The EUR/USD pair continued the bullish correction path with the start of this week’s trading until gains reached the 1.1467 resistance, its highest level in four months before settling around the 1.1440 at the beginning of today’s trading. Euro gains were amid investor optimism about the ongoing talks regarding the European Recovery Fund, amid hopes for a breakthrough at the European Union summit in Brussels. After three days of controversy over the bailout package, European leaders are reported to be studying a 390 billion Euro settlement proposal for relief aid from Covid-19 instead of the 500 billion initially planned. In contrast, the US dollar is under pressure from the strength of the second wave of the deadly Corona pandemic in the United States.

The meeting is scheduled to resume at 14:00 GMT. For his part, Dutch Prime Minister Mark Rutte said the talks were making progress, but he warned that the talks could collapse. There are many issues to be concluded, including conditionality of funds, terms of loans, and veto of assistance payments.

On the economic side, data from the European Central Bank showed that the Euro-zone current account surplus declined in May, largely reflecting the widening deficit in secondary income. The current account surplus fell to 8 billion Euros in May, from 14 billion Euros in April. In the same period last year, the surplus was 23 billion Euros. The trade surplus rose to 17 billion Euros from 13 billion Euros in April. Meanwhile, the surplus on services fell to 4 billion Euros from 5 billion Euros.

Basic income fell to 5 billion Euros from 8 billion Euros a month ago. Meanwhile, the deficit in secondary income widened to 18 billion Euros from 12 billion Euros. In the twelve-month period to May, the current account recorded a surplus of 264 billion Euros, or 2.2 percent of gross domestic product for the Eurozone, compared to a surplus of 318 billion Euros, or 2.7 percent of GDP in the twelve months to May.

And before that, the professional forecasters’ survey published by the European Central Bank last Friday showed that the Eurozone is set to shrink sharply this year due to the coronavirus pandemic. According to SPF respondents, the economy will contract by - 8.3% this year, instead of the previously expected 5.5%. However, the growth outlook for 2021 was revised to - 5.7 percent from 4.3 percent and for 2022 to 2.4 percent from 1.7 percent.

The 2020 inflation forecast was kept at 0.4 percent. Meanwhile, forecasts for next year have been reduced to 1 percent from 1.2 percent and the estimate for 2022 to 1.3 percent from 1.4 percent. The survey showed that expectations for a peak in the unemployment rate were postponed to 2021. The unemployment rate for this year is seen at 9.1% instead of 9.4%. The unemployment rate is expected to reach 9.3 percent next year and 8.5 percent in 2022.

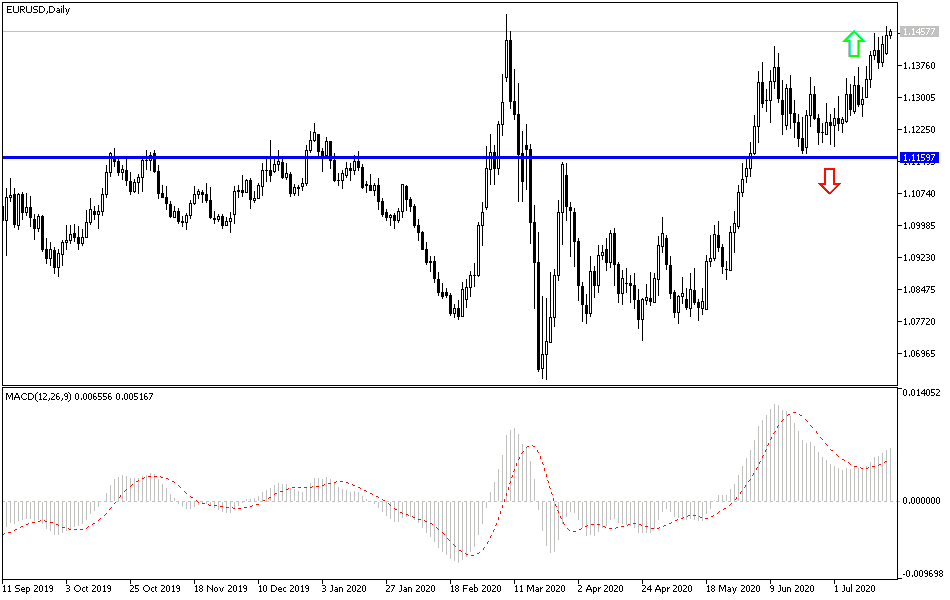

According to the technical analysis of the pair: The bullish momentum of the EUR/USD performance is still valid as long as it breaches the 1.1425 resistance, and it must be taken into account that even if an agreement occurred between the leaders of Europe, the markets priced the Euro based on the possibility of this happening, and therefore, the official announcement may bring the pair some gains that are not strong or sharp, and in return, the failure in reaching an agreement will bring strong profit taking sell-offs and push the Euro back down, and the closest support levels for the pair are currently 1.1390, 1.1300 and 1.1225, respectively.

The pair does not expect any important economic data today, whether from the Eurozone or the United States of America.