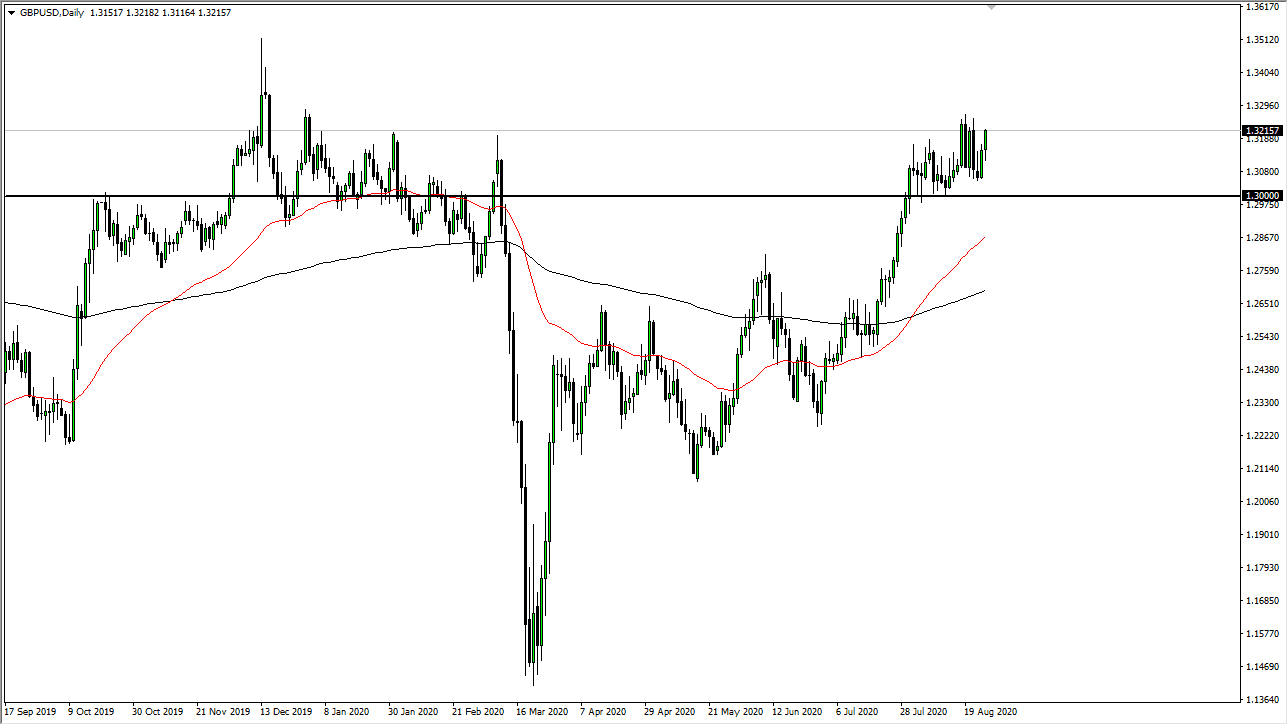

The British pound rallied again towards the 1.32 level during the trading session on Wednesday, an area that has caused some problems. Ultimately, this is an area that I think does get broken, but we obviously have some work to do. The market need some type of catalyst, and that catalyst could be Jerome Powell speaking during the day on Thursday. After all, he is extraordinarily dovish when it comes to monetary policy and I cannot imagine how that is going to change anytime soon.

This is not exactly an indictment on the health of the UK economy, or even monetary policy for that matter. It just is a bit of an unwind of the long US dollar position that everybody was in. We do have a ways to go before one can get excited in my opinion, but clearly the upside is being pressured. I think we probably go sideways between now and that speech, and possibly even further into the end of summer as a lot of big traders are away for vacation. The markets continue to be very skittish to say the least, and it is worth thinking about that we have rallied quite significantly just a few weeks ago, so perhaps we are trying to digest the gains in this area more than anything else.

Do not be surprised at all if today ends up being a choppy day, because not only would it match what we have seen over the last couple of weeks, but any time that there is a major speech like the one we are going to receive, one would have to think that there is high probability that people will be jumping in and out of positions. To the downside, I believe that the 1.30 level is offering a significant “floor in the market” right now, so as long as it holds, I do believe in the upside longer term. I just believe that it is possible we may have to spend some more time grinding away before the takeoff happens. Longer-term, I would anticipate that this market will probably go looking towards 1.35 handle, but again it is going to take some time to happen so no need to rush your trading, short-term pullback should offer short-term buying opportunities more than anything else.