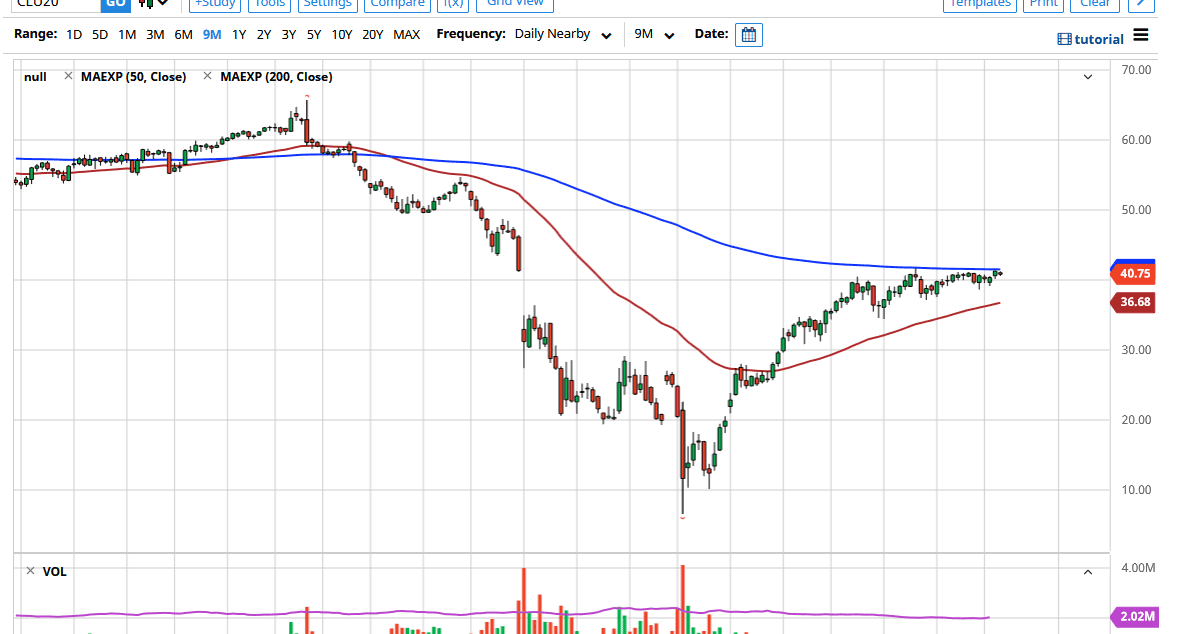

The West Texas Intermediate Crude Oil market continues to sit still and put traders to sleep. The 200 day EMA above continues offer resistance, so I think it we can break above there it would open up a lot of eyes to the potential of a move higher. At that point I would anticipate that we are likely going to see a potential move towards the $49 level, an area that had a lot of selling previously. At this point, I think that the market would be a bit overextended but overall, I think it is more than likely going to be a scenario where we will take advantage of momentum on a break above the 200 day EMA and simply trying to race towards that area. Just above that area we have the psychologically important $50 level which almost always attracts attention in the oil market, so it should not be a huge surprise that it would bring in sellers.

To the downside I believe that there is still a significant amount of support, especially near the 50 day EMA which is currently sitting at $36.68. This is assuming that we can even get down there, because every time we had a move lower, we have struggled to even reach that area. The $40 level between here and there offers a significant amount of support as well, so at the end of the day I think it is just a buying opportunity waiting to happen.

The oil markets like to find some type of $10 range to trade in, and right now I think that is what we are trying to do. The question is whether or not the squeezing of the 50 day EMA and the 200 day EMA will continue to keep this market pressured for very much longer? Typically, this type of squeeze gets resolved with an explosive move, and right now we are trying to figure out what that is going to be. I believe at this point we are likely to see more noise than anything else, so do not be surprised if we simply continue to chop back and forth in a market that really has been horrible to trade as of late. If you are a short-term scalper, perhaps it works but in this environment the prophets have not been easy to come by.