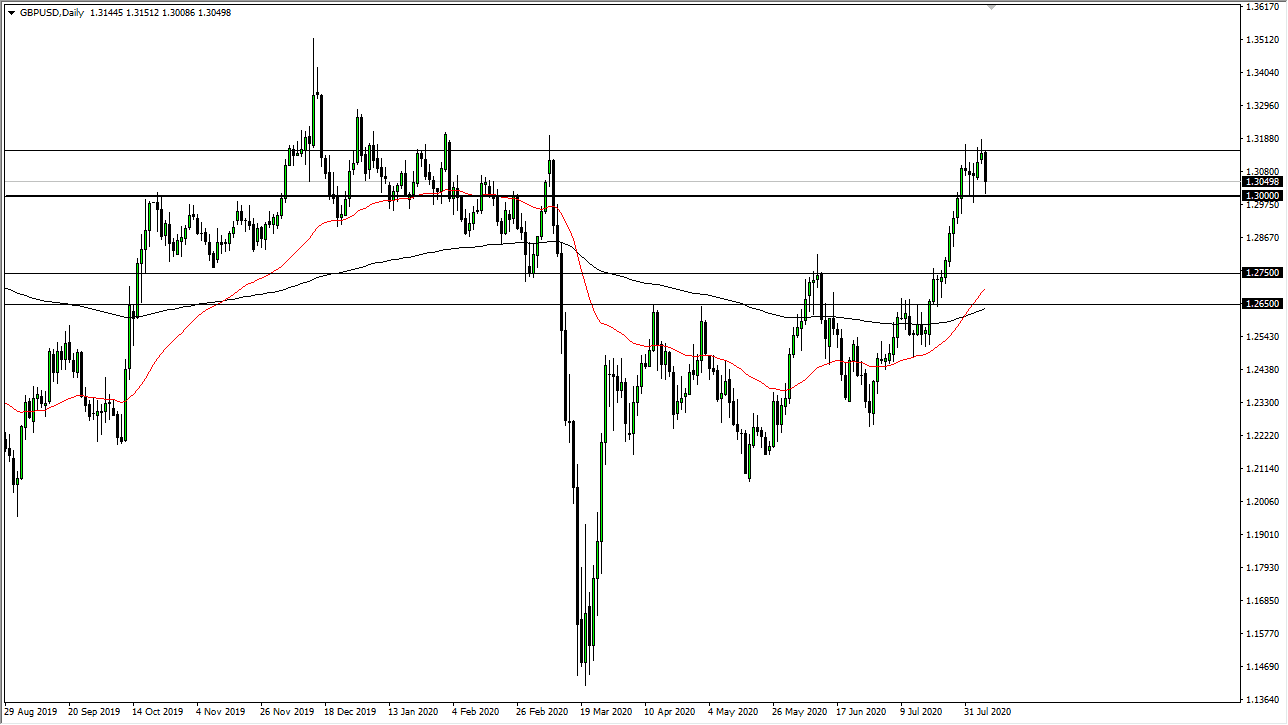

The British pound fell significantly during the trading session on Friday after the Non-Farm Payroll announcement came out. Having said that, we tested the 1.30 level, an area that will attract a lot of attention. It is a large, round, psychologically significant figure in an area that had previously been resistant. That being said, we did bounce a bit towards the end of the day, but I would not read too much into that as a lot of day trading type of plays would have been reversed in order to take profits into the weekend.

At this point, we will probably go sideways or drop from here. That has somewhat always been the case for me this week, as we had gotten a little bit extended. I think it is really simple though, you are looking for value in the British pound, so, therefore, shorting it does not make any sense. The Federal Reserve is out there looking to print US dollars, and that will drive the value of the greenback lower over the longer term. This is not so much a situation where people love the British pound, it is more or less a situation where people are trying to get away from the greenback. With that being said, if we do pull back you have to be looking for an opportunity to go long. The 1.30 level makes quite a bit of sense, but I’m even more interested in buying the British pound down near the 1.2750 level, a real possibility if we continue to see US dollar strength. I think at this point the US dollar has been oversold so it does make a certain amount of sense that we get this pullback.

The 1.2750 level is the beginning of massive support extending down to the 1.2650 level, so I do think that there would be plenty of buyers in that general vicinity. Ultimately, this is a market that I think will find reasons to go higher over the longer term but may need to give back a little to continue. Even if we do not break down from here, at the very least I would expect some sideways action so that we can build up the momentum necessary to continue going even higher. A break above the highs from the Thursday session would be very bullish and could send this market towards the 1.35 handle eventually.