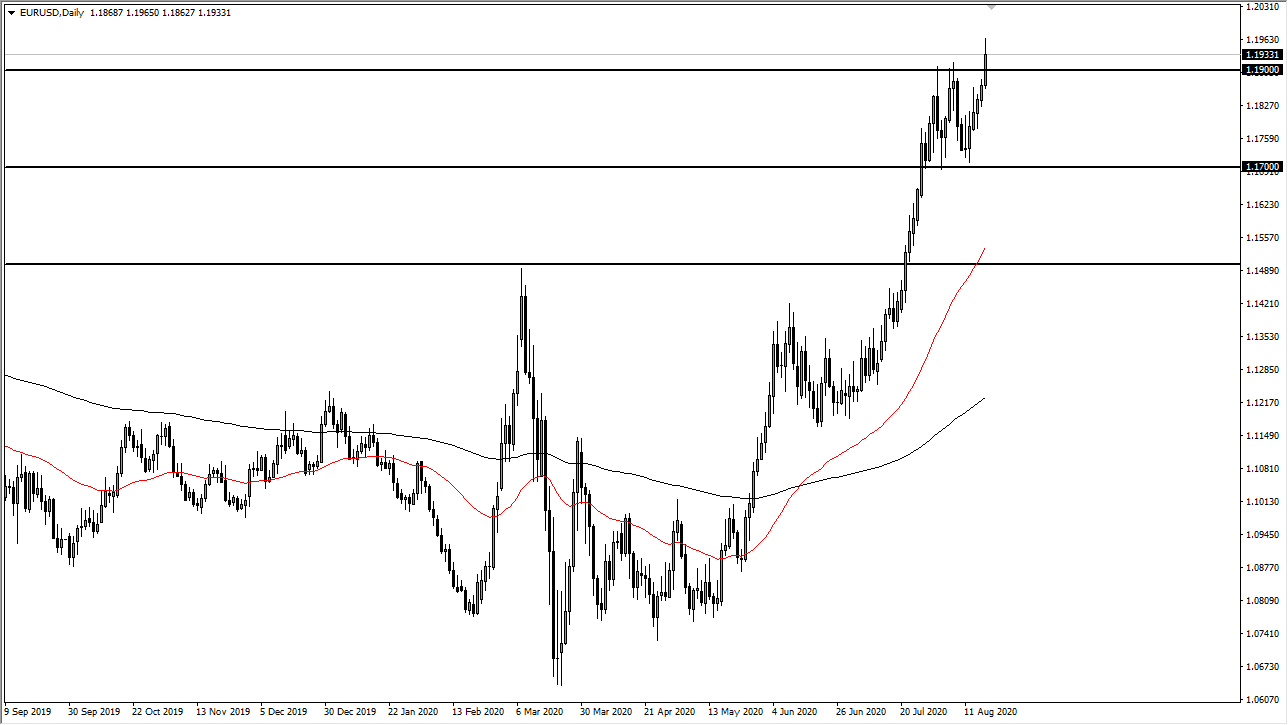

The Euro has broken above a significant resistance in the form of the 1.19 level, as the consolidation area that we had been in is finally in our rearview mirror. We did give back some of the gains later in the day but that is a common theme after a major breakout, so I think a short-term pullback may be coming but that short-term pullback will more than likely offer nice buying opportunity. Remember, the Euro has been in an uptrend for some time and the fact that we are consolidating for a little while before taking out to the upside again should not be a huge surprise.

We have already seen this recently, as we reached towards the 1.1350 level and then went sideways. We eventually broke out from that bullish flag and cleared the 1.15 handle, the 1.17 level, and then attempted to break above the 1.19 level, something we just did today. In the short term, we had bounced around between the 1.19 level and the 1.17 level, forming a bit of a flag or rectangle, depending on how you look at it. Either way, this shows that the market is breaking out to the upside.

At this point in time, based upon the measurement of the rectangle you would expect the Euro to go to the 1.21 level, perhaps even higher than that. Based upon a measurement of the potentially bullish flag, that could send this market looking towards the 1.25 level. After all, the Federal Reserve continues to flood the market with greenbacks and that helps the value of the US dollar fall. By its very definition and the fact that the Euro is essentially the “anti-dollar”, that means that this market should continue to rise. Do not get me wrong, I do not believe that we are suddenly in a great economic situation and that the US dollar will be sold off as a result, but ultimately it is the Federal Reserve in their antics that are driving this. The Euro is an extremely low levels, so it should not be surprised at all that we did see a little bit of a spike. I believe that the 1.17 level offers massive support now.