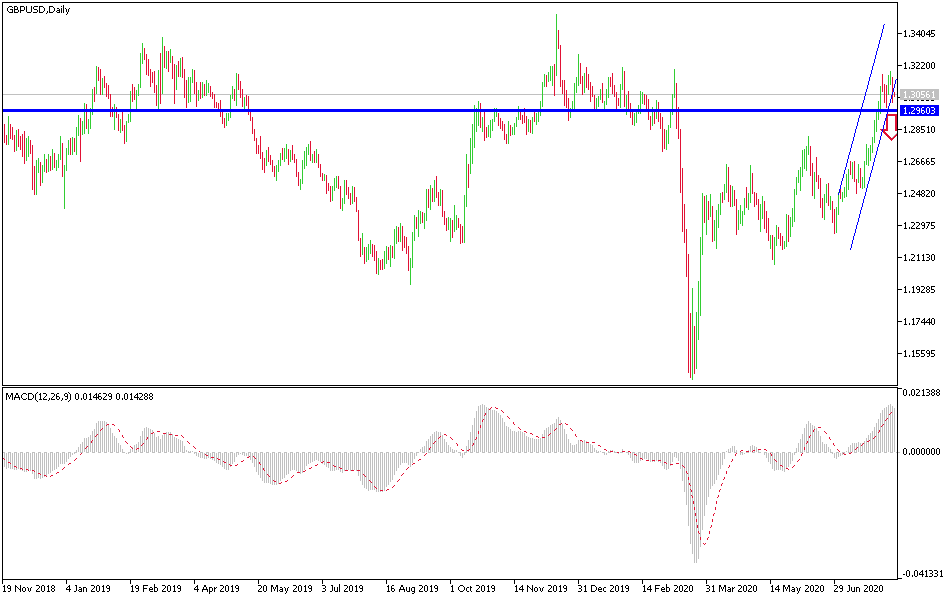

During last Friday's trading session, the GBP/USD currency pair retreated from its current 5-month high of 1.3187 to trade around 1.3009 before closing the week's trading around the 1.3053. The correction was supported by long-awaited profit-reaping sales that I mentioned a lot, after the release of better than expected job numbers in the United States for the month of July, and before that, the Bank of England's decision on interest rates. Nevertheless, the pair continues to trade within an ascending channel amid increasing upward pressure as long as it holds around and above the 1.3000 resistance.

Friday's decline pushed the pair below the 100-hour simple moving average line and slightly above its 200-hour counterpart on the hourly chart. It also prevented the pair from entering the overbought levels of the 14-hour RSI. It is now trading near oversold levels.

On the economic side, from Britain, the Bank of England voted last Thursday to keep the key interest rate unchanged at 0.1% and did not expand the stimulus plans. At the same time, the bank did not hint to the future of negative interest rates as the markets wanted. Prior to that, Markit's manufacturing PMI for July rose slightly from expectations at 53.6, with a reading of 53.3. The Services PMI came in below expectations, at 56.6, with a reading of 56.5. On the other hand, the UK Construction PMI reading from Markit beat expectations of 57 with a reading of 58.1.

From the United States, non-farm payrolls for the month of July exceeded expectations of 1.6 million jobs, with a reading of 1.763 million jobs, although it is higher than expectations, but it is much lower than what was recorded in the previous release. Average hourly earnings for the month also beat estimates of 4.2% (year over year) with growth of 4.8%. The labour force participation rate slightly exceeded expectations of 61.1% with a reading of 61.4%, while the country's unemployment rate was 10.2% better than the expected rate of 10.5%. Before that, the ISM PMI readings for the US manufacturing and services sectors exceeded expectations.

According to the technical analysis of the pair: On the near term, it appears that the GBP/USD is trading within a bullish channel on the hourly chart. This indicates a short-term bullish bias in market sentiment. The pair recently pulled back after meeting trend line resistance. It is now closer to the oversold levels at the 14-hour RSI. Accordingly, the bulls will target profits at the bounce around 1.3130 or higher at 1.3187. On the other hand, bears will be looking for short-term gains from a pounce around 1.3033 or below at 1.2974.

On the long term and based on the performance on the daily chart, it appears that the GBP/USD pair has recently made a bullish breakout from a rising wedge. This indicates a strong long-term bullish bias in market sentiment. The pair is now at overbought levels on the 14-day RSI. Accordingly, bulls are looking to extend current gains towards 1.3300 or higher to the 100% Fibonacci level at 1.3519. On the other hand, bears will target long-term pullback gains around 61.80% and 50% Fibonacci retracement levels at 1.2710 and 1.2462 respectively.