The S&P 500 has rallied a bit on Friday like I suggested it could, as the market continues to grind back and forth. Ultimately, there is a significant gap underneath that continues to offer support, and as we go through earnings season it is obvious to me that we have nowhere to be in the short term. That being said, it is highly likely that the market is going to continue to see buyers on dips based upon the idea of value.

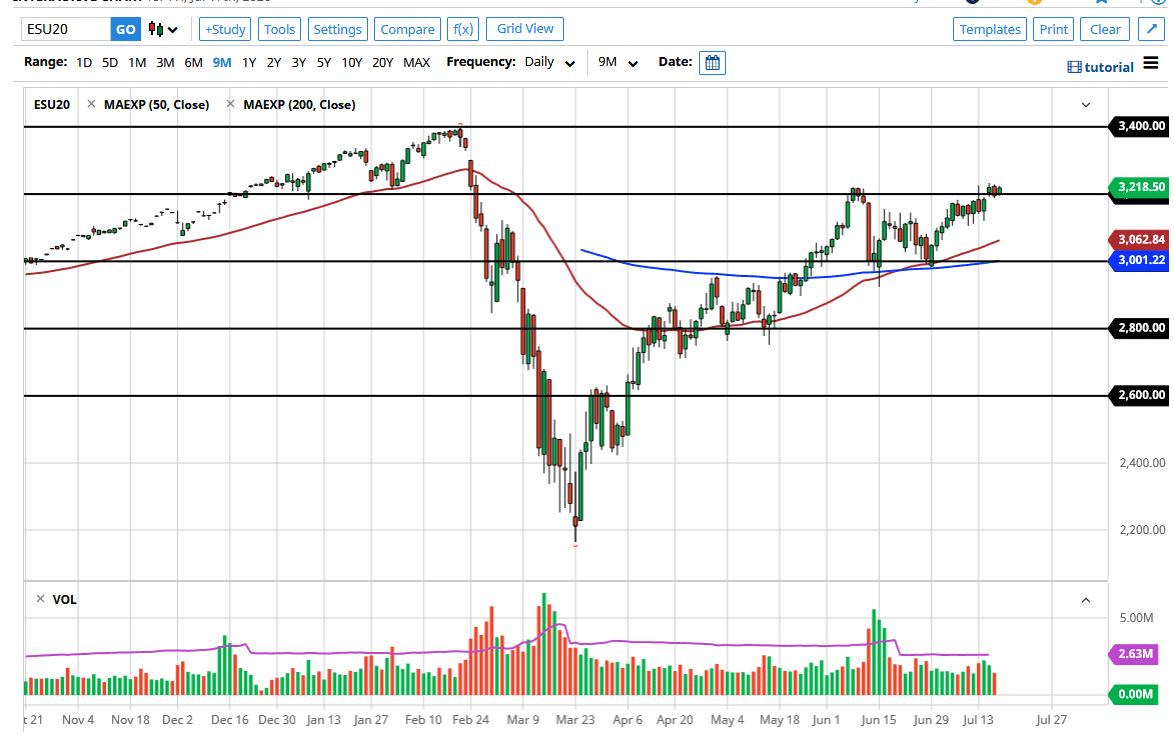

The 3100 level underneath will be massive support, and as a result, it is likely that we will continue to see buyers in that general vicinity at the first sign of a bounce, and that is exactly how I will trade this market. Ultimately, I do believe that we will break above the highs of the last couple of days and then go looking towards the gap near the 3350 region. Above there, then the 3400 level above would be a target. That of course is the all-time high but as we have rallied so much from the bottom, one would have to think that it is only a matter of time before we get there.

With the Federal Reserve pumping of the markets everywhere they can, this is almost in the short outcome. Yes, there are plenty of people out there that will tell you how horrible everything is and how the stock markets are not reflecting reality, but quite frankly I do not know that they have reflected reality since the Great Financial Crisis. If that is going to be the case, then you have to ask the following question: “Why would they start to reflect reality now?” As long as you learn to simply embrace the price action and understand that the market is likely to continue to see money flow into it based upon the fact that the Federal Reserve is throwing too much liquidity out there, it makes sense that “There is no alternative” scenario continues to be the favored one. The 200 day EMA is currently sitting at the 3000 level, so I think that is going to be your “floor” in the market. It is not until we break down below there that I would be concerned about the overall trend, so, therefore, I think this remains to be a “buy on the dips” marketplace.