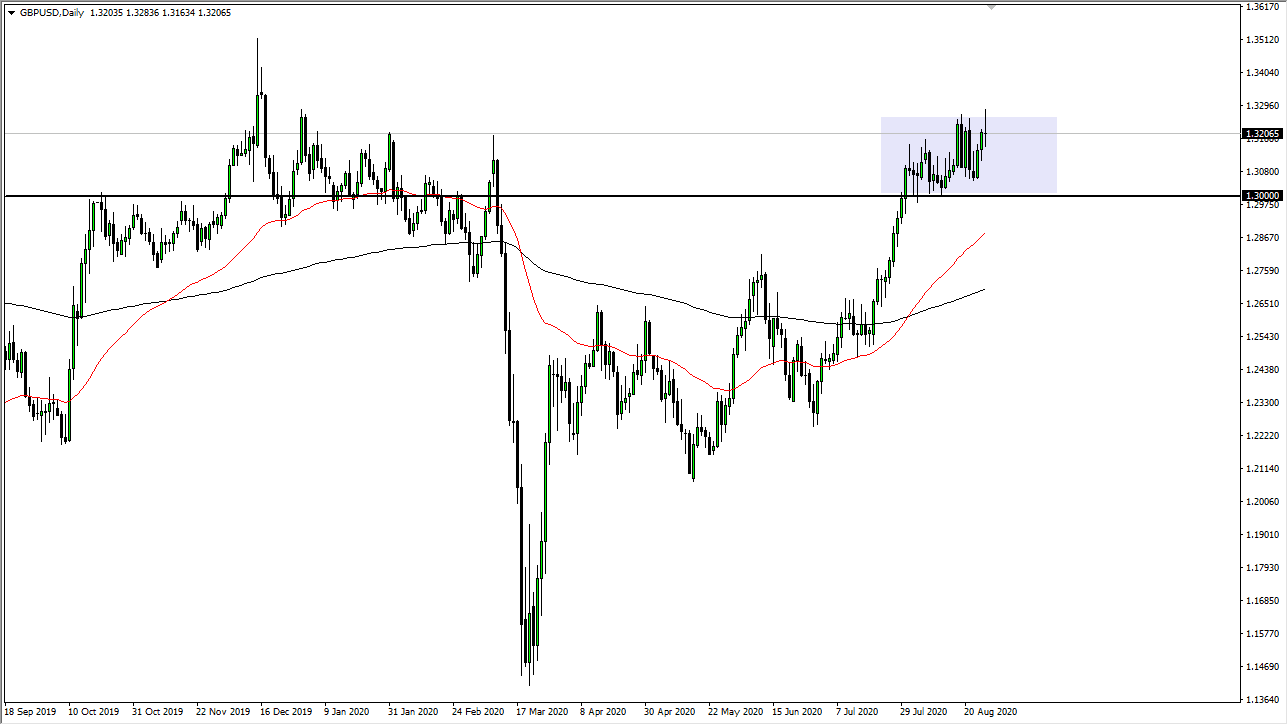

The British pound rallied quite significantly during the trading session on Thursday, heading into the Jerome Powell speech. However, by the end of the speech he may have disappointed a lot of people out there looking for dovish statements, and therefore the British pound has pulled back to show signs of exhaustion. I think at this point in time we will more than likely see a lot of noisy trading, and a pullback looks very likely heading into the weekend. If that is the case, then I believe that the buyers will be looking at the 1.30 level as an area of value. We may not even drop that low though, because a lot of the other charts are forming up trending channel, which you can make a case for here.

If we were to break down below the 1.30 level, then it is likely that the market will go looking towards the duty day EMA, which of course is painted in red on my chart. After that you then see the 1.2750 level as a potential buying opportunity that extends down towards the 1.2650 level. On the other hand, if we were to break above the top of the candlestick for the trading session on Thursday, that would be a very bullish sign and could open up the possibility of a move towards the 1.35 level which I do think happens given enough time. In the meantime, I think that pullbacks are buying opportunities that a lot of traders out there will be looking for, but I think it is likely that a pullback probably has people looking more at buying sometime early next week, not necessarily heading into the weekend.

I would anticipate more noise than anything else, especially as the global economy seems to be a car stuck in neutral. In other words, with the Federal Reserve not killing the USD on Thursday via the speech, it means that we will more than likely continue the overall uptrend when it comes to the British pound against the US dollar, although this pause may flush out a few of the “weak hands” out there. I think that longer-term we are probably going to continue to see a lot of back and forth, but with an upward tilt. Be prepared for the grind, because we are in the midst of vacation season on top of everything else.