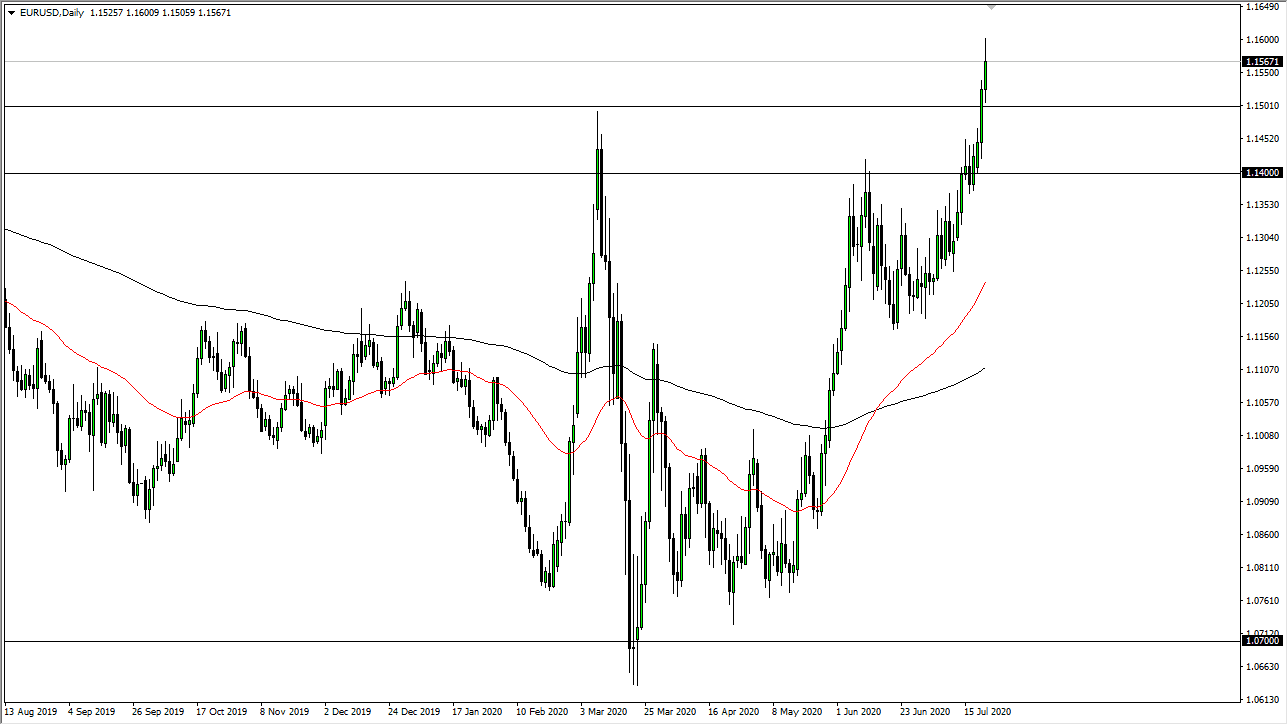

The Euro has rallied significantly during the trading session on Wednesday, reaching towards the 1.16 level where we had seen a bit of resistance. A pullback from that level makes quite a bit of sense, considering that the market has gotten a bit parabolic. I think that the 1.15 level underneath will continue to be important, as we had seen a lot of resistance between the 1.14 handle and the 1.15 level. That should now offer significant support, but at this point, we need to see a bit of a pullback in order to find the value that is necessary to take advantage of in the Euro. After all, the market cannot go straight up in the air, so it makes quite a bit of sense that we get a pullback.

The market getting overstretched like this is not a huge surprise, considering the fact that we have had so much pressure building up underneath what would have been thought of as a major level. Now that we have broken above the 1.15 handle, I think that it is only a matter of time before we continue the uptrend. Keep in mind that this pair does tend to be rather choppy in general, so do not be surprised to see a lot of back and forth on the way to higher levels. From a longer-term standpoint, I anticipate that this market will go looking towards the 1.20 level but that could take months.

If we were to break down below the 1.14 handle, it could send the market down to the 1.12 handle or the 50 day EMA. I do not think it will happen anytime soon though, because this has been a monumental break out to the upside. You can see it is an anti-US dollar rally more than anything else, due to the fact that the gold markets, Australian dollar, and many other assets have shown so much bullish pressure against the greenback. In fact, I do not really have a scenario in which I’m willing to start selling this pair again, barring some type of major headline that causes the financial markets to go haywire. In this environment, it is always possible, but it seems like the Federal Reserve is the main driver of everything that is going on. As long as they stay loose with monetary policy, the Euro continues to break higher.