Record and historical economic deflation in the U.S during the Q2 of the controversial year 2020, will be tough, but expected, on the USD, which explains why the USD/JPY remained around its lowest levels since the mid of last March, as the pair tested the 104.76 support before settling around 104.96 at the time of writing. Investors gave up on the USD, as economic horizons outside the U.S improved, while a second coronavirus wave sparked fears about the American recovery. The US economic recovery is under threat months ahead of the presidential elections, which has catastrophic consequences on the local and international expectations, while the current white house administration is retreating in polls, and for that, it presents investors with a glance of a world not hampered by a trade conflict with China or Europe.

This headwinds come with a tight outfit for the USD by the Federal Reserve since late March, when the bank started expanding its budget by injecting new funds directed to bonds markets from all self-plans, and also from some commercial lenders.

In this context, Erick Bregar, head of Forex Strategy in Exchange Bank of Canada, says: “the overwhelming opinion of the Federal Reserve meeting today is that the placing of COVID-19 degraded expectations of the US economy will force the Federal Reserve to adopt a more pessimistic tone”. Federal Reserve Budget expanded from $4.2 trillion to less than $7 trillion, only from the begging of March, risking an excess in US Dollars, which comparing to signs of more economic recovery in Europe and other parts of the world, led to investors averting from buying the USD.

The U.S central bank announced that interest rates will remain at near zero levels amid economic difficulties imposed by the coronavirus. The bank added that it decided to keep interest rates at the 0-0.25% range, as it is since last March. The Fed’s Monetary Policy statement suggested that economic activity and employment recovered somewhat in recent months after sharp declines, but are still way lower than first year levels.

According to the bank’s vision, this recent improvement in public finance situation is due to policy measures to support the economy and the credit flow to American families and companies. The bank reiterated their commitment to use a full set of tolls to support the U.S economy in these difficult time.

In addition to keeping interest rates at their current levels until they are confident of the economy overcoming recent events, the bank said they will also continue increasing their possessions of treasury bonds and mortgage backed housing and commercial securities, at least at the current pace. The unanimous decision to leave interest rates as is was wildly expected, although some investors might be disappointed because the Fed’s statement did not present any specific evidences around more stimulus.

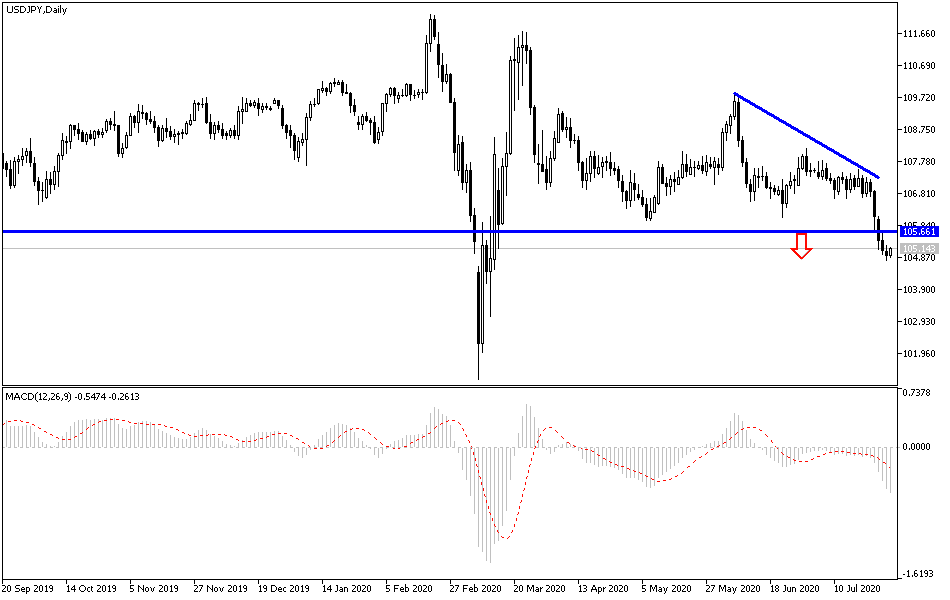

As per the technical analysis of the pair: Bears’ control over the USD/JPY performance is still the strongest, and breaking below the 105.00 support confirms that technical indicators reached oversold areas. The current bullish correction chance might be stronger at the 103.35, 104.00 and 104.90 support levels. On the bullish side, the 108.00 resistance still the first bulls’ stop. The pair will interact today with the announcement of the U.S GDP growth, as well as the weekly unemployed claims.