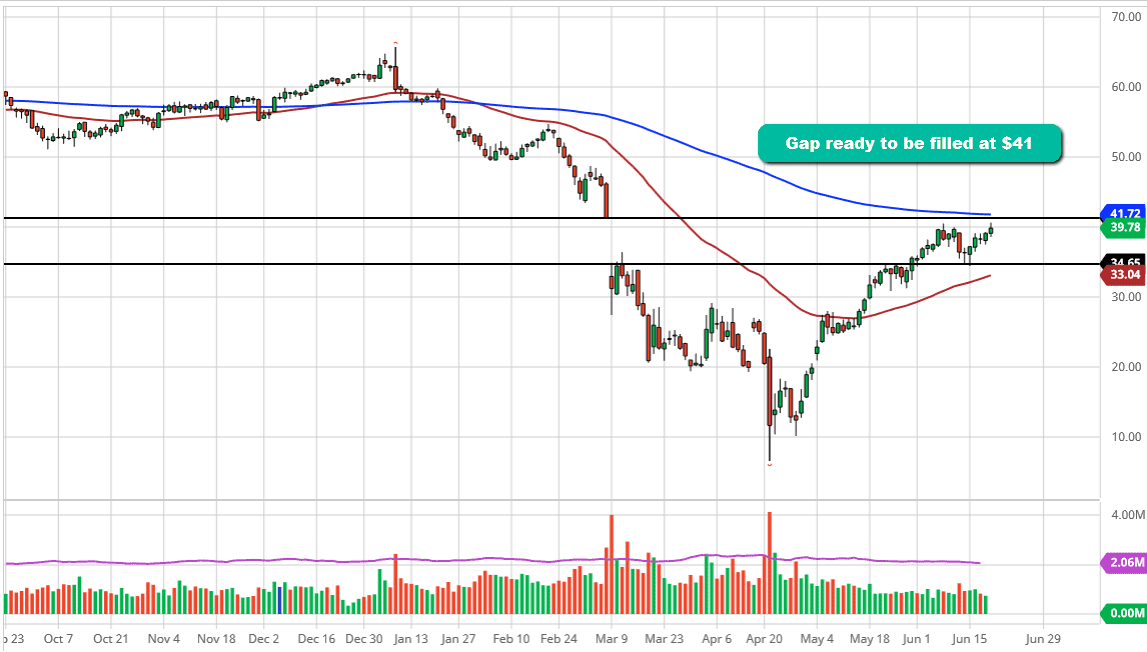

The West Texas Intermediate Crude Oil market looks as if it is trying to rally towards the $41 level, which is the top of the gap. Ultimately, the gap will get filled, and it is likely that we will continue to see a lot of buyers on dips. The $41 level is also backed up by the 200 day EMA so I think it is going to be difficult to break out to the upside. If we do, one will have to think that there will be plenty of supply to push this market back down. If the day does close above the 200 day EMA, then it is likely that we would go towards the $49 level.

I think it is much more likely that we find enough resistance to turn around and break down to fill some type of range out. The $40 area will be the top of the range, and the bottom of the range will probably be $30 level. All things being equal, I think that the market will probably continue to find a range that it’s comfortable with, after seeing this big move to the upside.

The 50 day EMA is reaching towards the $35 level, and that could cause a bit of a squeeze as well. Right now, we are between the 50 day EMA and the 200 day EMA, which means that we are starting to see both buyers and sellers congregate in this area. I think at this point we will continue to see a lot of choppy behaviors, and I do think that breaking above that gap will be difficult. I anticipate a short-term push to the upside, followed by a move back down towards the $35 level. It is possible, however, that we would break out towards the $49 level, where I would see more resistance, and possibly the market might use the $35 level as support. All things being equal, it is a short-term rally that I am expecting followed by a bit of support and resistance seeking and probing in order to find the range, where the market will feel comfortable. Oil tends to trade in roughly $10 ranges, so at this point it is likely that we will eventually find out where that is.