The Euro went back and forth during the trading session on Tuesday, forming a “long-legged doji”, which shows extreme volatility yet extreme uncertainty. When you look at the Euro, you can see that we have been grinding quite a bit and it simply does not look like a bullish flag so much anymore, as the angle is quite a bit sharper than that. With that being the case, I think that it is only a matter of time before sellers will probably fade rallies as they occur.

This does not mean that we will break out right away, but with the jobs number coming into few stations, that will greatly influence what happens with the US dollar in general. I think it is highly likely that if we break down below the lows just under the 1.175 level, we will then go looking towards the 1.10 level underneath, which also features the same area that we are seeing the 200 day EMA.

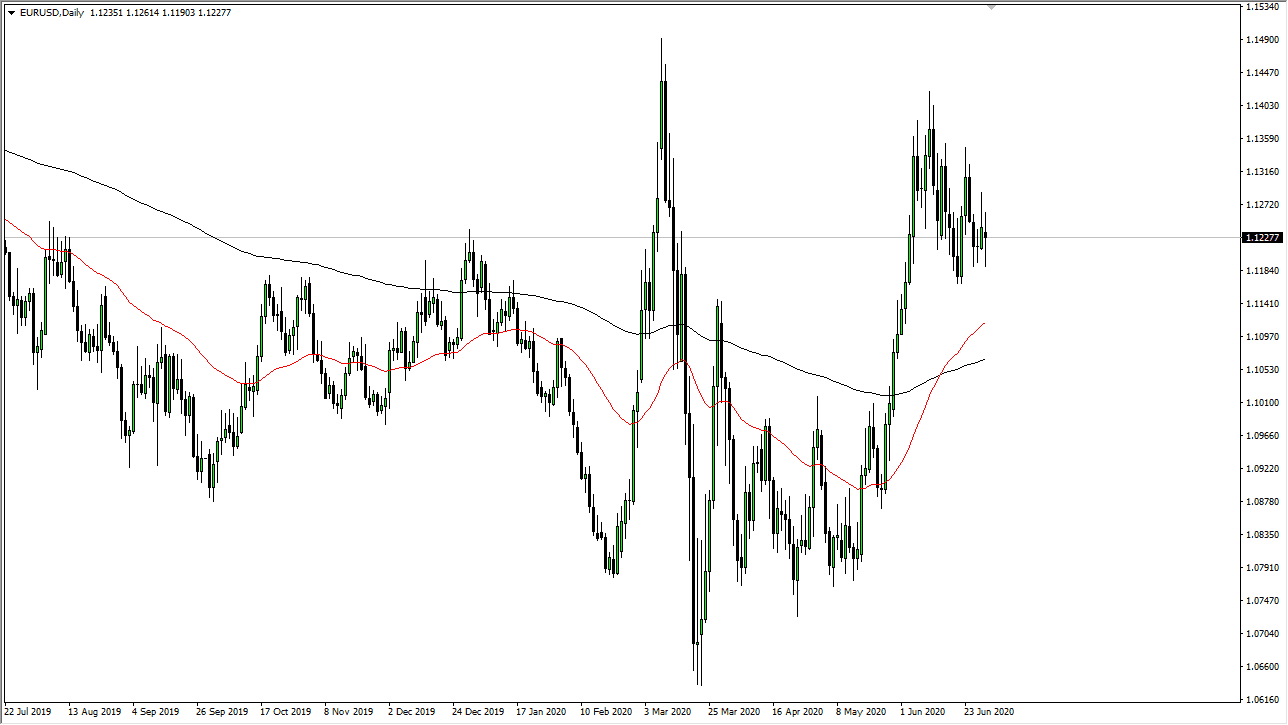

The market has been bouncing around for some time, and I think it is only a matter of time before we see a lot of resistance and support given enough time. The overall range seems to be between the 1.07 level on the bottom and the 1.15 level on the top. In fact, the 1.14 level is significant in the sense that it is a major level that extends all the way to the 1.15 level as far as resistance is concerned. To the downside, the 1.09 level extends down to the 1.07 level as far as support is concerned. I do think it is only a matter of time before we try to reach towards the lows, but I do not think that it is going to be some type of major meltdown. Both of the central banks are trying to kill their own currencies, so it is going to continue to be a lot of noisy trading based upon the most recent headline. I do think that there are a lot of concerns when it comes to European banks, and of course the Brexit situation which is not getting any better. While a lot of people focus on Great Britain when it comes to Brexit, the reality is that it also has a massive effect on the European Union. Beyond that, Europe is just now starting to open up and if people start to get spooked again, they will go right back to the US Treasury market.