GBP/USD: Gains awaiting stimulus.

Today's GBP/USD Signals

- Risked 0.75%

- Trades must be taken before 5 pm London time today.

Short Trade Ideas

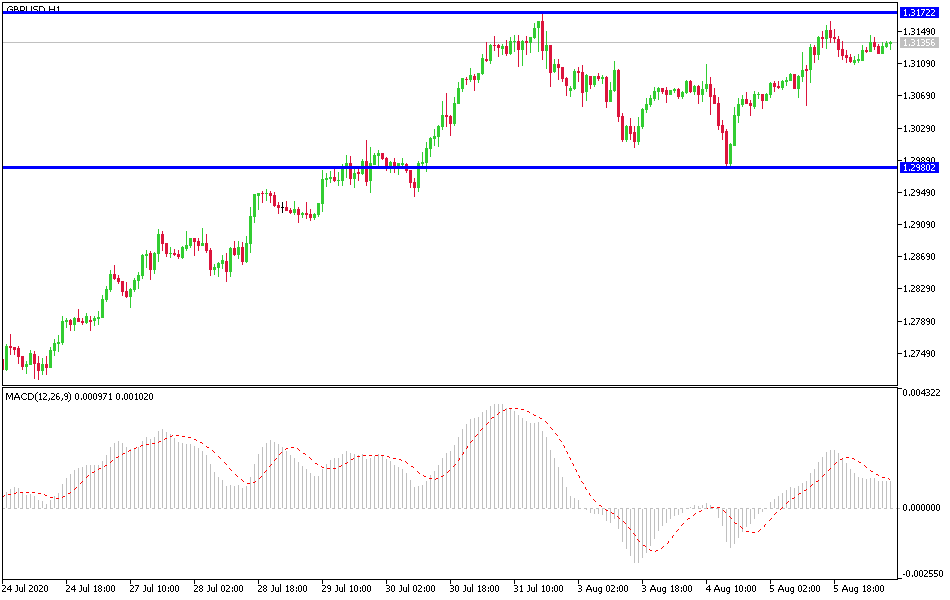

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3280.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3060, 1.2970.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

For the second day in a row, the GBP/USD currency pair refused to cross below the 1.3000 level, which is still a catalyst for the bulls' control. As I mentioned yesterday, gains will be on an important and influential date, as the Bank of England announces an update of its monetary policy. Expectations are almost certain that the bank may keep interest rates and asset purchase plan as is, and the most closely watched for will be the contents of the statement and the bank’s governor’s comments. The pair is very close to exceeding its highest level in five months.

Final data from IHS Markit showed that the British services sector recorded its strongest growth in five years during the month of July as the phased reopening of business operations led to an increase in corporate and household spending. Accordingly, the final IHS Markit PMI rose to a reading of 56.5 in July from 47.1 in June. The index rose on a monthly basis after it reached its lowest level in the survey at a reading of 13.4 in April, but the last reading was the first in which it exceeded the 50 level that separates growth from deflation since the outbreak began.

The composite output index, which combines manufacturing and services, improved to 57.0 in July from 47.7 in June. The reading indicated the fastest growth in the private sector since June 2015. In the manufacturing sector, output growth was the strongest since November 2017. In the services sector, respondents reported increased commercial activity due to the easing of measures taken to limit the spread of the Coronavirus. The volume of new businesses increased for the first time in five months. However, international travel restrictions contributed to a steady decline in new export sales.

Accumulated business in the services sector fell again in July. The lack of pressure on the weaker than expected commercial capacity and demand resulted in fewer employees. Moreover, the survey showed that business expectations among service providers rose the most in July, with optimism reaching its highest level in five months. Finally, average cost burdens increased at a strong pace in July, but intense competition for new business means that service providers' production fees have not changed significantly since the previous month.

Commenting on the results, Tim Moore, director of economics at IHS Markit, said that while the latest survey data provides a number of positive signals that the British economy has returned to growth, the weak employment figures reported in July is a cause for concern and is likely to hamper the long term recovery in business and consumers.

I recommend selling the GBP/USD pair after all its gains, as the future of Brexit remains uncertain.

Regarding the British pound, it will be affected by the BoE’s announcement of interest rates and QE plans, as well as comments from the Banks’ Governor. Regarding the US dollar, weekly unemployed claims will be announced.