AUD/USD: Monitoring tensions with China.

Today’s AUD/USD Signals

- Risk 0.75%.

- Trades must be entered from 8 am New York time to 5 pm Tokyo time today.

Long Trade Ideas

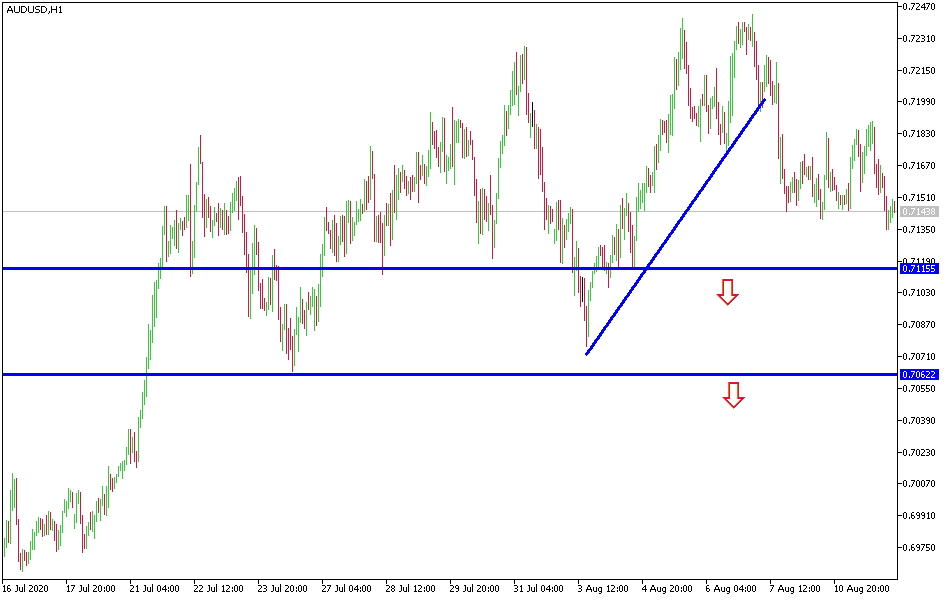

- Long entry following bullish price action on the H1 time frame immediately upon the next touch of 0.7185 or 0.7220.

- Place the stop loss 1 pip below the lowest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade Ideas

- Short entry following bearish price action on the H1 time frame immediately upon the next touch of 0.7110 or 0.7060.

- Place the stop loss 1 pip above the highest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

As I mentioned yesterday, increasing tensions between the United States and China negatively affect the Australian dollar gains against the rest of the other major currencies. The AUD/USD dropped to the 0.7134 support, its lowest level in a week. The 0.7000 support will be a target for the bears if the USD continues to gain. Ahead of a review of the Phase-one trade agreement between the world's two largest economies later this week, reports indicate that China is ramping up purchases of US soybeans. Six shipments for the months of November and December have already been purchased. Reports indicate that new soybean orders may come at the expense of Brazil.

US President Trump saw that the Q3 GDP in the United States could reach 20%. While this can be just a case of encouragement and ambition, it's worth noting that the Atlanta Fed GDP tracker currently puts it at 20.5%. The New York Fed model points to 14.6%. Meanwhile, Trump said he is considering cutting the capital gains tax. While the executive administration does not have this power, it can support capital gains with inflation, which some Republicans have long advocated.

The US administration is facing a difficult task, as the US numbers of cases and deaths from the COVID-19 epidemic are the highest in the world, and there are obstacles to passing more stimulus plans at the present time. The results of recent opinion polls confirm the extent of the dilemma facing Trump in overcoming the upcoming presidential elections with ease. In terms of retaliatory measures between the United States and China, they have reached unprecedented levels, which increases market anxiety in the event Trump wins a second term.

Regarding the Australian dollar, Westpac consumer confidence index will be released, followed by the wages index. For the US dollar CPI reading will be announced, which is the most important inflation measure in the country.