Gold markets have been rather choppy during the month of August, but that should not be a surprise given a couple of different factors. To begin with, August is typically a very quiet month when it comes to gold, and many other commodities for that matter, as it is the height of vacation season. With that being said, most of the big traders simply are not to worry about the market, not when they are with their families, and taking a break from the stress of trading large amounts of money. That being said, this typically sets up September as a very interesting month to say the least.

Acknowledging the time of the year of course is the first thing that I do, but the other factor of course is that the market had gone straight up in the air to begin with. Markets cannot go in one direction forever, and I personally know of at least two retail traders that have blown up their accounts trying to trade the market this past month. Shorting gold in an uptrend is a great way to lose money, and therefore I am not going to do this. This is not to say that I do not expect the market pull back a bit, I actually do. The question is not so much whether or not we could pull back, but how far can we?

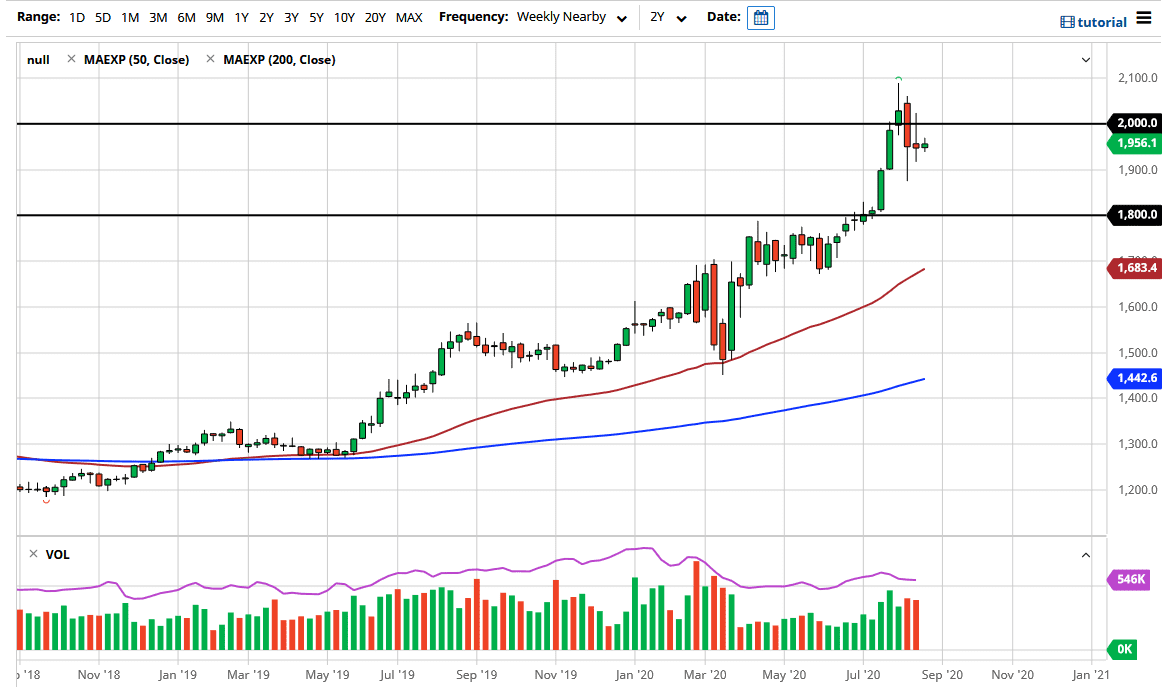

The first level that I think will be tested is the $1900 level. At that point, you should have some people looking to defend that massive option barrier, and it could hold for the bigger move. However, I think there is an even bigger opportunity down at the $1800 level, as it is a large, round, psychologically and structurally significant figure. That area has not been retested after the breakout, so we could see something like that happen.

The alternate scenario is that we get a weekly close above the $2000 level, which would signify that the market is ready to continue the uptrend. I do believe it is only a matter of time, and it is worth noting that listening to the speeches the Federal Reserve bankers will probably be the most important thing gold traders can do this month. The markets are most certainly at an inflection point, and with the Federal Reserve printing as many greenbacks as possible, I still believe that gold rises over the longer term. Beyond that, we also have to worry about the various macroeconomic concerns out there. With this, I look to “buy value” when it comes to gold in the month of September by purchasing dips.