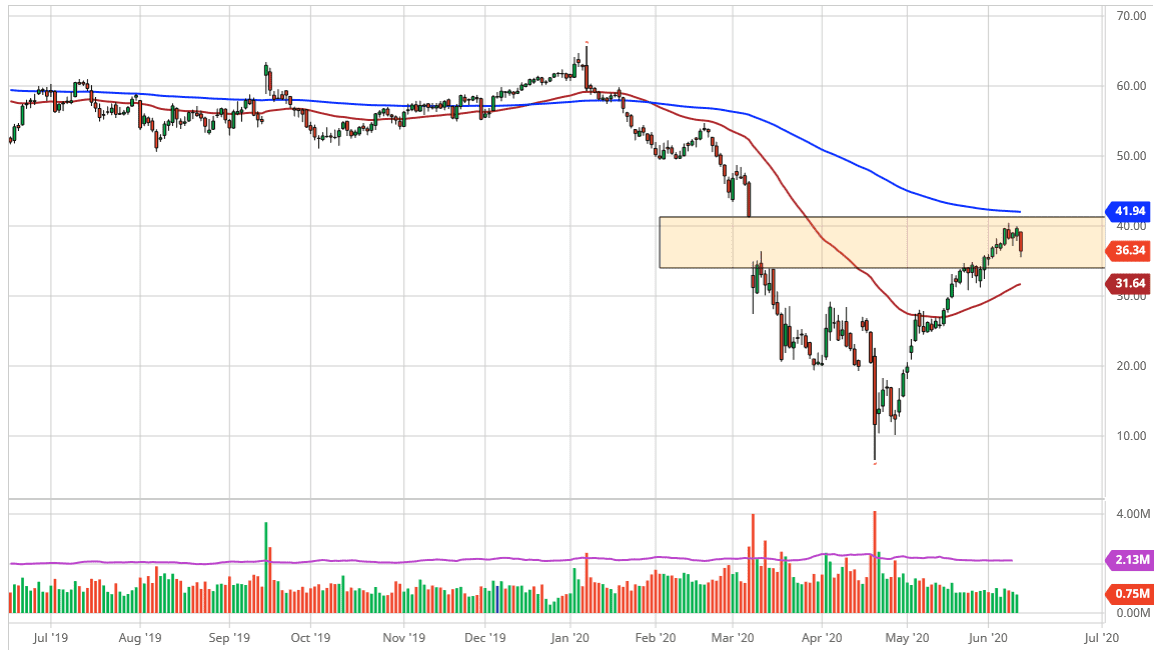

It is worth noting that the $40 level is an area that has offered a lot of selling pressure, so I think at this point it is likely that we will see this area that continues to attract selling pressure, but I think the $41 level still needs to be touched in order to fill that gap. The 200 day EMA should also offer resistance as well. To the downside, the $35 level underneath should cause some issues, as it an area where we have seen both buying and selling, so I think it should offer support. The 50 day EMA is reaching towards that level, so that also gives the market the possibility of going higher.

We are currently still within the gap, and a lot of times that will end up being a consolidation area overall. I think that the market could very well end up being tight in this area. I think that the crude oil market will continue to go higher unless of course you see some type of massive selloff in equities, which you can use as a bit of a risk barometer over here. I do not necessarily think that this market is one that is going to explode to the upside, as the 200 day EMA will be a massive barrier. Given enough time I think that the market is likely to decide where we are going longer-term, so at this point I think we are going to see a lot of choppy behavior, just like we are going to continue to see in stock markets. Do not worry, we will get some type of obvious signal, but right now as long as we are between the 50 day EMA and the 200 day EMA, I suspect we remain very choppy and range bound.