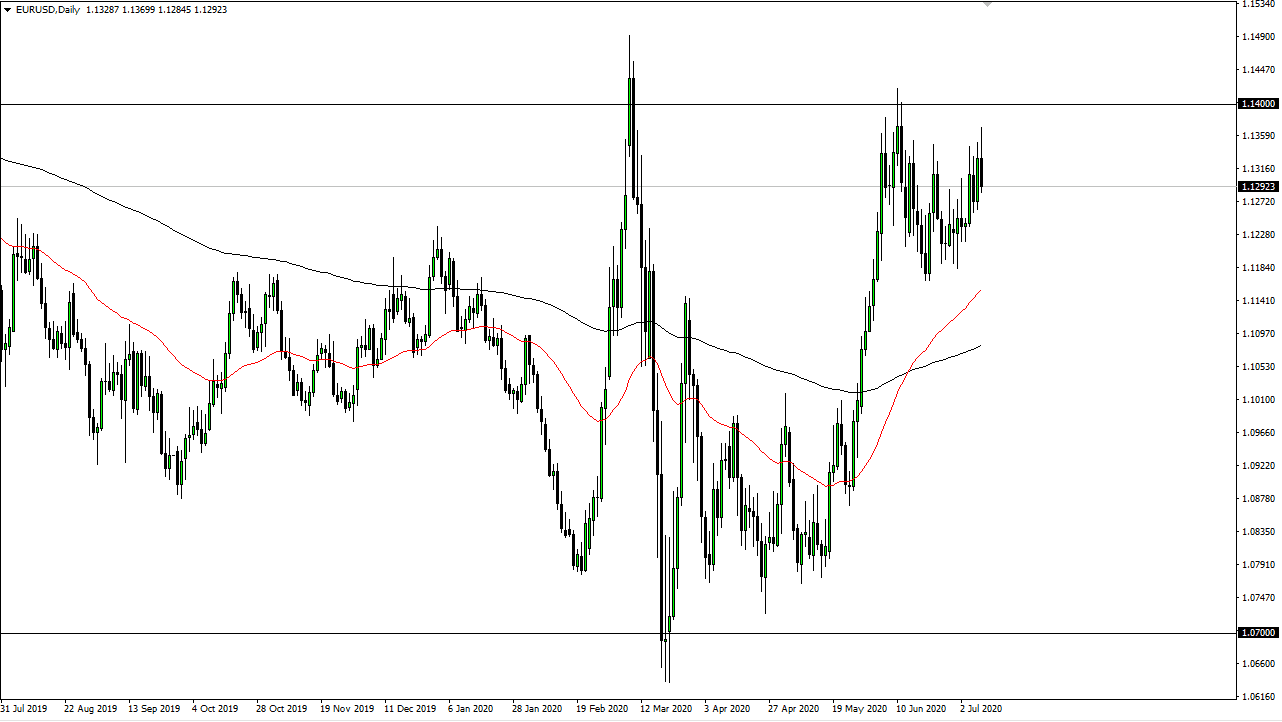

The Euro rallied a bit during the trading session on Thursday initially but turned around and the 1.1350 area yet again to show signs of exhaustion. If that is going to continue to be the case, then it is likely we will fade short-term rallies. This makes quite a bit of sense considering that the market continues to see so much in the way of significant selling time and time again. Granted, during the Thursday session we did get a little bit higher than we had over the last couple of weeks, but we still have not broken above the most recent high near the 1.14 handle.

The market continues to look as if it is in a range between the 1.14 level on the top and the 1.12 level underneath. If we were to break down below there, it is likely that the market could break down towards the 1.10 level or at the very least the 200 day EMA which is closer to the 1.1050 level. I think at this point we are going to continue to see a lot of choppy behavior due to the fact that the world simply does not know what it wants to do. After all, we have to worry about coronavirus figures slowing down the economy in not only the United States but the rest of the world in general. Beyond that, there are pundits out there who believe that the Euro will continue to strengthen due to the fact that there are new European pandemic funds to try and keep things held together, but that involves printing more Euros. In other words, they are essentially doing the same thing as the Federal Reserve is, at least as far as monetary flow is concerned

Speaking of the Federal Reserve, they are probably the main reason why this pair has rallied in the first place, as they have promised to flood the market with as many dollars as it takes to keep everything moving. I do not think that we have much in the way of clarity anytime soon, so I believe we will continue to jump around in this tight range that we have been in over the last couple of weeks. That is the normal behavior for the Euro in general anyway. I do believe that we simply limp into the weekend overall.