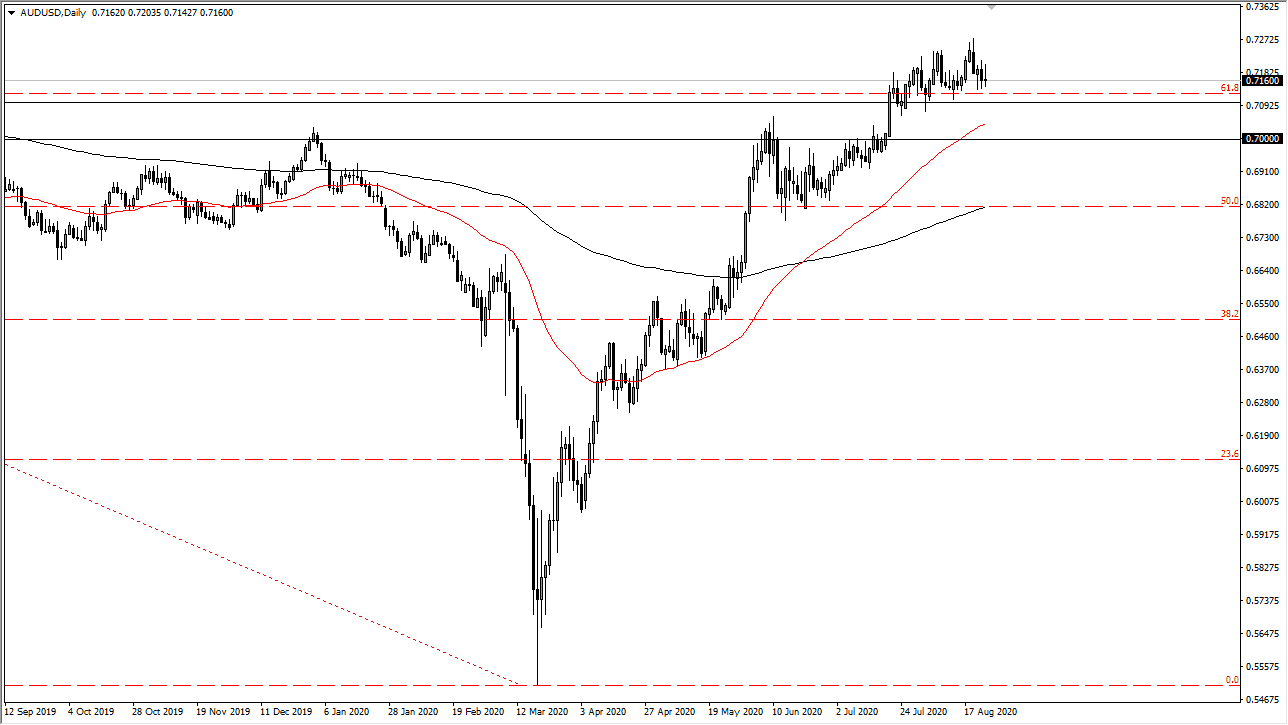

The Australian dollar has gone back and forth during the course of the trading session on Monday, but ultimately ended up forming a little bit of a negative candlestick. That being said, there is still a lot of support underneath, so I like the idea of buying on the dips still, and we may get that opportunity rather soon. I see a significant amount of support between the 0.71 handle and the 0.70 level, with the 50 day EMA slicing right through it. Looking at this chart, we have been in an uptrend for some time and now I think we are simply trying to figure out where to go next.

Looking at this chart, the trend is most certainly higher, and of course I do think that it is only a matter of time before we break out to the upside. This will be especially true if Jerome Powell comes out and says something at Jackson Hole later this week that is extraordinarily dovish, which is very possible. I think between now and that symposium, we could see a lot of choppiness. Ultimately, the Australian dollar is a place that money will flow to one people start to think about the Federal Reserve trying to kill the greenback, as it is not only not the US dollar, but it is also highly correlated to gold. Gold is overbought, so do not be overly surprised if we pull back just a bit, but it is worth noting that while the gold markets have been selling off recently, the Australian dollar has held up quite nicely.

If we were to break down below the 0.70 level, then it is likely that the market goes looking towards the 0.68 level. That is an area that has plenty of interest as well, and of course the fact that the 200 day EMA is sitting there certainly does not hurt either. All things being equal, I think this remains a “buy on the dips” type of situation unless something changes structurally. I do not see that happening anytime soon, so therefore this is a market that I think will continue to go higher over the longer term, but simply needs to build up the momentum to finally go higher. If we can rally from here, we could go looking towards the 0.73 handle, and then possibly the 0.75 level.