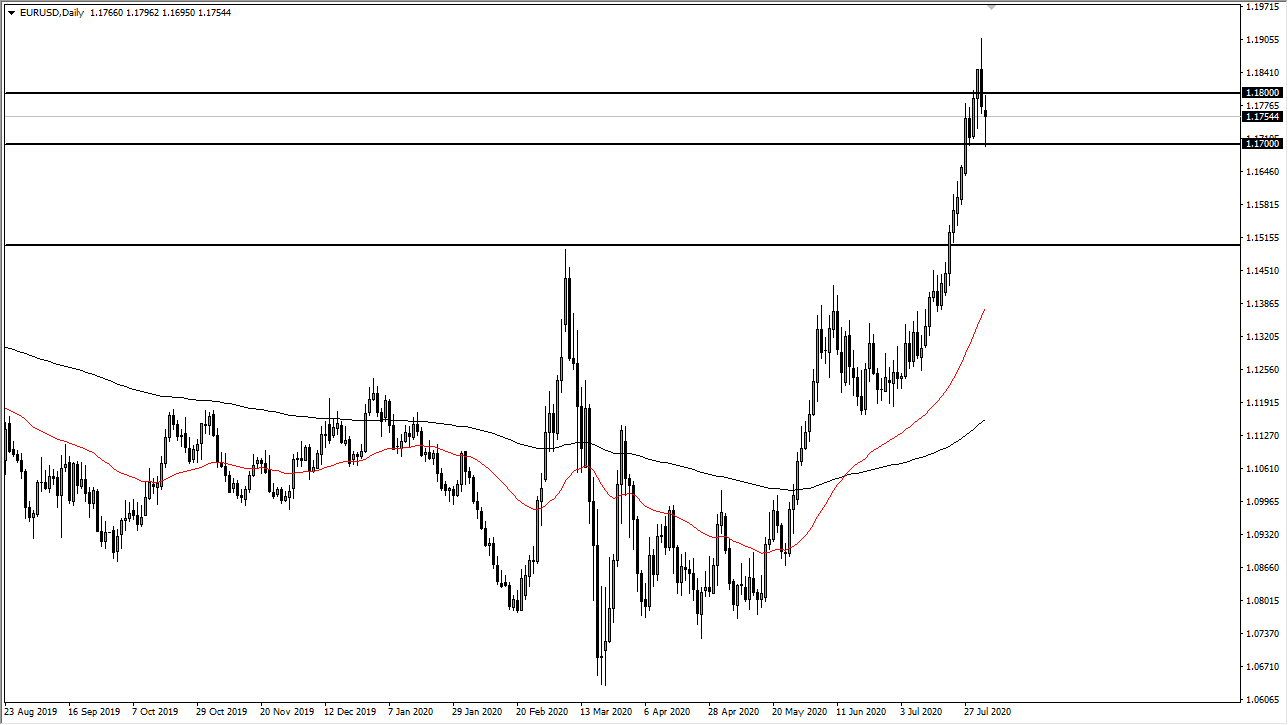

The Euro fell after initially trying to rally during the trading session on Monday which kicked off the week. However, the market has turned around completely to show signs of life again at the 1.17 handle. This is an area that was important in the past, so with that being the case it is likely that we will continue to see a lot of reaction to that level, and now that we have bounced from here it is possible we may go looking towards 1.18 level again. That being said, I really wished we had seen a bigger pullback, although we still could. After all, we have clearly changed the overall attitude but at this point, it is a bit overbought.

Looking at this chart, if we can break down below the 1.17 level, we could go looking towards 1.15 level. That is a major support level and should attract quite a bit of attention. At this point, the market is likely to see buyers every time we drift, and the 1.15 level will probably cause a major reaction. With the Euro rallying the way it has, it is likely that the market has changed the longer-term trend. The market has plenty of buyers built up in the trend, as the speculative longs in the futures market are at all-time highs. With the Federal Reserve doing everything they can to flood the markets with liquidity, it does make sense that the US dollar falls rather significantly.

To the upside, I believe that we could go as high as 1.20 in the next month or so. However, the market has gotten a bit ahead of itself so I would not be surprised at all to see the occasional pullback and perhaps even a sideways grind while we get used to the idea of being up at this massive elevated area. I do not have any interest in trying to short this pair, at least not anytime soon and certainly not until we break well below the 1.15 handle. Yes, this pair has been parabolic, but this is the type of rally that certainly means something. We are up 1100 pips since it started, something that the Euro simply does not do very often. From everything that I see here, this is a longer-term multi-year trend change.